Season Pass Sales

According to the NSAA, the 2021-22 ski season saw a significant uptick in season passes sold. It wasn’t just the two big players of Epic and Ikon either. Ski areas from big to small from all over the country saw an increase. Additionally, other major players have emerged in the multi-resort marketplace.

With the popularity of season passes growing, the number of skier visits from season pass holders has surpassed the visits from single-day ticket sales. This was not the case just a few years ago.

As early as the 2018-19 season, day visitors exceeded season pass visitors. The trend has only skewed more toward season pass visits every year with last year seeing 51.9% of visits from season pass holders and only 37.3% from single-day sales. The other 10.8% is made up of off-duty employees and complimentary tickets.

Why the change?

A big reason for season passes gaining in popularity is the emergence of multi-resort season passes and how they are priced. These season passes tend to charge a very reasonable amount for the season pass, but then charge an exorbitant amount for a single-day lift ticket.

This pricing structure changes the consumer’s behavior to gravitate to the better value season pass. Even a short-term visitor to a ski resort could see cost savings by buying a season pass versus paying for day tickets. An example would be someone who wanted to ski in Park City for a week. An Epic Pass for $859 has a break-even point of just four days compared to buying day tickets at $259 each (without the assumption of a discount for multiple days skied).

It is a brilliant marketing move by the ski resorts. They sell a bunch of season passes and get a ton of predictable capital upfront. They add to the incentive to purchase early by enacting price increases as the season gets closer. Then it doesn’t even matter if the season pass holders come skiing because they already have their money.

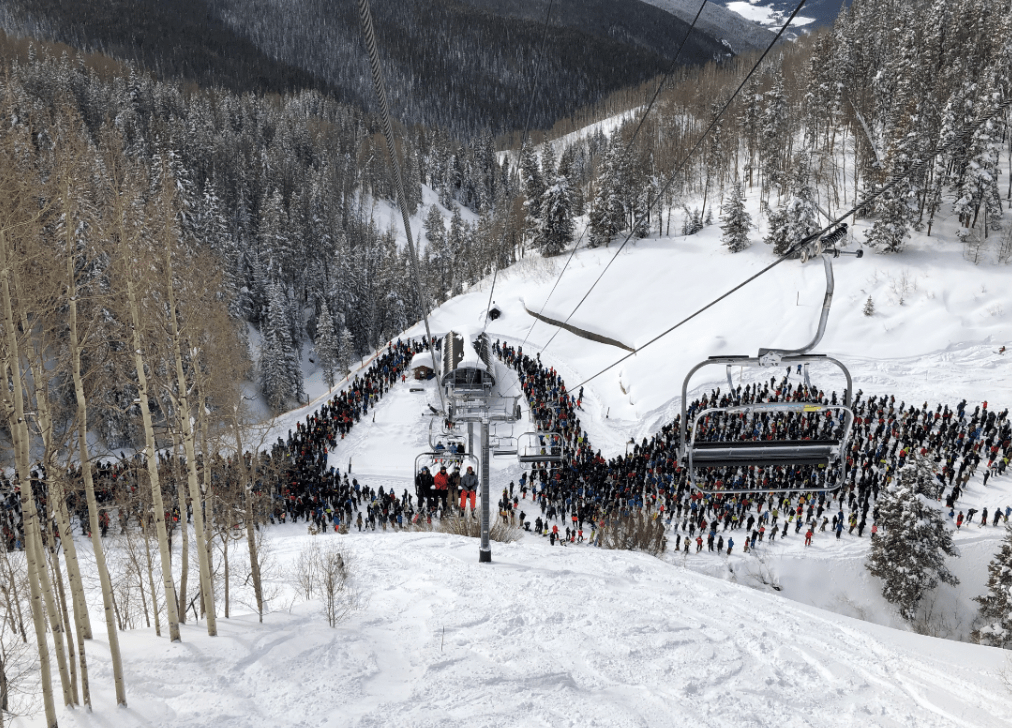

Another incentive to buy a season pass is some resorts have announced they will limit single-day lift ticket sales. This is an attempt to mitigate overcrowding on the slopes. So, the message is basically to buy a season pass or you might be shut out by limited day ticket sales.

What about the little guys?

It’s not just the big conglomerate ski passes that are doing this. Local ski hills are offering extra incentives for their season passes as well. Much of this comes from reciprocal pass agreements. This is where resorts have a mutual agreement to let pass holders at their respective mountains ski at both resorts. Some resorts have an impressive number of partner resorts, making them legitimate multi-pass alternatives.

Season pass sales for the upcoming season appear to be trending up again. It will be interesting to watch this trend to see if skier visits continue to become a bigger percentage from season pass holders or if the casual skier eventually gets priced out of their limited ski days every year.

At Tenney Mountain we figured season ticket sales out in the 1960’s Plus we promoted the SKI93 season ticket. The problem was to stablize the income stream eliminate the need for borrowing for pre-season expenses. It has taken a long time for the rest of the industry to wake up.