A new study analyzing Google’s newest search data and trends indicates it may be a brilliant season for Australia and New Zealand’s ski resorts, with many major ski destinations receiving more than 100% increases in pre-COVID levels of search popularity. With South Hemisphere resorts due to open in coming weeks, this indicates Europe and Northern America may be in-store for similar trends later in the year.

The research piece, conducted by ski training operator WE ARE SNO, looked at Google search popularity for South Hemisphere’s major ski resort over the past year and compared it with previous years’ data to indicate trends in how the season may shape up.

Which ski resorts are seeing the greatest search interest

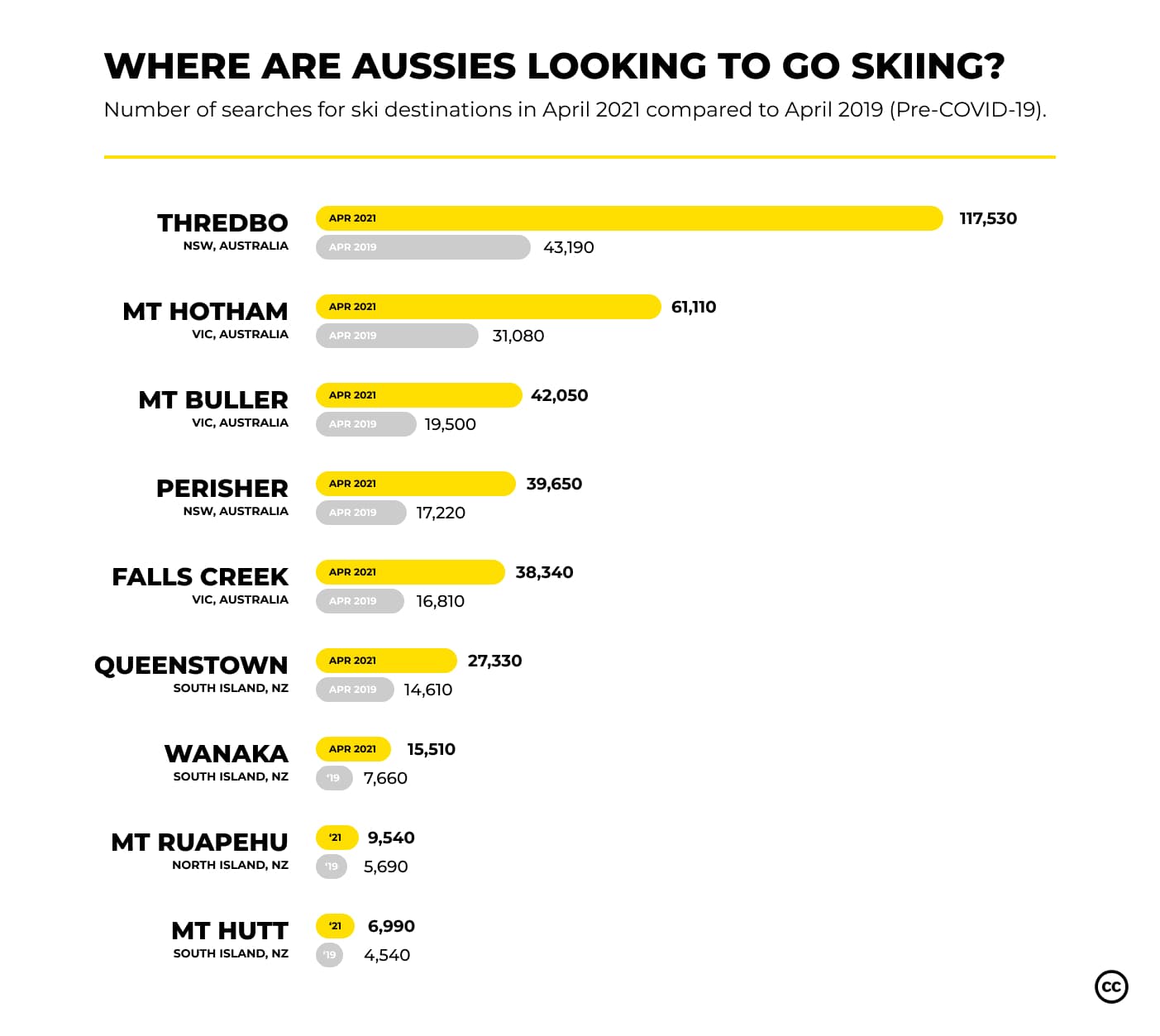

Thredbo, one of Australia’s premier ski resorts, has recorded a massive 172% increase in searches compared to pre-COVID levels for the same time period. With 117,530 searches for the resort in April 2021, the highest ever recorded, up from 43,190 searches in the comparative period of 2019.

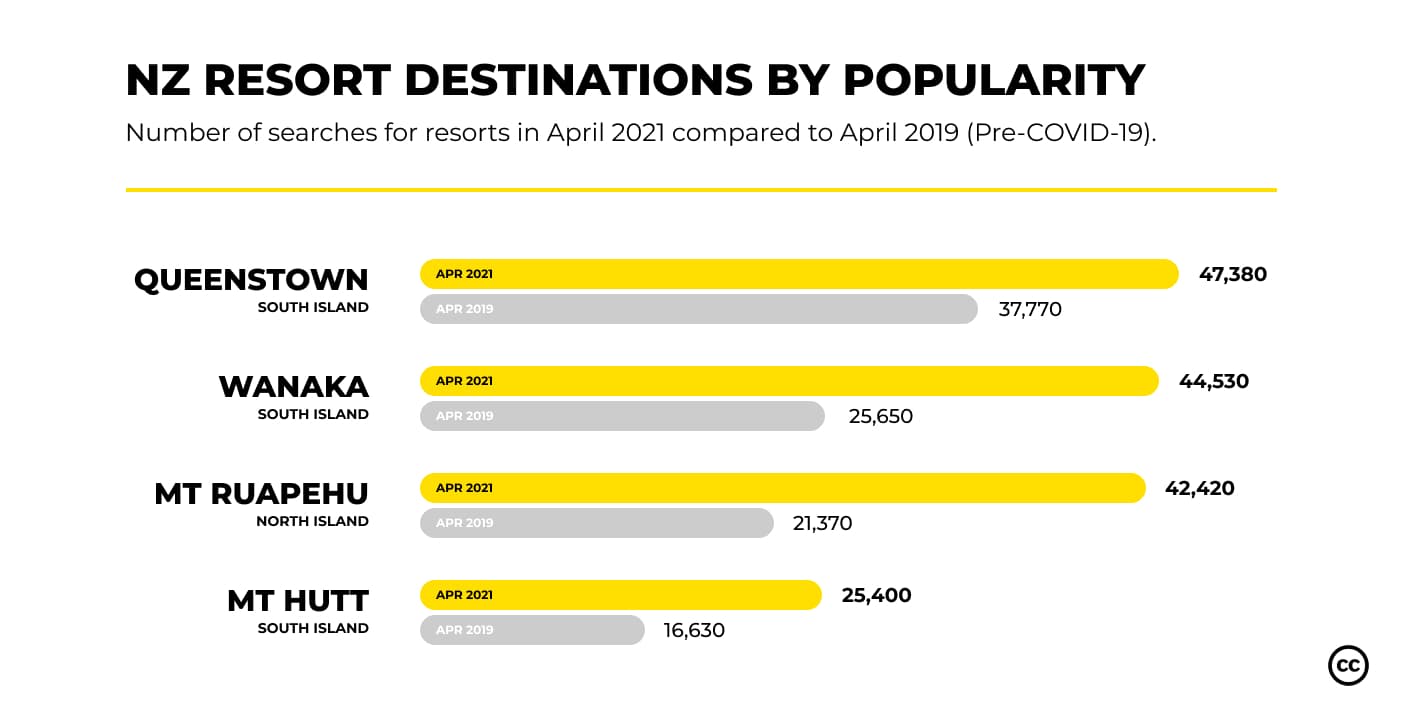

Queenstown, New Zealand (with surrounding resorts of The Remarkables and Coronet Peak) also recorded a surge in search interest in April 2021, with a total of 47,390 searches from Australians and New Zealanders. This figure is a 25% increase on the same period pre-COVID (April 2019) and over 105% higher than last year, when COVID caused widespread disruption.

Even more impressive, search interest in Queenstown ski holidays from Australians is up 87% compared to the comparative pre-COVID period, suggesting a huge uptake on the newly formed travel bubble – allowing Australians to travel quarantine free to and from NZ. Almost 44% of Queentown’s economy is tourism-based, which provides welcome news to everyone in the tourism, leisure, and hospitality sectors.

Avoiding longer lift queues this season may be difficult, but the data suggests that Mt Hutt might be the resort offering the best chance. Recording a still impressive increase in searches, up 54% on pre-COVID levels and totaling 6,990 in April 2021, this was the smallest increase of resorts analyzed.

Even locally owned ski fields with limited facilities and lift infrastructure have seen their search popularity shoot up. This suggests that the bounce back will be widespread and impact the ski industry globally.

More people are looking to learn to ski or snowboard

With fewer travel options available to Aussies and Kiwis, it appears that more people are looking to get into snow sports too. This could mean a prosperous winter for instructors, with the number of people looking to learn to ski or snowboard doubling compared to a normal season like 2019. Searches for “learning to snowboard” and “snowboarding lessons” are up 92% compared to 2019, while the same ski terms are up 79% – the green slopes will be busy this year!

Adrian Gourlay, Managing Director of WE ARE SNO said the following:

“The data is showing the pent up demand that exists amongst the snowsports community, and also how the pandemic restrictions seem to be encouraging new people to try snowsports and visit more localised destinations.

Demand for instructor lessons plummeted in most resorts last season, while some had to close early or never opened. 2020 was a tough year for the industry as a whole, but we remain optimistic that this search volume will transfer over into increased levels of resort visitation.”

The full Google data can be viewed here, showing the scale of surging search demand for NZ and Australian resorts and other pieces of data that were analyzed as part of the research.

How do trends look for the rest of the world?

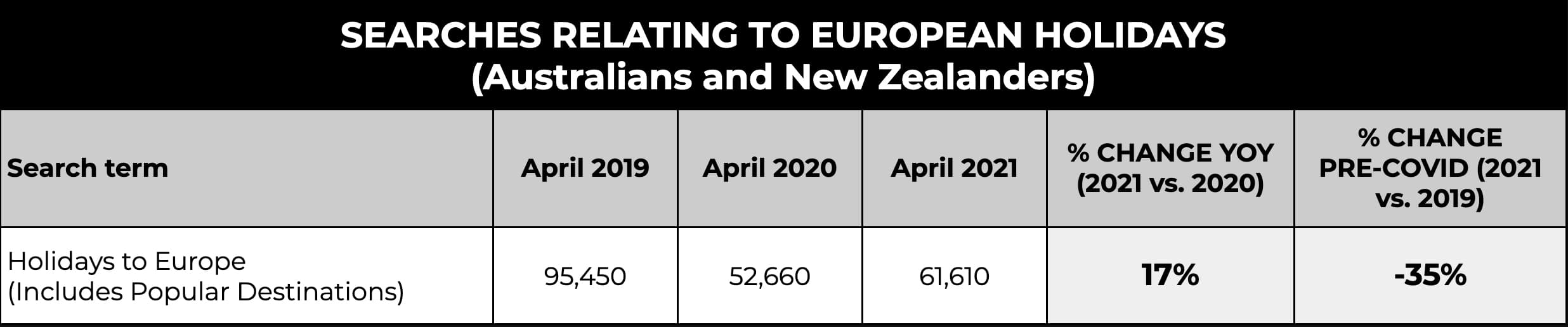

Global search interest for most international ski destinations remains subdued, largely driven by the ongoing impacts of COVID-19, border restrictions, and local lockdowns.

Whistler, Canada’s largest ski resort’s search interest remains 22% down on pre-COVID levels but has recovered 58% year on year.

Zermatt, however, one of Switzerland’s most famous resorts, has seen a 9% increase in pre-COVID levels, possibly due to the government’s decision to keep ski resorts operating this year while many resorts across Europe were forced to shut. While Tignes, a French resort forced to close last season, has seen search popularity fall by 58% for the same period.

It is hoped by many that these positive search trends will manifest into an increase in resort visitation and slope users.