Vail Resorts, Inc. yesterday reported results for the third quarter of fiscal 2020 ended April 30, 2020, which were significantly impacted by COVID-19 and the resulting closure of the Company’s North American destination mountain resorts and regional ski areas on March 15, 2020.

The company reported its net revenue fell US$263.9 million, or 27.5 percent, while net income fell $139.6 million compared to the same period last year.

Ski lift revenue dropped $152.1 million, or 28.9 percent, “primarily due to decreased visitation associated with the closure of our North American destination mountain resorts and regional ski areas due to COVID-19,” as well as a deferral of $121 million in pass product revenue.

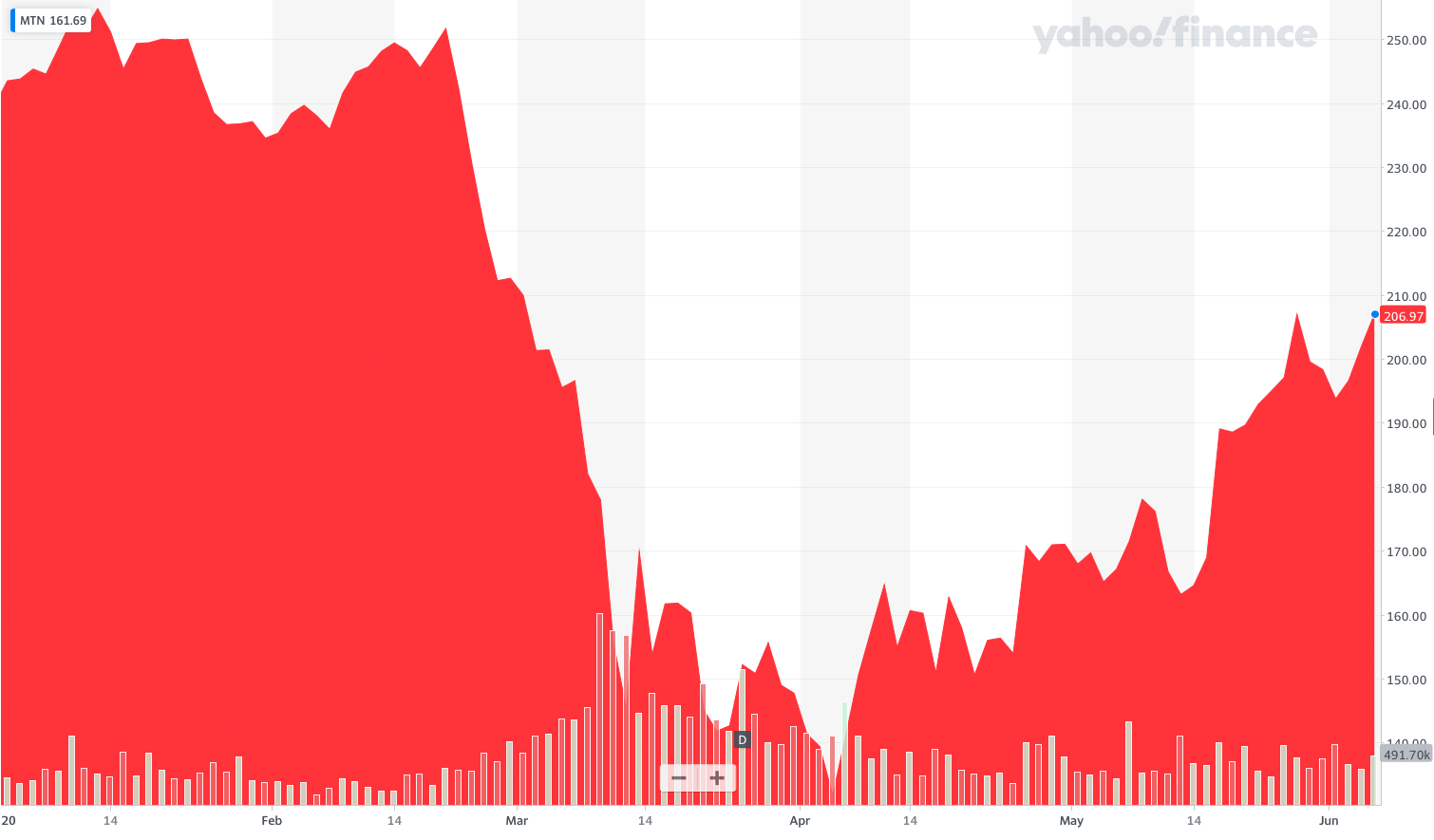

Vail Resorts shares have fallen 14% since the beginning of the year and yesterday hit $206.97, a decline of 5% in the last 12 months. Vail Resorts has underperformed the market so far this year.

Highlights

- As a result of the disruptions caused by COVID-19, we took the following strategic actions to address the public health situation and strengthen the Company’s financial and liquidity position to navigate through the current circumstances and position the business for long-term success:

- Closed operations at all North American resorts and rental/retail stores from March 15, 2020, through the remainder of the 2019/2020 winter ski season;

- Reduced our capital plan for the calendar year 2020 by $80-$85 million;

- Suspended our cash dividend for a minimum of two quarters (preserving approximately $142 million);

- Furloughed the majority of year-round hourly and certain salaried employees in the U.S.;

- Implemented a six-month salary reduction for all salaried employees in the U.S.;

- Eliminated full salary for CEO and 100% of cash compensation of Board of Directors for six months;

- Suspended our 401(k) match for six months;

- Raised $600 million in 6.250% unsecured senior notes due May 2025; and

- Obtained financial covenant maintenance waivers under the Vail Holdings, Inc. (“Vail Holdings”) revolving credit facility through January 2022.

- Net income attributable to Vail Resorts, Inc. was $152.5 million for the third fiscal quarter of 2020 compared to net income attributable to Vail Resorts, Inc. of $292.1 million in the same period in the prior year, primarily as a result of the negative impacts of COVID-19 as outlined further in the details below.

- Resort Reported EBITDA was $304.4 million for the third fiscal quarter of 2020, compared to Resort Reported EBITDA of $480.7 million for the same period in the prior year, primarily as a result of the negative impacts of COVID-19 offset by cost actions implemented, as described above.

Commenting on the Company’s fiscal 2020 third-quarter results, Rob Katz, Chief Executive Officer, said:

“Our results for the quarter and for the full 2019/2020 North American ski season were significantly impacted by COVID-19 and the resulting closure of our North American mountain resorts beginning March 15, 2020 for the safety of our guests, employees and resort communities. In addition, even before the closure and during the first two weeks of March, we experienced a negative change in performance that we believe was due to the impact of COVID-19 on traveler behavior. As of March 18, 2020, we anticipated that our operating results in March and April would be negatively impacted by $180 million to $200 million compared to the Resort Reported EBITDA expectation we had on March 1, 2020. Relative to these expectations, our results were favorable by approximately $40 million, primarily driven by cost actions implemented in April 2020. In addition, Resort Reported EBITDA for the quarter was negatively impacted by the deferral of approximately $113 million of pass product revenue and related deferred costs to fiscal 2021 as a result of pass holder credits offered to 2019/2020 North American pass holders to encourage renewal for next season.”

Regarding the Company’s summer operations, Katz said:

“We are planning to be operational for the North American summer and Australian ski season in late June or early July, which could vary by resort, and opening dates for each business are subject to new information and public health guidance with regard to COVID-19. We expect that our results in the fourth quarter of fiscal 2020 will be materially negatively impacted by the travel environment and we will see lower visitation to our resort properties. However, we are not able to fully assess that impact at this time and will not be issuing guidance for the fourth quarter or fiscal year. We believe we have developed efficient operating plans to deliver a safe and enjoyable guest experience at our resorts this summer in North America and for the Australian ski season, with the ability to adjust as consumer demand and local guidelines and practices shift.”

Balance Sheet & Liquidity

Commenting on the Company’s liquidity, Katz stated:

“Our total cash and revolver availability as of May 31, 2020 was approximately $1.1 billion, with $465 million of cash on hand, $419 million of U.S. revolver availability under the Vail Holdings Credit Agreement (“Credit Agreement”) and $168 million of revolver availability under the Whistler Credit Agreement. As of April 30, 2020, our Net Debt was 3.6 times trailing twelve months Total Reported EBITDA.

“In April, we announced plans to support our liquidity by reducing our capital plan for calendar year 2020 by approximately $80-85 million, suspending cash dividends to shareholders for two quarters (preserving an additional $142 million of liquidity), furloughing a significant number of our year-round hourly and salaried employees in the U.S., and implementing six-month salary reductions for all salaried employees in the U.S., among other cost actions.

“As previously disclosed, on May 4, 2020, we completed an offering of $600 million in aggregate principal amount of 6.25% unsecured senior notes due 2025, a portion of which was utilized to pay down the outstanding balance of our U.S. revolver under the Vail Holdings Credit Agreement in its entirety. Additionally, we entered into an amendment to the Vail Holdings Credit Agreement, providing, among other terms, that Vail Holdings will be exempt from complying with the agreement’s financial maintenance covenants for each of the fiscal quarters ending July 31, 2020 through January 31, 2022 unless Vail Holdings makes a one-time irrevocable election to terminate such exemption period prior to such date. We expect to have sufficient liquidity following these actions to fund our operations for up to two years, even in the event of extended resort shutdowns.”

Operating Results

A more complete discussion of our operating results can be found within the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of the Company’s Form 10-Q for the third quarter ended April 30, 2020, which was filed today with the Securities and Exchange Commission. The discussion of operating results below compares the results for the quarter ended April 30, 2020 to the comparable quarter ended April 30, 2019 unless otherwise noted. The following are segment highlights:

Mountain Segment

- Total lift revenue decreased $152.1 million, or 28.9%, to $374.8 million primarily due to decreased visitation associated with the closure of our North American destination mountain resorts and regional ski areas due to COVID-19, as well as the deferral of $121 million of pass product revenue to fiscal 2021 ($115 million of which would have been recognized in the third quarter of fiscal 2020) as a result of credits offered to 2019/2020 North American pass product holders.

- Ski school revenue decreased $34.2 million, or 30.9%; dining revenue decreased $17.3 million, or 21.9% and retail/rental revenue decreased $35.9 million, or 31.5%, all primarily as a result of our resort and retail store closures due to COVID-19, partially offset by incremental revenue from Peak Resorts, Inc.

- Mountain Reported EBITDA decreased $166.7 million, or 35.6%, primarily due to decreased visitation associated with the closure of our North American destination mountain resorts and regional ski areas due to COVID-19, as well as the deferral of $113 million of pass product revenue and related deferred costs to fiscal 2021 as a result of credits offered to 2019/2020 North American pass holders and adjusted for final foreign exchange rates. Mountain Reported EBITDA includes $4.4 million of stock-based compensation expenses for the three months ended April 30, 2019, compared to $4.0 million in the same period in the prior year.

Lodging Segment

- Lodging segment net revenue (excluding payroll cost reimbursements) decreased $20.5 million, or 27.0%, primarily due to the closure of our North American lodging properties as a result of COVID-19.

- Lodging Reported EBITDA, which includes $0.8 million of stock-based compensation expenses for both the three months ended April 30, 2020, and 2019, decreased $9.7 million, or 76.8%, primarily due to the closure of our North American lodging properties as a result of COVID-19.

Resort – Combination of Mountain and Lodging Segments

- Resort net revenue decreased $264.1 million, or 27.6%, to $693.7 million, primarily due to decreased visitation associated with the closure of our resorts, retail stores and lodging properties due to COVID-19, as well as the deferral of $121 million of pass product revenue to fiscal 2021 ($115 million of which would have been recognized in the third quarter of fiscal 2020) as a result of credits offered to 2019/2020 North American pass holders.

- Resort Reported EBITDA was $304.4 million for the three months ended April 30, 2020, a decrease of $176.4 million, or 36.7%, compared to the same period in the prior year, which includes impacts from the deferral of $113 million of pass product revenue and related deferred costs to fiscal 2021 as a result of credits offered to 2019/2020 North American pass product holders, $1.4 million of acquisition and integration-related expenses and approximately $1 million of net unfavorability from currency translation related to operations at Whistler Blackcomb and our Australian ski areas, which the Company calculated on a constant currency basis by applying current period foreign exchange rates to the prior period results.

Total Performance

- Total net revenue decreased $263.9 million, or 27.5%, to $694.1 million.

- Net income attributable to Vail Resorts, Inc. was $152.5 million, or $3.74 per diluted share, for the third quarter of fiscal 2020 compared to net income attributable to Vail Resorts, Inc. of $292.1 million, or $7.12 per diluted share, in the third fiscal quarter of the prior year. Fiscal 2020 third-quarter net income included the after-tax effect of asset impairments related to the Company’s Colorado resort ground transportation company of approximately $21.3 million and acquisition and integration-related expenses of approximately $1.0 million.

Season Pass Sales

Commenting on the Company’s season pass program, Katz said:

“As announced on April 27, 2020, to address the difficult decision to close our North American mountain resorts as a result of the unprecedented circumstances surrounding COVID-19, we have rolled out a comprehensive plan to address our pass holders’ concerns about the early closure this past season and provide improved coverage for the future.

“We are providing credits to 2019/2020 North American pass holders to apply toward the purchase of a 2020/2021 pass product. Season pass holders will receive a minimum credit of 20% toward next season’s pass. For season pass holders who used their pass less than five days, they will be eligible for higher credits up to a maximum of 80% for season pass holders who did not use their season pass at all. For Epic Day Pass, Edge Card and other frequency based products with unused days remaining, we will be offering credits for each unused day up to a maximum of an 80% credit. The credits will be available for our pass holders who purchase 2020/2021 pass products by September 7, 2020.

“As a result of the early closure this season and the meaningful credits we are offering to 2019/2020 North American pass holders, we will be delaying the recognition of approximately $121 million of our deferred pass revenue, as well as approximately $3 million of related deferred costs (a net Resort Reported EBITDA impact of approximately $118 million), that would have been recognized in the remainder of fiscal 2020 and will now be recognized primarily in the second and third quarters of fiscal 2021. This shift in recognition timing will partially or fully offset the negative impact of the credits being offered to pass holders, depending upon the final usage of such credits towards the purchase of 2020/2021 North American pass products.

“We are redefining how we will protect season passes through the launch of ‘Epic Coverage.’ Epic Coverage is free for all North American pass holders and completely replaces the need to purchase pass insurance. Epic Coverage provides refunds in the unlikely event of certain resort closures (e.g., for COVID-19), giving pass holders a refund for any portion of the season that is lost. Additionally, Epic Coverage provides a refund for personal circumstances covered by our pass insurance for eligible injuries, job losses and many other personal events. In addition to these changes, in order to give our pass holders the time they need to make decisions regarding next season, we are extending the deadline for pass holders to receive spring benefits (including Buddy Tickets) until September 7, 2020, and we are extending the period for pass holders to lock in their purchase with only $49 down for the next few months. We will not be providing an update on the results of season pass sales until our fourth quarter earnings conference call in late September.

“We continue to be confident in the long-term prospects of our business model that is built on the loyalty of our guests, the strong lineup of season pass products that provide access to our irreplaceable network of world-class resorts and the sophisticated marketing approach we use to communicate with and attract our guests. As we head into this summer and next ski season, we will be providing an exceptional experience for our guests through our passionate employees and the investments we’ve made in our resorts and technology, supported by our strong capitalization and liquidity that positions us well to pursue our growth goals over time.”

Something good to report finally !!!!!

I see someone in the near future being fired

RK ?