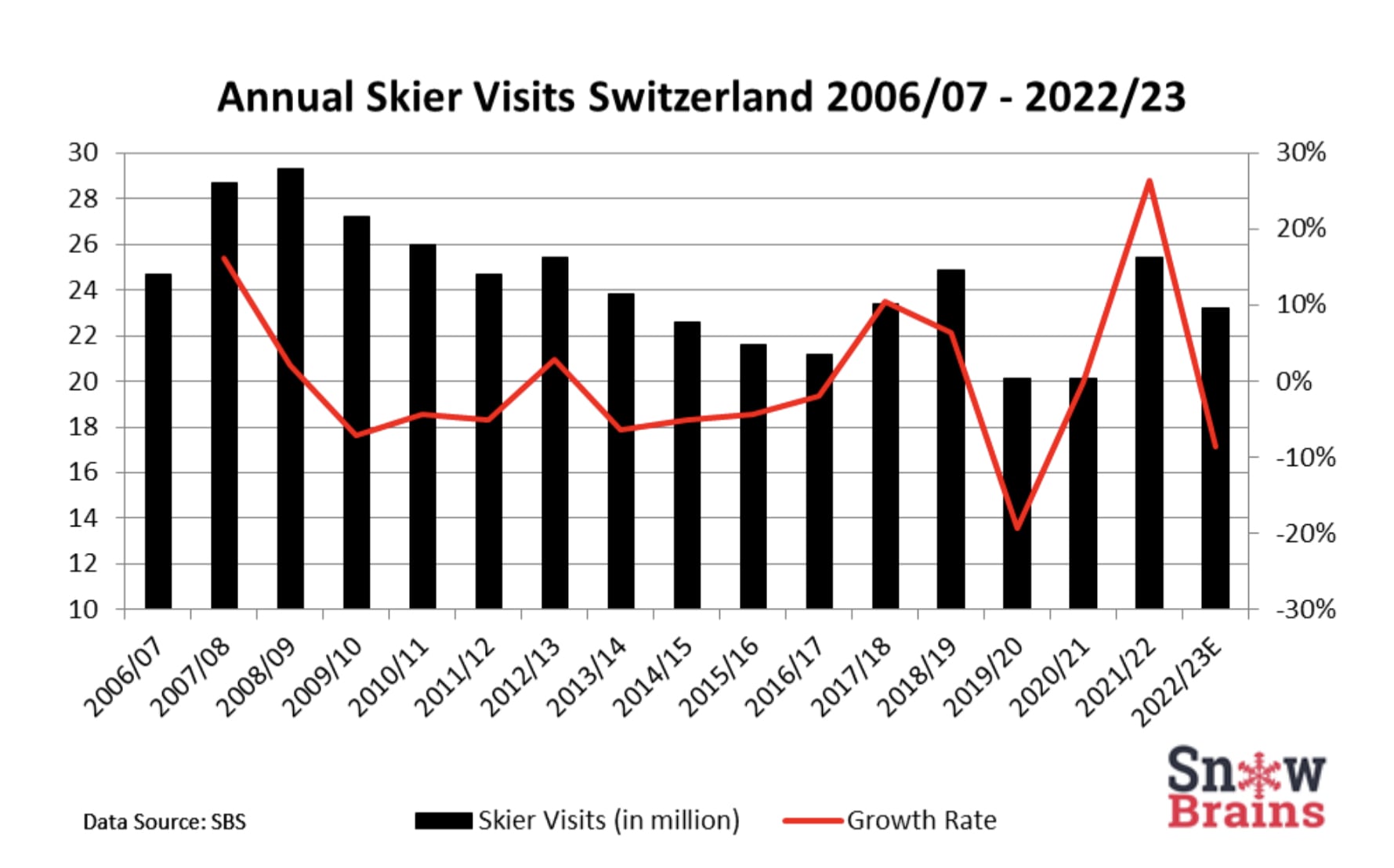

While US ski resorts booked a record season in 22/23 with 64.7 million skier visits, Swiss ski resorts had an average season with 23.2 million skier visits. Skier visits in Switzerland were down 9% on last year, however 21/22 had been the second best year in the last ten years, putting this season’s ski resort visitation number in line with their five-year average. By contrast, the 2022/23 U.S. skier visit number was an increase of 7% on last season.

Nevertheless, for a country with a population of only 8.7 million inhabitants, Switzerland’s skier visit numbers are very high on a per capita basis. The United States have a population of almost 40 times that of Switzerland yet less than three times the skier visits. This is due to the large participation rate of the Swiss population in skiing, which is around 35% for this Alpine nation. The participation rate in America is around 3%. Switzerland also has about 33% foreign visitors to their resorts, while the USA only has 6% international ski tourists.

The Swiss mountain operations association ‘Seilbahnen Schweiz’, or short ‘SBS’, collects visitor data from its members across Switzerland and their 2023 data showed, that snowsport participants were down 12% this year while skier visits were down 9% on a year-on-year comparison. The skier visit number is defined as the days every skier (or boarder) visits a resort. So if you go to a resort for one whole week, that equals seven skier visits (apologies to all snowboarders, it is the official terminology).

In 2022/23, the Swiss ski resorts were challenged by below average snow falls, cloudy weather and a strong Swiss Franc. Thanks to snow making, many resorts were able to operate successfully. The SBS data however shows, that there was overall a wide variation.

Visitation numbers fluctuated strongly by region, with the Valais ski areas, such as Crans-Montana, Verbier, Saas-Fee or Zermatt, as well as Graubünden ski areas, which is home to St. Moritz, Grindelwald and Flims Laax, recording 14% and 9% increases in revenues respectively compared to the 5-year average, while the other cantons in Switzerland had decreases in skier visits.

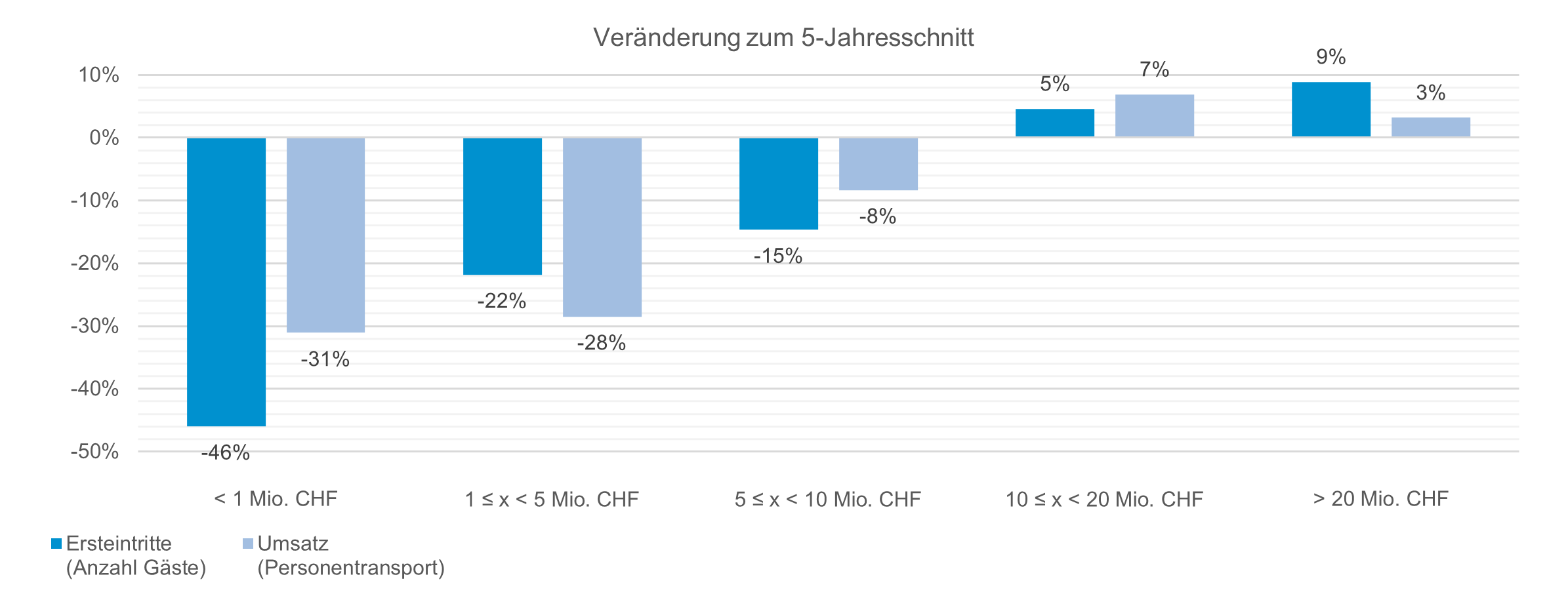

Aside from regional variations, strong variations were also seen by resort size. Large ski resorts with more than CHF 10 million in revenues saw a growth in both visitors as well as revenues, while those below the CHF 10 million threshold lost both visitors as well as revenues. The largest resort by revenue in Switzerland is Zermatt, followed by the combined resort of Arosa-Lenzerheide, Davos-Klosters, the Jungfrau region and Adelboden-Lenk. Large resorts increasingly attracting the lion share of visitors, is a global phenomenon and has been one of the driving forces behind a lot of mergers of adjacent ski resort in the last two decades. Smaller resorts most likely also faired worse as they typically lack snowmaking facilities. In Switzerland, only about 54% of Swiss ski areas have snowmaking, compared to 87% of resorts in the USA.

Please note: All numbers are from the preliminary SBS report and a final report will be issued in September 2023.