China has recently staked its claim as the country with the most ski resorts in the world. According to the National Sports General Administration’s December 2023 figures, the nation boasts 935 ski resorts. However, the more conservative “2023-24 China Ski Industry White Book,” authored by industry expert Benny Wu, places that number at 719. While impressive, the discrepancy invites a closer look at what constitutes a “ski resort” and how these numbers stack up globally.

Wu, a leading consultant in the field and a contributor to Vanat’s renowned annual ski report, “International Report on Snow & Mountain Tourism,” breaks down the Chinese ski industry in meticulous detail. The higher government figure, he explains, likely includes closed resorts and even ski simulators, inflating the count. For clarity, Wu’s analysis sets the more credible baseline at 719, which notably includes 60 indoor ski centers—a significant factor when comparing China’s ski infrastructure with that of other nations.

Meaningful comparisons of ski resorts across the globe have been notoriously difficult. European resorts count the skiable kilometers while American resorts count the skiable area in acres. Even within these measures, how and what you count is open to interpretation, making reliable size comparison difficult. Ski industry expert and esteemed industry consultant Laurent Vanat uses a metric of counting resorts as those with at least five lifts in his annual report “International Report on Snow & Mountain Tourism.” This standard, for example, reduces Germany’s official 675 ski areas to 54 and the United States’ 470 to 202. While Wu does not align precisely with Vanat’s criteria, he does provide insight into China’s infrastructure by highlighting resorts with more than four aerial ropeways—a category encompassing chairlifts, gondolas, aerial trams, and T-bars (i.e., any ski lift that requires an overhead rope).

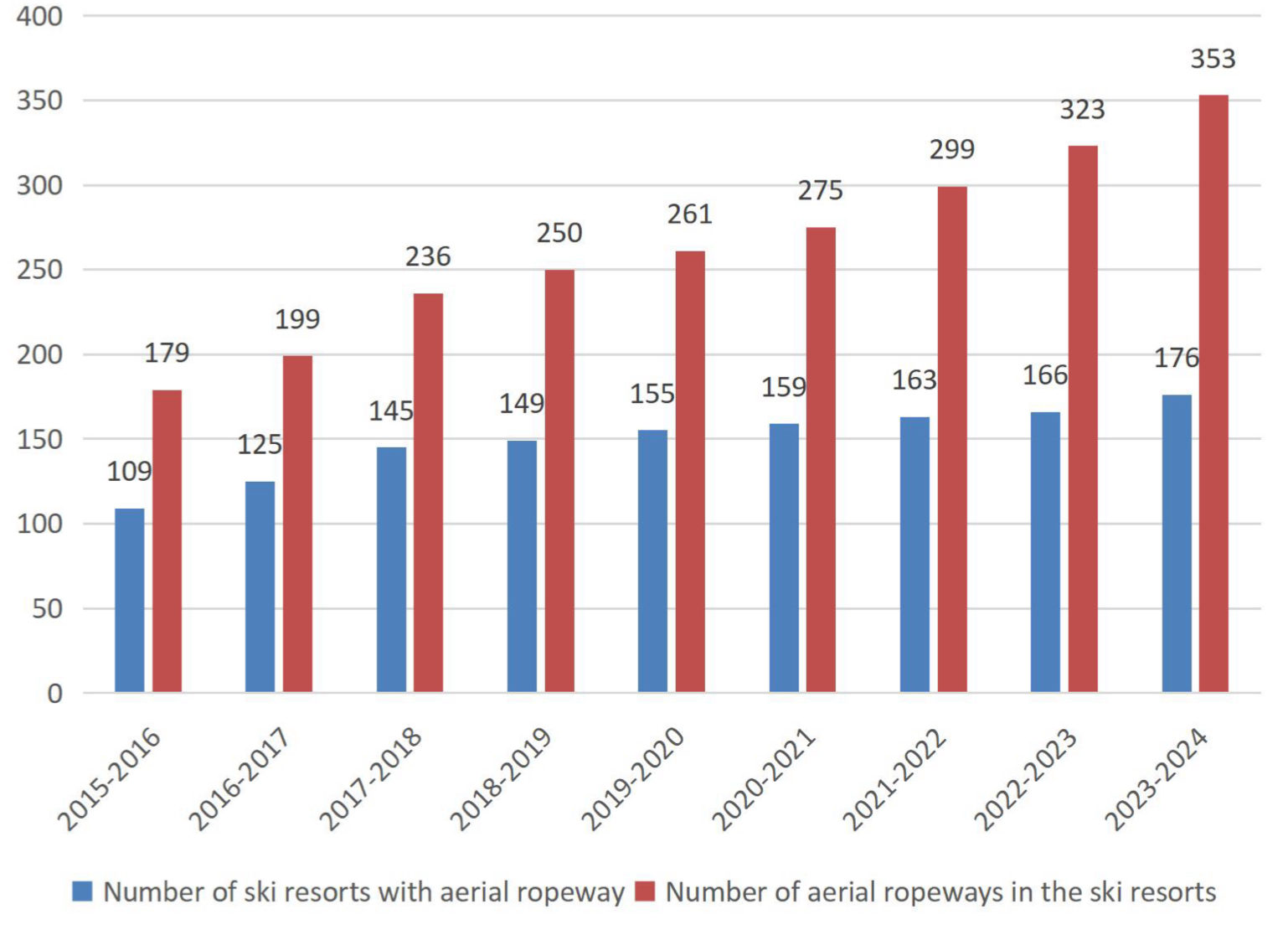

By this measure, China has just 16 resorts meeting the four-ropeway threshold and 176 resorts featuring any type of aerial ropeway. The remaining 543 resorts rely on simpler systems like magic carpets, raising questions about whether they can genuinely be considered full-fledged ski resorts.

Wu also examines another critical metric: vertical drop. Of China’s 719 ski areas, only 152 boast a vertical drop of more than 100 meters (328 feet). Some of these include indoor centers, such as Shanghai’s recently opened facility—the largest in the world—with a vertical of 120 meters. Only 33 resorts surpass the 300-meter (1,000 feet) mark, a benchmark that typically signals a resort of significant size and challenge.

- Related: Phase II of China’s Taicang Alps Resort Aims to Create the Largest Indoor Ski Area in the World

Skiable area is yet another telling metric. Wu identifies only 14 Chinese resorts with over 100 hectares (247 acres) of skiable terrain—a figure dwarfed by the United States, where over 200 resorts exceed that size. The overlap between this group and those with at least four aerial ropeways suggests that China’s true number for actual ski resorts sits somewhere between 14 and 33, a far cry from the 719 or 935.

While the numbers may not confirm China as the world leader in significant ski resorts, its ski industry is undeniably thriving. Skier visits grew by 16% year-on-year, reaching 23.1 million for the 2023-24 season. The country added 30 new aerial ropeways in a single season, and the popularity of larger resorts is skyrocketing; visits to the 33 resorts with vertical drops of over 300 meters rose by a remarkable 51%, reaching 6.36 million.

This growth, catalyzed by the 2022 Beijing Winter Olympics, is bucking the global trend of stagnation or decline in skier visits. While the claim of hosting the most ski resorts may falter under scrutiny, the enthusiasm and investment driving China’s ski boom are undeniable. While the Chinese ski industry might still be carving out its place on the global ski stage, the pace and scale of its rapid ascent are sure to leave any sceptic impressed.