In March 2020, the future of the ski industry seemed uncertain. With resorts shut down across the country and questions about how extreme and prolonged the response to the coronavirus would have to be, a winter of skiing no longer seemed like a sure thing. In the years since, skiing has appeared to bounce back even stronger than before. With a few years of perspective, questions can now be answered about how much of the bounceback was only due to steady growth in the ski industry. How much of it came from pandemic innovations implemented by resorts to keep people skiing?

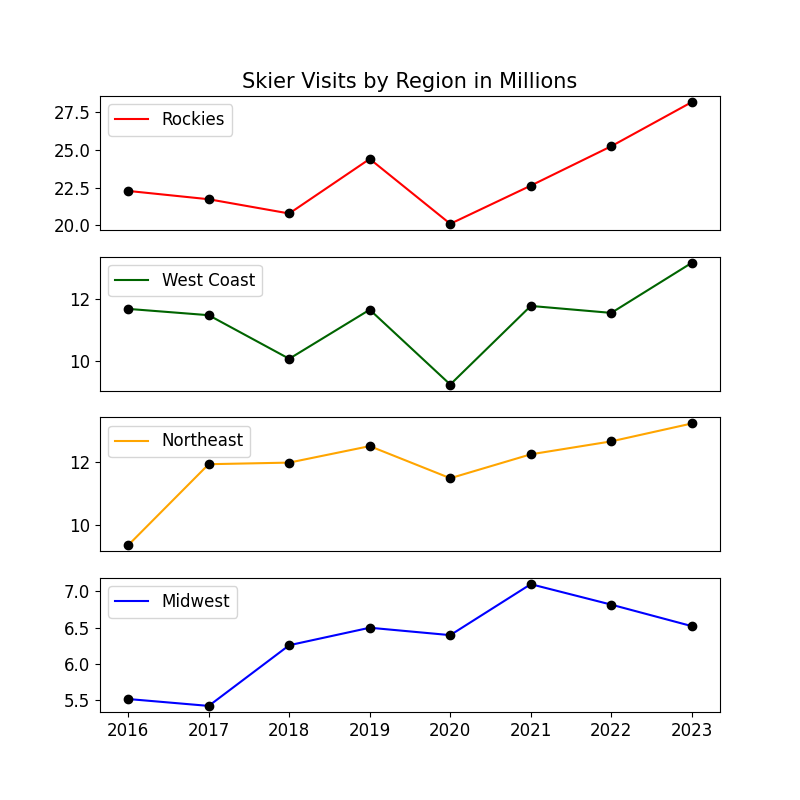

Every year, the National Ski Area Association collects data on the number of skier visits in each region in the United States. These data give insight into where people went skiing during the pandemic. The graph below is broken out by region and shows the total number of visits per year.

While all regions experienced a drop in skier visits in 2020, the magnitude of this drop varies quite a bit. The Rockies and the West Coast saw huge dips, while the Northeast and Midwest saw only moderate decline. Indeed, the Rockies and West Coast get a lot of skier visits from ski vacations, many of which were cut short or canceled by the pandemic. On the other hand, the Northeast and Midwest are home to smaller, more local resorts and are almost exclusively visited by a loyal group of consistent skiers and snowboarders. Many of these Northeastern and Midwestern riders may have had to cancel their trips out west that year, but they found plenty of time to ski closer to home, in part likely due to benefits of work-from-home policies.

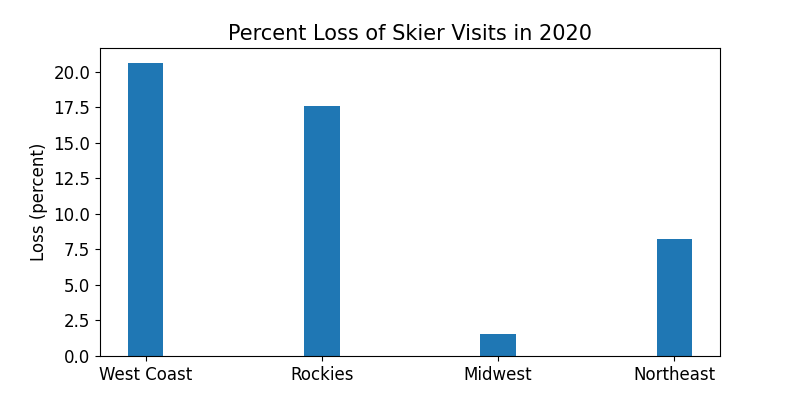

Viewed a different way, the difference in skier visit drops by region is staggering. The bar chart below shows the percent drop between 2019 skier visits and 2020 skier visits by region.

The Midwest had almost zero drop in skier visits during the 2020 season. In fact, the Midwest has experienced sharper declines in recent years due to low snow and warm conditions. Part of the reason for such a small decline in skier visits in the Midwest and Northeast may also be that their seasons are typically a month or two shorter than the West Coast or the Rockies. There are also fewer people skiing in the Midwest compared to other regions of the country. Since many ski resorts did not close until well into March 2020, the Midwest and Northeast likely already tallied many of their expected skier visits for the regular season, which typically runs from a little before Christmas to right around spring break in mid-March.

Ski resorts primarily rely on skier visits to make money. Despite all of the expensive hotels, exorbitantly priced cheeseburgers, parking fees, and pricy booze, almost all ski resorts still derive most of their income from day ticket and season pass sales. In recent years, resorts across the industry have been trying to move towards more season pass holders and fewer day ticket sales. Season pass sales are more reliable income than day tickets. Resorts usually have a pretty good idea of how much revenue they will have for the year, and stretches of bad snow or poor weather have less of an impact on overall revenue. Selling more season passes shifts more of the risk of bad conditions onto the pass holder. At the same time, resorts do not take in as much money on big weekend powder days that draw enormous crowds.

During the pandemic, the shift towards selling more season passes insulated the ski industry from a hard crash. When resorts shut down early in 2020, more season pass sales meant less revenue lost to day tickets that would have been sold in the spring. Lindsay Hogan, Senior Director of Communications for Vail Resorts, told me in an email:

“Our company’s core strategy of advance commitment through the Epic Pass is what has made this possible. By incentivizing guests to buy their skiing and riding ahead of the season, we lock in revenue before the snow falls, which has allowed us to continually invest back into our resorts, our employees, and our communities, no matter the weather—and even amidst a global pandemic. It has created stability for an industry that historically was ruled by weather.”

Vail Resorts is a publicly traded company, meaning the Securities and Exchange Commission requires Vail Resorts to submit quarterly and annual reports detailing the financial performance of the company. These reports give a detailed look into how Vail Resorts was impacted during the pandemic and in the years that followed. Going beyond information about skier visits, these reports give a clearer picture of how much money the company was bringing in, and how it chose to spend that revenue.

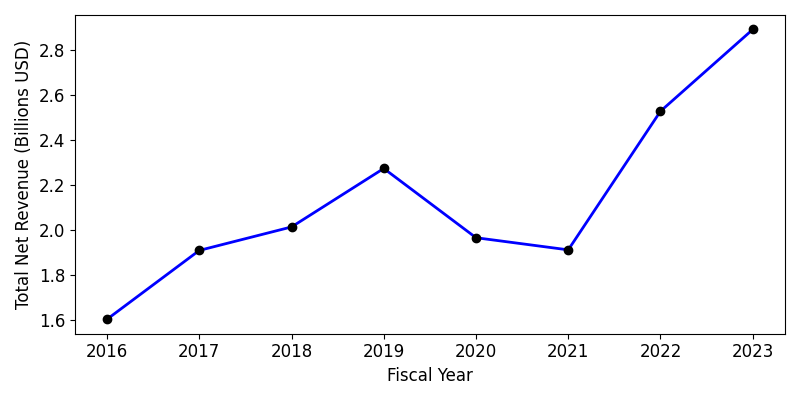

When looking at how Vail Resorts performed financially, one of the simplest pieces of information to start with is the total net revenue. This takes into account all the money from lift tickets and season passes, food and beverage, hotel revenue, and much more. Shown below is a plot of Vail Resorts’ annual revenue from 2016 to 2023.

In 2020 and 2021, Vail Resorts experienced a sharp decline in net revenue. This downturn mirrors the data shown above for skier visits and was completely expected. Fewer people went skiing, meaning Vail Resorts took in less money. However, 2022 and 2023 saw an explosion in revenue, at a faster rate than the period between 2016 and 2019. In fact, this bounce back has been so substantial, that 2023 appears to follow the same prepandemic growth rates, making it seem like the pandemic never happened, financially at least.

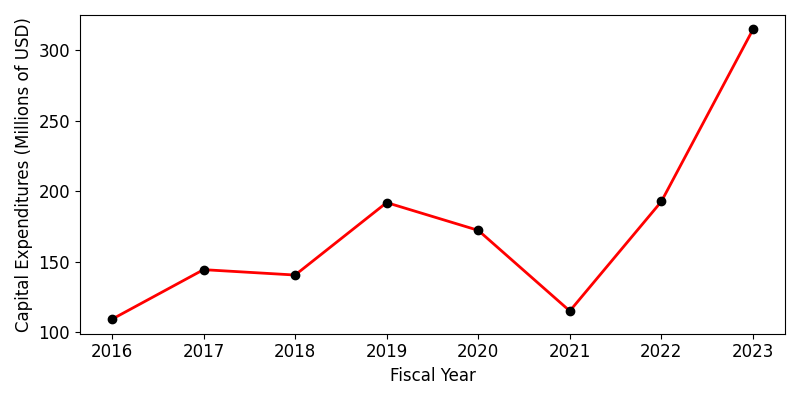

Part of this explosion in revenue may be from the tremendous amount of investment Vail Resorts put into capital expenditures. These capital projects are large-scale resort upgrades that include chairlift construction, terrain expansions, lodge renovations, and other headline-making projects. Below is another plot, this time showing how much money Vail Resorts spent on capital projects between 2016 and 2023.

At first glance, the story appears to be similar to skier numbers and total revenue, with a downturn in 2020 and 2021, then a surge in 2022 and 2023. It is important to note the scale of this plot. Since 2016, Vail Resorts capital expenditures have nearly tripled. With 2021 capital expenditures near 2016 levels, Vail Resorts has nearly tripled its capital expenditures in just two years. These large capital expenditures, at least for Vail Resorts, signal both health and optimism in the ski industry.

Capital expenditures can help drive more visitors to ski areas because they usually involve significant changes or upgrades. For example, some of the projects Vail Resorts have recently completed have included an upgraded gondola and chairlifts at Whistler-Blackcomb in British Columbia and terrain expansion at Beaver Creek in Colorado. These improvements increased uphill capacity and spread out crowds, making the resort more attractive.

Vail Resorts has also portioned an enormous amount of its capital expenditures towards Breckenridge Resort in Colorado. In 2021, a new high-speed chairlift was installed on Breck’s Peak 7. In 2022 and 2023, several fixed-grip double chairlifts were replaced with high-speed quads, significantly increasing the uphill capacity. Each chairlift installation can cost well over one million dollars and take many months to complete. All of these upgrades at Breckenridge likely involved planning well before the pandemic started. Despite no capital projects in 2020, Vail Resorts has taken on an ambitious amount of improvements in recent years, demonstrating a positive outlook for the future.

Beyond the headline projects at world-famous resorts like Whistler-Blackcomb and Breckenridge, Vail Resorts has brought a similarly intense level of investment to its other smaller resorts. “All of our resorts, even our smaller ski areas in the Northeast, Midwest, and Mid-Atlantic, are essential to our business strategy and the future of our sport,” Hogan said. “Resorts like Wilmot outside of Chicago or Mount Sunapee near Boston or Liberty near Washington, D.C. are where the vast majority of skiers and riders learn the sport–as they’re close to some of the biggest population centers in the country. So continuing to invest into those resorts is critical.”

Vail Resorts was not the only member of the ski industry to pursue huge capital projects immediately following the pandemic. POWDR, the Park City, Utah-based company, pursued lift upgrades at Mt. Bachelor in Oregon, Snowbird in Utah, and Copper Mountain in Colorado, along with new lodges at Copper Mountain and Killington in Vermont. Stacey Hutchinson, POWDR’s Vice President for Communications and Government Affairs, shared the following statement via email about the lasting impacts of the pandemic on the ski industry:

“Ski resorts provided an excellent opportunity for people to enjoy the outdoors in a safe and controlled environment during the pandemic, and that continues today.”

POWDR would not confirm if it has been utilizing a similar strategy of pushing more skiers towards season passes as a way of insulating themselves from unforeseen impacts on skier visits, similar to the rest of the ski industry.

With the pandemic now a few years in the rearview mirror, the ski industry continues to grow. The fear once expressed in early 2020 that the ski industry may crumble now seems a bit overblown. Whether the continued growth of the ski industry is due to policies and strategies enacted before the pandemic or in response to it is unclear. While we all hope there are no other pandemics looming on the horizon, the ski industry is sure to face other challenges in the coming years. Lower snow totals and shorter seasons, brought on by the climate crisis, will be a huge problem for the ski industry to tackle. Hopefully, the pandemic provided a roadmap and a testing ground for how to keep the chairs spinning when the world tries to stop them.

More from Zach Armstrong:

- How Eldora, CO, Ski Patrollers Finally Got Their Union

- How the Fatal GS Bowl Avalanche at Palisades Tahoe, CA, Happened and Why it Could Happen Again

- Public Money Gets Funneled into Massive Deer Valley, UT, Expansion

- Ski Industry Unions Across America Fight For Experienced Staff Retention and Training Incentives