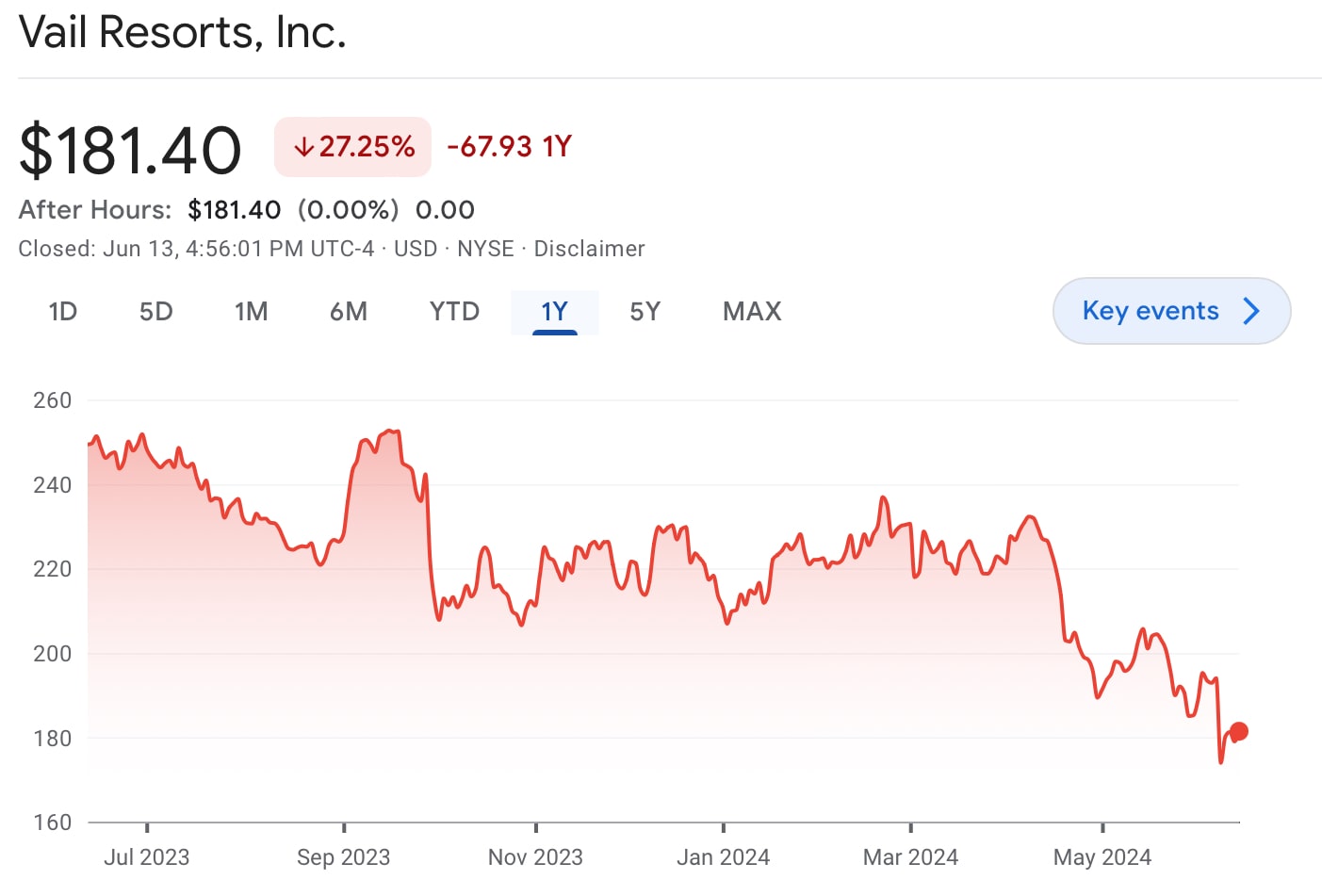

Vail Resorts released its quarterly earnings on June 6 and investors did not like what they saw/heard during the earnings call. The company downgraded its outlook for the 2024 Fiscal Year for a third time, and shares briefly fell by up to 14.9%. The share price went as low as $165.14 before recovering again to around the $180-level. Some may have seen the low as a buying opportunity or short sellers potentially locked in a nice profit, but the current price level is a far cry from the share’s 52-week high at $254.78

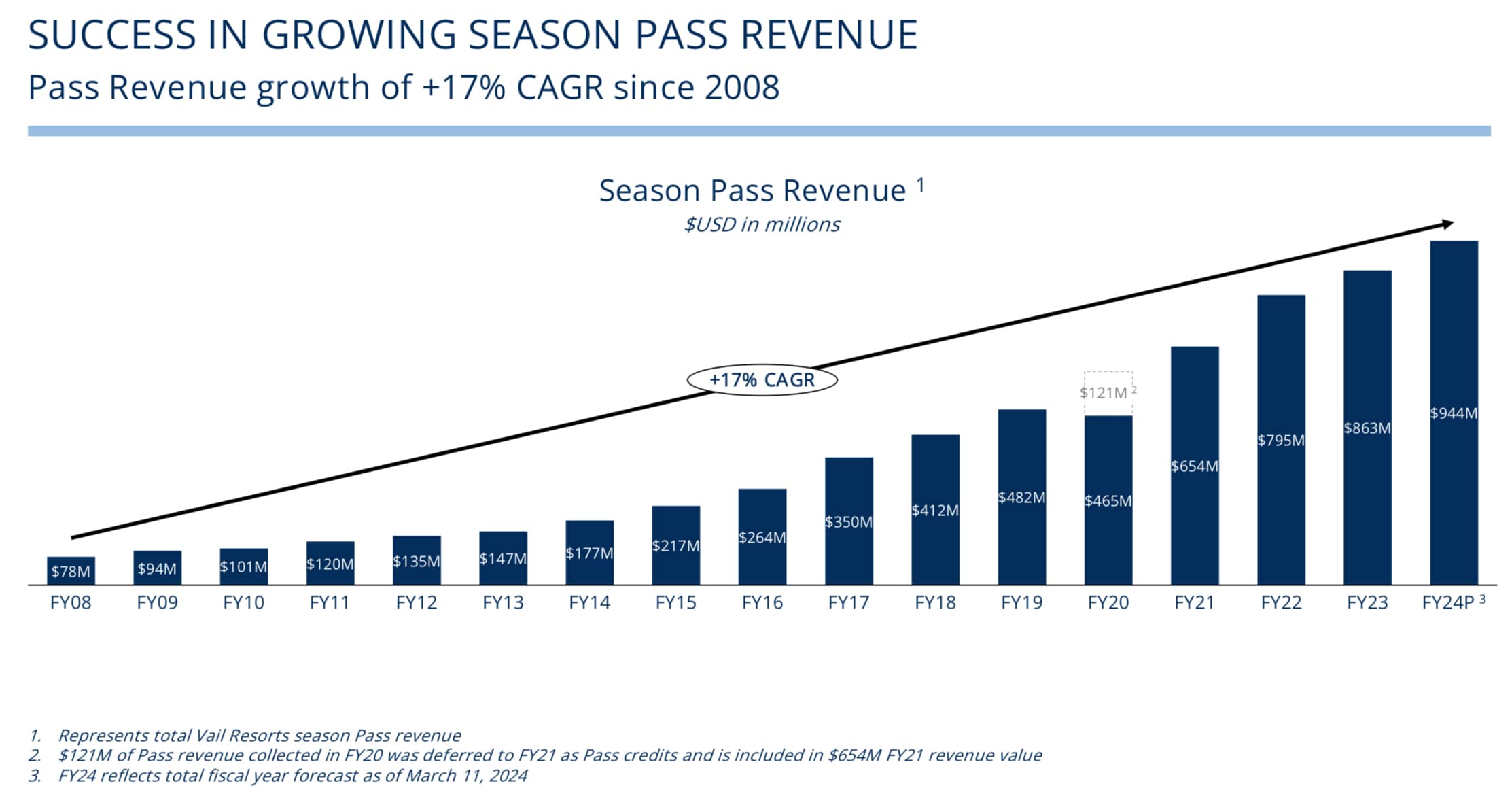

The quarterly earnings for the quarter ending April 30 are the third quarter in Vail Resorts’ fiscal year, which runs until July 31. Results from April 30 will include the majority of 23/24 winter-related revenues. Epic Pass sales for 24/25 have started in March so next quarter’s sales results will still be important and a good initial indicator of the 2025 Fiscal Year. According to Vail Resorts’ CEO Kristen Lynch the fourth quarter is very important as, “the majority of our pass selling season is ahead of us, and we believe the full year pass unit and sales dollar trends will be relatively stable with the spring results.” As of May 29, Epic Pass sales are down by 5% year-on-year on a unit basis but up 1% in revenues due to a pass price increase of 8% year-on-year.

After a bumper 22/23 ski season, the slow start to the 23/24 season weighed on pass holders’ visitation numbers and impacted lift ticket sales. While visitation by pass holders picked up in spring, lift ticket sales are down -17% year-on-year. A large part of this slump appears to be down to a particularly warm season in Whistler Blackcomb, Canada. Vail Resorts CEO Kristen Lynch added, “The winter season included significant weather-related challenges, with approximately 28% lower snowfall for the full winter season across our western North American resorts compared to the same period in the prior year and limited natural snow and variable temperatures at our Eastern U.S. resorts (comprising the Midwest, Mid-Atlantic, and Northeast). For the 2023/2024 North American and European ski season, total skier visits declined 7.7% as compared to the prior year period, which we believe was driven by a combination of unfavorable conditions and broader industry normalization post-COVID following record visitation in the U.S. during the 2022/2023 ski season. Skier visitation from lift ticket guests was particularly impacted, declining 17% compared to the prior year period.”

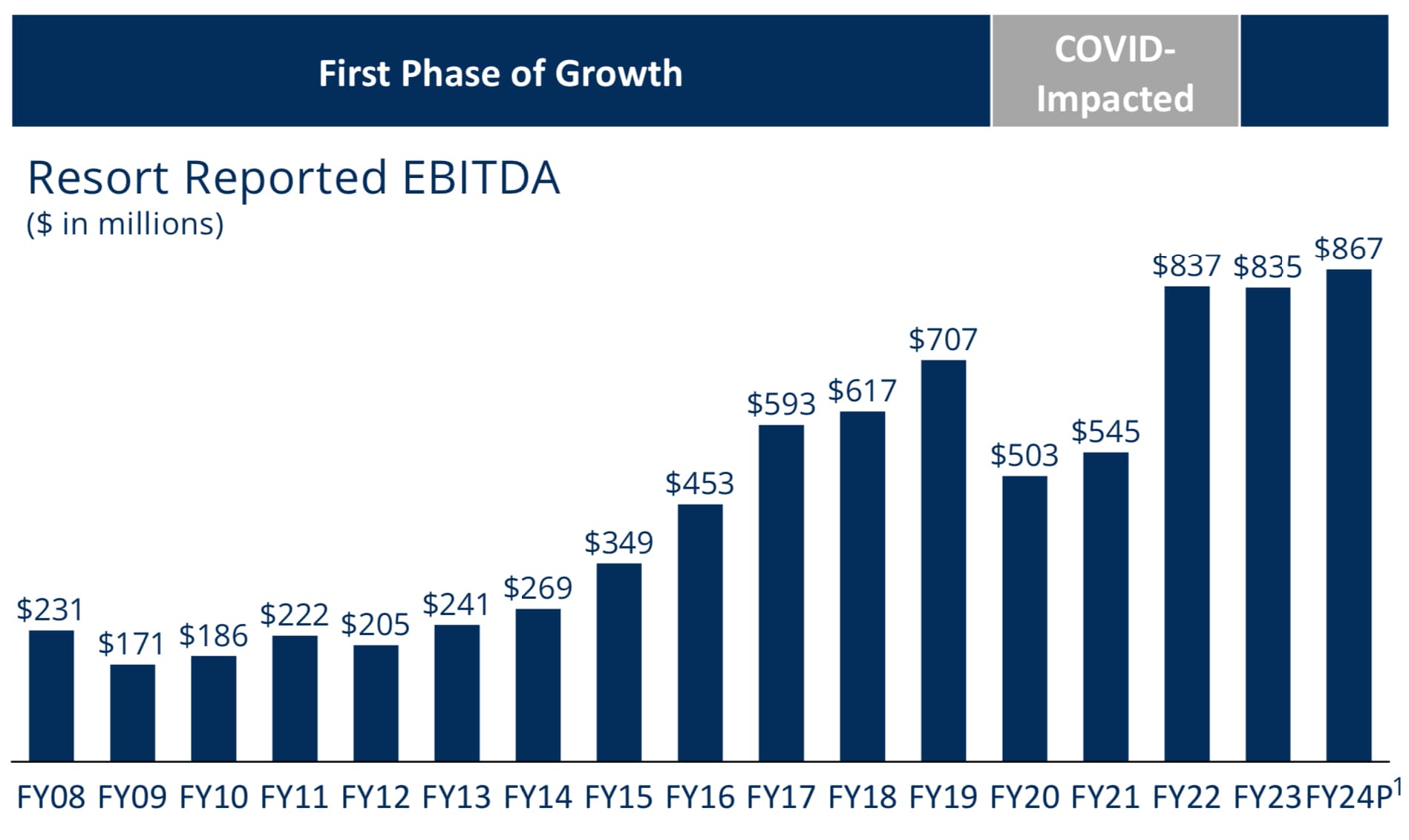

This has impacted revenues as well as EBITDA (EBITDA: Earnings Before Tax, Interest, Depreciation, and Amortization) forecasts for the 2024 fiscal year. In March, Vail Resorts was expecting a Resort Reported EBITDA of $867 million but has now revised this down to a range of between $833 million and $851 million, excluding the cost of integrating its new resort Crans-Montana in Switzerland. While the earlier EBITDA figure included the acquistion cost of $4 million, it did not include additional costs resulting from the expansion in Switzerland. Lynch explained, “In addition, with the closing of the acquisition, we now expect Crans-Montana to contribute negative $12 million of Resort Reported EBITDA for fiscal 2024, including negative $9 million from acquisition, closing, and integration expenses and negative $3 million from operating results in the fourth quarter.” Including these additional costs from the Crans-Montana acquisition, the new estimate for the 2024 EBITDA is there fore $8 million lower, between $825 million and $843 million. For the Fiscal Year 2023, EBITDA was $835 million, so year-on-year growth could potentially be negative.

Also weighing on Vail Resorts’ financial forecasts are poor sales of the Australian Epic Pass. Regarding Epic Australia Pass sales, Lynch commented, “Epic Australia Pass sales end on June 12, 2024, and are down approximately 22% in units through May 29, 2024, which we believe is primarily a result of the historically poor conditions during the 2023 ski season in Australia. The Epic Australia Pass has grown 43% in units over the past three years.” This might explain why Vail Resorts announced on June 12 that the Epic Australia pass sale would be extended by a week to June 19. The company is clearly hoping that recent snowfalls might motivate some Australians to purchase a season pass after all, now that resorts have received decent snow cover.

Since its peak in November 2021 of $372.51, the share price of Vail Resorts has more than halved. Despite a 10-year compound average growth rate of its EBITDA of 12% per annum, the share price has stagnated in the last five years, but at the end of the day it has more than doubled in the last 10 years. So maybe the current price situation is more accurately reflecting the company’s growth potential. It is still trading at a P/E ratio (share price over earnings per share) of 24.68 and it pays to be realistic about the company’s growth rate potential in the future. Vail Resorts dominates the American ski industry with a market share of 36% there is limited room for a growth in a stagnating market. The number of active skiers in the USA has not changed dramatically over the last 20 years, however ski days fluctuate each season, depending on snow levels.

All in all Vail Resorts is a healthy company with decent cash flows and an annual dividend yield of 4.9% to shareholders. The corporation recently rolled its $600 million debt facility into senior notes with a 2032 expiry, and there is plenty of cash on the books, so there is no need for concern on a cash flow aspect. However, maybe the shares will not be quite as in demand as the business model is reaching maturity. Vail Resorts is trying to branch out into growth segments with its new Epic Gear offering but the main driver will remain its pass product. The company is looking outside North America for further growth, particularly at Europe, where a total of 179 million annual skier visits are recorded, making it the largest ski market in the world. However, whether the American business model can be translated into Europe is a question that remains to be seen. With a slew of huge resorts on offer and prices for lift tickets at less than half the price of North American resorts, it will be harder to convince Europeans to lock into a multi-resort season pass at a cost of more than 10 days of skiing to break-even.

Disclaimer: This piece does not constitute an offer for shares nor is it investment advice but rather an opinion piece. SnowBrains does not accept any responsibility for losses incurred and investors need to seek their own evaluation before investing in Vail Resorts.