Vail Resorts’ stock took a beating in open trading when the market opened again yesterday, January 2, after the New Year’s holiday. Following the ski patrol strike at Park City, Utah, the share price of the skiing behemoth fell -6.56% during market hours. The company’s share price closed at $175.16. The company has been listed on the New York Stock Exchange (NYSE) since February 1997 under the stock ticker symbol ‘MTN.’

Vail Resorts is facing sharp criticism from guests over handling the strike by the Park City Professional Ski Patrol Association (PCPSPA), which has resulted in long lift lines and limited terrain opening during its peak holiday period. PCPSPA, representing nearly 200 patrollers and mountain safety staff, initiated the strike on Friday, December 27, after contract negotiations with Vail Resorts broke down. At the heart of the dispute are wages and benefits, with the union seeking to raise the base wage from $21 to $23 per hour to keep pace with inflation and the cost of living. Guests allege that Vail Resorts did not communicate the strike, leaving visitors frustrated by long lift lines and limited terrain opening.

- Related: Park City Ski Patrol Officially on Strike Today—Likely First-Ever Ski Patrol Strike in History

Equity investor and partner at Cerity Partners Jim Lebenthal shared his recent experience at Park City, Utah, on CNBC’s Closing Bell: “I’m a little angry! […] I was out in Park City, Utah, for the last week. We got 2 feet of new snow—that’s every skier’s dream, right? Let’s go skiing, guys! Except the problem is, Vail Mountain, which owns Park City, didn’t let any of us know that there was a ski patrol strike going on. So, less than 20% of the mountain was open at the peak holiday time. That meant I got a great time looking at the snow from the ski lines which stretched on for an hour.”

To be fair, poor early-season conditions did not help Park City’s operations. Snow depth at the Utah resort was at 68% of the December average. Vail Resorts moved some ski patrol staff from other resorts to Park City, however, the move resulted in upset among the Breckenridge, Crested Butte, and Keystone staff that were relocated over the holiday period to Park City. According to an open letter by the unions of those ski patrols, the move of some senior staff caused disruptions at other resorts. The unions claim that this move has caused uncertainty, safety concerns, and potential risks for both employees and guests, particularly during the busy holiday season. The PCPSPA strike moves into the seventh day of an unfair labor practice strike, that calls for an end to coercive practices, better communication, and fair contracts. It also needs to be pointed out that news of the strike had been shared across several news channels on December 27, however, we cannot attest how and if Vail Resorts communicated the strike to guests at Park City on the day.

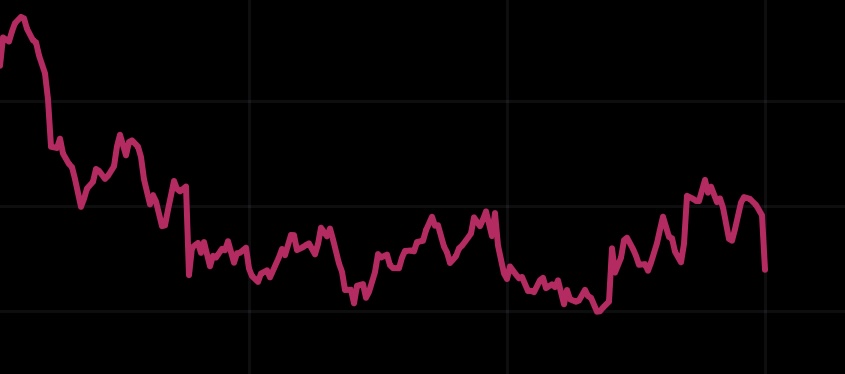

The MTN stock has been underperforming indices such as DJ Travel and DJ Hotels, which it has been part of for several months now. While other shares and indices in the same sector are up over the last 24 months, Vail Resort’s share price is down almost -30%. Vail Resorts has a market capitalization of $6.56 billion, based on 37.44 million shares and a closing price of $175.16. The closing price of $175.16 represents a Price to Earnings ratio (P/E) of 22.9 on the 2025 average earnings per share (EPS) estimate of 7.64 and a P/E of 21.1 on the 2026 average EPS of 8.32.

The company has recently been buying back shares in a bid to boost its share price. According to the Q1 2025 earnings report, Vail Resorts repurchased approximately 0.1 million shares at an average price of approximately $174, in hopes of creating a floor under the share price. Market trading on Friday, January 3, will show if the share price will find support around the $174 level.