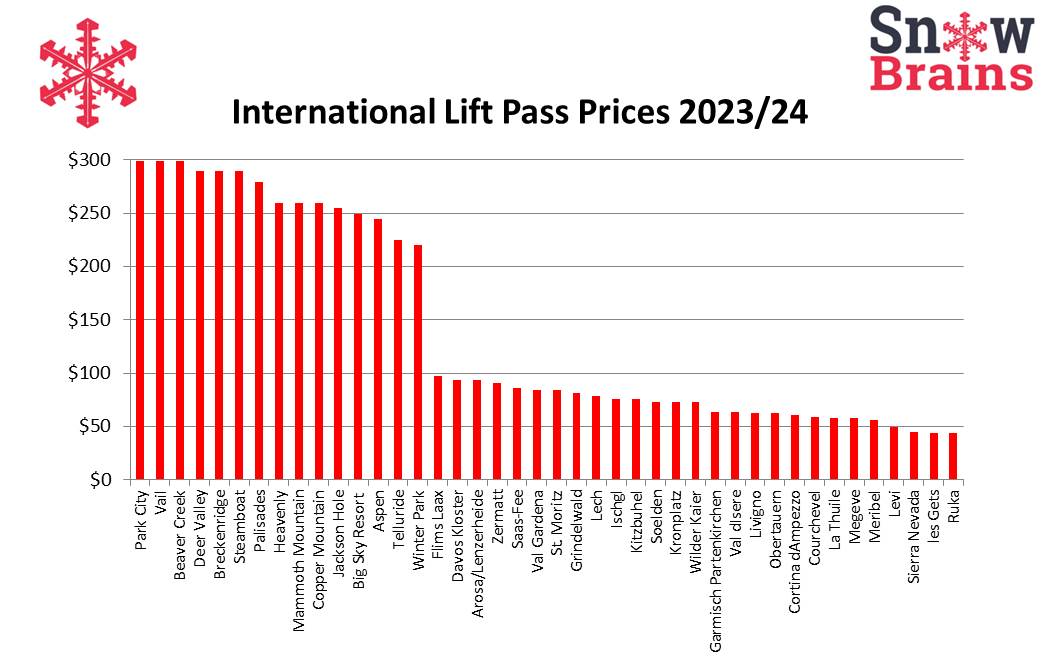

If you’re a snowsport enthusiast, you’ve likely heard (and participated in) the age-old debate: American ski resorts vs. European ski resorts. Beyond the obvious differences in terrain, snow, culture, and scenery, one critical factor often tilts the scale in favor of European slopes for budget-conscious skiers: cost. American ski resorts have earned a reputation for being significantly more expensive than their European counterparts. With ski lift day passes in America around four times the cost of European counterparts, one has to wonder where this difference comes from.

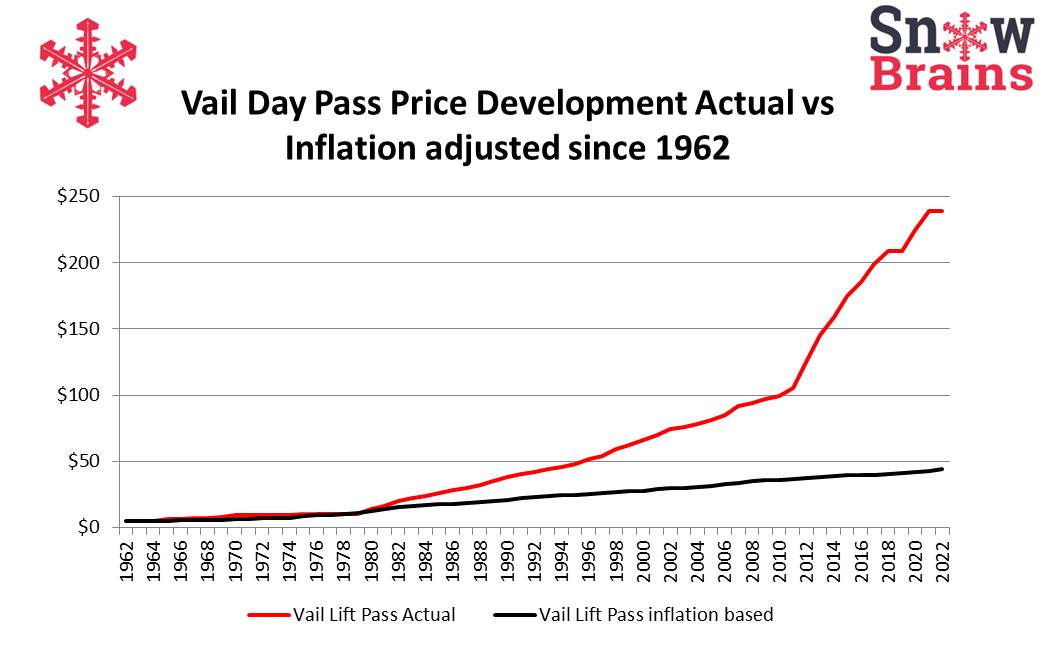

Vail announced it will charge up to $300 for a day ticket next season while no European resort has yet broken the three-digit barrier, and European resorts are starting to look like a feasible alternative for middle-class Americans. Ticket prices in the U.S. were comparable to their European counterparts and tracked inflation until the 1980s when prices ran way ahead of inflation. When Vail Mountain opened in 1962, a day pass lift ticket cost $5. Adjusted for inflation (measured by the Consumer Price Index or ‘CPI’), a ticket would be around $44 by 2022. However, the actual price last season was a staggering $239.

Of course, this is a comparison that does not take into account the significant infrastructure upgrades undertaken by Vail. However, comparing the pricing of U.S. resorts with state-of-the-art European resorts shows that Americans are paying around four times the lift ticket price to comparable European ski resorts. There is not a single European resort charging more than $95

This price difference stems from the very different history of American resorts versus European resorts. In Europe, skiing evolved organically over a long period, with many ski resorts already being popular wellness destinations in summer, credited with healing properties from the pristine alpine air. Meanwhile, the American ski industry did not take off until the 1950s and was a combination of imported visions from Europe combined with corporate strategies rather than organic growth. Geographical and cultural differences come into play as well. Ultimately, the price difference comes down to a combination of factors, which we have analyzed below. Most factors are intertwined, but we have separated them here as best as possible for better illustration.

1) The Evolution of the American Ski Industry

Skiing evolved in America in a different way than in Europe. Skiing was initially a means of transport in Europe. European immigrants spread this form of transportation across mining towns in Colorado and Utah, such as Park City, Copper Mountain, or Aspen. When the mining industry went bust in America, so did most of these towns, and populations dwindled. Western American mining towns never attracted summer tourists like European ski resorts. Tourism was well established in the European Alps, with people traveling to alpine resorts for their healing properties. Ski tourism in Europe evolved from existing summer tourists discovering the stunning beauty of the Alps in winter for themselves over the years. In America, the collapse of the mining industry almost destroyed mining towns, and wealthy Americans brought the idea of turning these areas into ski resorts back from European trips. In the late 1930s, the first lifts were installed in America’s West, which kickstarted the idea of ski resorts in America.

The next surge in skiing in America came after World War II when around 62 veterans of the 10th Mountain Division opened ski resorts across the nation, resurrecting many mining towns as ski resorts. The most significant growth in American ski resorts occurred in the 1950s and 60s, with the ski industry growing at 15% per annum. From 1955 to 1965, the number of ski areas in North America went from 78 to 580. When this growth topped out in the late 1960s, resorts started to change hands, and the initial ski area founders aged out or moved on and sold their resorts to developers. Then, in the 70s, consolidation started, and mountain resorts fell under corporate management, sometimes by unrelated businesses, like Ralston Purina, which bought Keystone and Arapahoe Basin, CO, in 1973, or 20th Century Fox, which bought Aspen Skiing Co. in 1978.

- Related: The History of the Legendary 10th Mountain Division, The Men Who Started USA’s Ski Industry

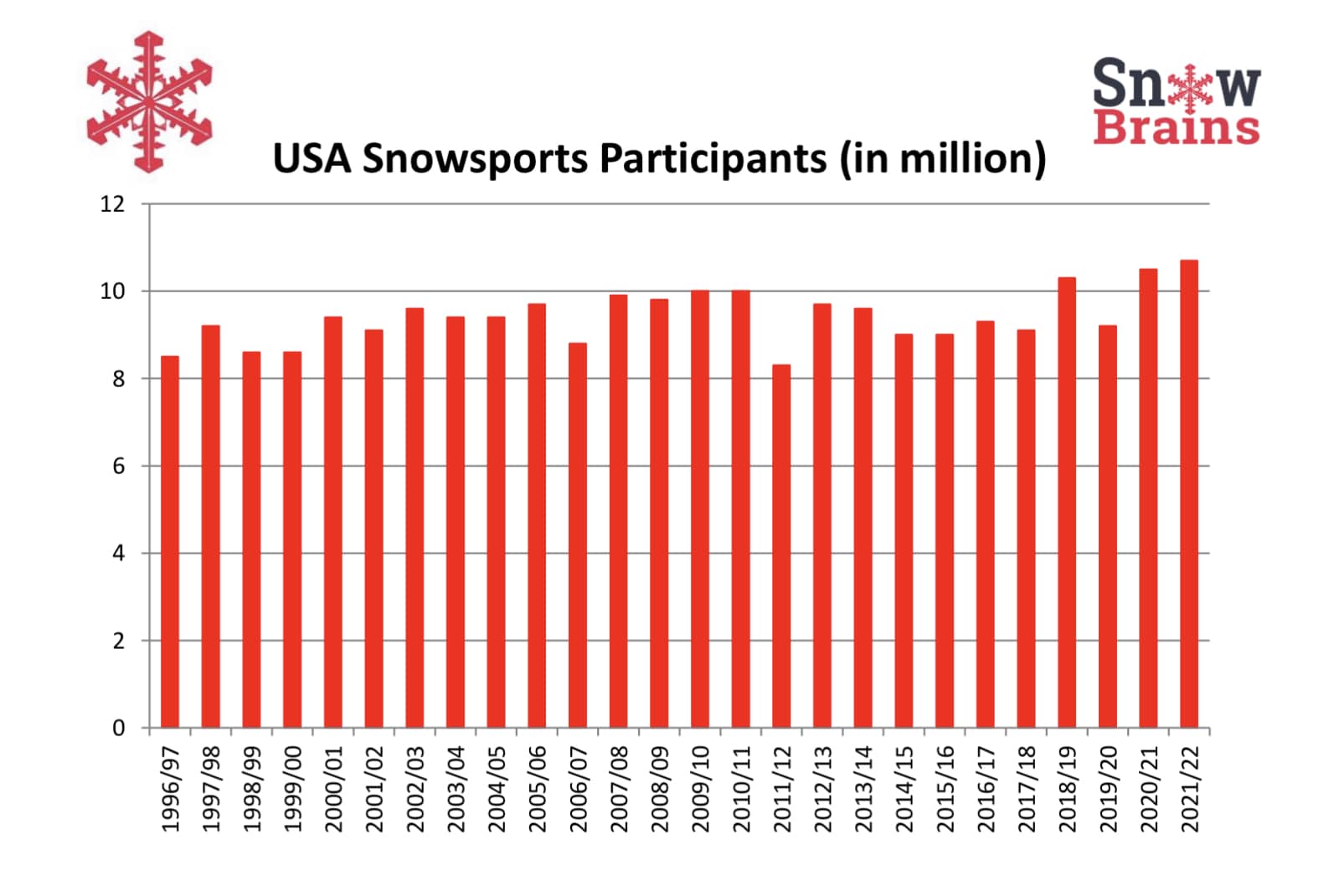

At the beginning of the 1980s, there were over 700 ski areas in the USA. Consolidation accelerated while the number of active snowsport participants stagnated, forcing smaller, privately owned resorts, which could not compete with the investments of large corporations, out of business. The number of ski areas has decreased to roughly 500 ski areas, yet between 2000 and 2017, the price of a day pass increased by 200%.

2) Resort Ownership

Market Theory has it that in an efficient free market, prices are set by balancing supply and demand; however, the ski industry in America does not represent an efficient free market. The number of active skiers in America has been relatively steady over the last 25 years. However, prices for ski tickets have gone up almost 500% in the same period. This is because roughly 50% of the U.S. ski resort market is dominated by two large players, Vail Resorts and Alterra. In this duopoly, Vail Resorts has the largest piece of the pie in the U.S., with an estimated market share of 36.1%, while Alterra has a market share of 15.1%. By its own estimations, Vail covers 53% of all North American destination guests (which includes Whistler Blackcomb in Canada, the largest resort in North America by visitation numbers). In a duopoly market, inefficiencies can be used to achieve outsized profits, and barriers to entry are high. Skiable mountains are a limited resource and are often situated in National Forests where land is protected from further development. In 2008, Vail Resorts and, in 2018, Alterra introduced multi-resort season passes, which are sold upfront, minimizing their risk and optimizing cash flows for the corporations. The price increase since 2008, when the Epic Pass was introduced, is very noticeable in the above chart of Vail’s actual versus inflation-adjusted day pass price.

3) Lack of International Substitution

American resorts do not face much international competition, with only Canada being a viable competitor. In Europe, Alpine countries and individual resorts compete for international skiers from its European neighbors in Germany, the United Kingdom, the Netherlands, or Belgium but also further afield, like Russia or China. The U.S. does not compete for international skiers as the inbound market is insignificant for U.S. resorts, with only 6% of foreign skiers coming to the USA. Outbound, there is only Canada that attracts any significant flow of skiers. Despite America’s large population, the flow of U.S. skiers to Canada is only the tenth largest outbound travel direction in ski flows. Germany, for example, has around 25 million skiers, of which about 14 million are active skiers in a year. This number compares well with America, which has about 25 million skiers, of which active participation is around 10 million. Approximately 59% of Germans will spend their ski holiday in Germany, while the remaining 41% will travel to Austria, Switzerland, France, or Scandinavia. This means close to six million Germans travel to mainly European resorts. This is more than half the number of active U.S. skiers, a significant number that creates competitive pressure for European resorts. America lacks this kind of international competition entirely, which is surprising given skiers from the East Coast will typically fly more than four hours to the West Coast when they could just as easily fly six hours to Vancouver or seven hours to Europe.

4) Insurance and Healthcare

Skiing and snowboarding are sports that carry some risks and ski resorts need to have liability insurance to cover litigations. As the first lawsuits started to emerge, the legal landscape surrounding ski resort liability started to solidify. The Ski Safety Act, first introduced in Colorado in 1979, served as a model for other states. Corporate liability insurance became an essential tool for ski resorts to navigate this evolving legal framework, causing liability insurance in the United States to increase by 600% in the 1980s. Today, corporate liability insurance at American ski resorts has evolved into a multi-faceted system. Resorts typically carry a combination of general liability insurance, which covers accidents and injuries on resort property, and specialized ski industry insurance. These policies are tailored to address the unique risks of skiing and snowboarding, such as collisions on the slopes and injuries related to ski lifts. The cost of this plethora of insurance policies is passed on directly to consumers. In Europe, skiers typically carry their own liability insurance and have private or public health cover, eliminating any need to sue to recoup medical expenses. In addition, the litigious culture where millions in remuneration are sought for wrongful deaths is a concept entirely unknown in Europe. Therefore, the liability insurance cost for European resorts is much lower than for their American counterparts.

All these factors have contributed to the dramatic price increase in American ski resorts over the last four decades to the point that prices younger generations out of the sport. Since the ski industry in America took off in the 1950s and 60s, the median skier age has increased by nearly 50% from 24 to 35. It can hardly be a development that the NSAA would encourage to combat the declining participation in younger generations. If they want to grow the sport, they will have to find ways to make skiing more affordable for families.

Hi Thro, throw, through,

I’ve also been to resorts in Switzerland, France, and Spain. I found all the resorts I went to in Europe to have similar lifts as the US in terms of smoothness, size, and speed. I noticed there are no single lift lines in Europe so for someone that often boards solo I give the edge over the US resorts for having two separate lines to get thru lines quicker by pairing up at the gate and ensuring lifts stay full ensuring everybodygets up the mountain in the least amount of time possible. With my season pass this year I’ve been able to snowboard 15 days in Europe across 6 mountains for free. I will now go to the mountains in the US to snowboard another 30 to 40 days this year at about 5 to 10 resorts. For me, it’s a no brainer that having a season pass is far more cost effective than trying to buy day passes in Europe. Talking to Europeans I didn’t hear of a European season pass that allowed them to snowboard across the world at a price comparable to a European season pass. I guess you can say we are quite spoiled in the US for those of us that actual like to ski/snowboard more than one week a season. But sure if you are one of those people enjoy your day passes, we’re just on two different levels in our commitment to this fun hobby.

Hi J, Joe, Joey.

I’m from Europe, I’ve been to many resorts in Canada BC, not so much US.

Ive been to resorts in Austria, Switserland, Italy, France, Germany and Spain.

So about the lifts in europe; they’re smoother, Larger, faster and cheaper.

I’ve been to Whisler in the past I don’t go there anymore in winter, sad I really like it there, a season pass is not someting I would buy.

Have rode and competed all over the US and if you ride more than a week an epic or ikon pass if definitely worth the costs compared to daily lift tix. However, as I’ve gotten older I don’t have the opportunity to ride as much and pretty much only am able to do a trip once a year. The past few years I’ve gone to France, Switzerland, and Japan and can tell you that it’s definitely a much better bang for your buck. Longest lift line over Xmas and NYE was ~15 mins and they all have high speed lifts and gondolas. Also, the food is incredible on the mountain and you’re not just getting shitty chicken fingers made by a teenager… Also US Apres Ski has nothing on Europe (Cloud 9 is trash)

Your argument is schnitzel. For the price of a season pass you can not only ski at the premier resorts all year long you can still go to Switzerland, France, AND Japan and your lift tickets are still free on either the Epic or Ikon pass. The argument is on average is Europe or the US cheaper to ski and the only response is it depends on whether you’re poor like you and can only afford to make one trip a year or well off like most Americans that ski and want to go 10, 15, 20+ days a year and do. I’m in Europe right now snowboarding for “free” minus rental gear, flights, pricey good food, and as fun as I’m having I can tell you it doesn’t outweigh having to pay over $1000 to fly round trip out here (if I was on a budget which I’m not), the few hundred I’m spending on rentals, and the cost of food to eat on or off the mountain in Switzerland. I had an excellent pizza and pint of beer for myself for 40 swiss franks ($45). Both the US and Europe has cheap mountains but maybe Europe has some great mountains that are still relatively cheap for a day or two a year, but once you get into the category of skiing is a winter lifestyle they are both about the same price. End the debate, if you’re serious about skiing get a freakin season pass and then it doesn’t matter which you choose you’ll have fun either way and won’t break the bank with one over the other. If you’re not serious about skiing and on a budget stop expecting to ride the same mountains as people that are. Go to a local lesser known mountain and enjoy shorter lift lines and chesp prices. Switzerland and Japan overall are the most expensive places to ski on earth. Anyone using them to make the argument that they are cheaper than the US is fos salty, and has a chip on their shoulder anout the US and nothing more. Trump is your President, get over it!

you have much more express lifts in Europe, especially Austria where Doppelmayr, the leading lift maker is situated. Leitner is from South tyrol, just around the corner.

The price of a lift ticket at a destination resort is expensive due to greed. Two large holding companies own almost all the destination resorts. The tickets have been fixed so that there is no real price competition. If you want to know the real value of a ticket look at the independent resorts. Their lift passes are 1/2 the conglomerates. The reason for the price fixing is to get you to buy an Epic or Icon Pass ahead of the season. This works well if you live in an area with a lot of resorts because your pass is limited to only a few days at anyone resort. What is most egregious is that almost all the resorts are on public lands that are managed by the department of the Interior. The American public is being price gouged to use their own land.

There are numerous passes in the US for that price including many of the Vail Resort mountains even if you only plan on skiing for a week. You clearly have never visited any of the vail mountains during peak season bc you certainly wouldn’t be asking them to lower their price. The mountains are packed to the max. If anything the prices should go up to think out the crowds so you can actually ski instead of stand in line all day.

If you don’t plan on skiing more than 10 day in a season than maybe Vail isn’t for you and your family. Go to a lessor known resort and ski for $50. Vail is already super crowded as it is if they lowered the price to $100 per day during peak season you would only get to ski for 30 minutes and the rest of the time you’d be standing in a lift line waiting. It’s called supply and demand. Stop expecting premier resort skiing for dirt cheap prices unless you’re going to commit to skiing for more than a week each year like the millions of us that do.

How is a duopoly that manages American skiing good for anyone but them? As a father of two young kids, Vail Resorts is charging $270 for all of us for a one-day pass, which does not include rentals or food. This is for a small, mid-Atlantic resort. The pricing is insane now and we shouldn’t have to fly to Europe for reasonable pricing. Vail Resorts btw is owned by a private equity firm and their model is extraction pricing.

Your reply wreaks of bitterness and jealousy. Even if the minimum number of days Americans use their season pass is 7 days, which it’s not, that still comes out to be no more than a $100/day for the best resorts in the country. There are dozens of season passes for less than $400/yr or $50 per day. It’s only idiots that hate the US and want to paint us in a bad light bc of envy that think like you. We have money and we can afford to ski all season so very over yourself. Get a life and stop worrying about how much better we have it than you.

Tit

No, if anything they are faster. Most EU resorts have state of art infrastructure. I’ve heard Japan is better mind you, never been though

I think you’ll find it is you who appears ignorant. I have lived in Europe and the US for decades and skied extensively in both. In Europe you buy a season pass with the assumption that you will stay in resort the entire season, typically living and working there. Holiday makers do not buy season passes as, per your research, they make no sense given their price.

In Europe you would buy a 6/7 day pass typically at around 50-80 euros per day. The majority of people travel to the resort.

Where is your research for the percent of active EU skiers who buy season passes? You will find it is minimal. They do not want or need a season pass. Now if you compare to the US, how many of those buying a season (or EPIC) pass are using it for more than 7 days (or lets be generous and say 10 days) you will likely find it is a low number.

What the US resorts have done is make the day pass so crazily expensive that, if you expect to ski in the US, you would almost certainly buy a season pass. Most of my friends in New York City buy a season pass and go on a week long trip because it is cost effective in the US.

Summary: In Europe a SEASON PASS = a SEASON PASS. In the US, for MANY, a season pass is the most cost effective way of going skiing for 1 week. This article is bang on the money.

Furthermore, nobody is jealous of American resorts. Their infrastructure pales in comparison to even an average EU resort, and the skiing is much the same, depending on the weather. Drinks and Food are significantly cheaper in European resorts. The only real benefit in the US is arguably a short trip… for Americans.

Are European ski lifts super slow in comparison?

Julia, your name was my deceased grandmother’s name who died in 1985. To your story. You omitted the fact that like Vail Resorts installing high speed chairlifts for example adding to the cost of lift tickets. These resorts have to recoup the cost of dismantling these older lifts and installing these high speed lifts which cost millions of dollars for like Vail Resorts Corporation.

Gary Woolard

If you want the ski resort prices to drop, then everyone stay home, or go elsewhere for one season and next year they will be begging you to come skiing!

And then the prices will go right back up the following season. Learn how long term supply and demand works, but for now keep your ignorance to yourself.

Many industry officials look at weather change as a concern. I have long said, they will price people out of the sport, before the snow runs out.

It’s amazing how many ignorant people like yourself and the author of this article are so quick to talk out their behind on things they have very little understanding about when two minutes of research could put an end to your bogus nonsensical arguments.

According to a report by the National Ski Areas Association (NSAA), the number of season pass holders in the U.S. increased by 17.5% from 2019-20 to 2020-21, reaching a total of 9.1 million. This means that about 86.7% of the 10.5 million active skiers and snowboarders in the U.S. had a season pass last season.

Now go look up the average price of season pass in the US versus Europe and you will see the price per day difference for 90% of skiers and snowboarders in the US is negligible compared to the average price someone in Europe pays for an entire season.

There’s no excuse to be this ignorant with all the info the internet has to offer. The only conclusion is it comes from a place of malicious intent due to those that are jealous of the US .

American business greed is the reason. Sometime over past decades the American business model has become – “Fleece them for every penny you can”.