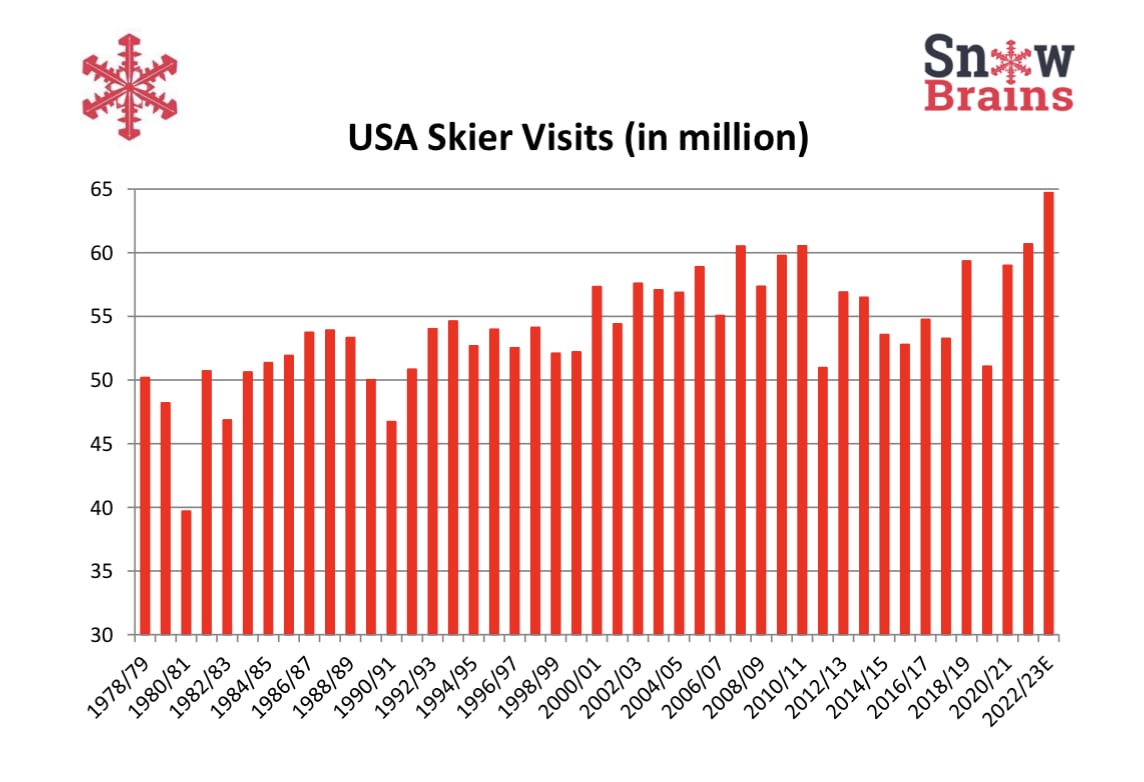

During the 22/23 ski season, 64.7 million skier visits were recorded in U.S. ski resorts. This figure was a record and an increase of 6.6% on the already impressive 21/22 season. While the data collected by the National Ski Areas Association (‘NSAA’) is still preliminary and will still increase, as many resorts still operated until Memorial Day, it is an indication that skier visits have turned a corner in the USA and are experiencing an upward trend.

Skier visits are defined as the number of days a skier (or boarder) has visited a resort and are typically based on data from turnstiles at lift gates. So if you go to a resort for one whole week, that equals seven skier visits (apologies to all snowboarders, it is the official terminology). However, This data does not reveal how many active skiers (or boarders) there were in total in the USA in 22/23. This data point is referred to as the Participation Number.

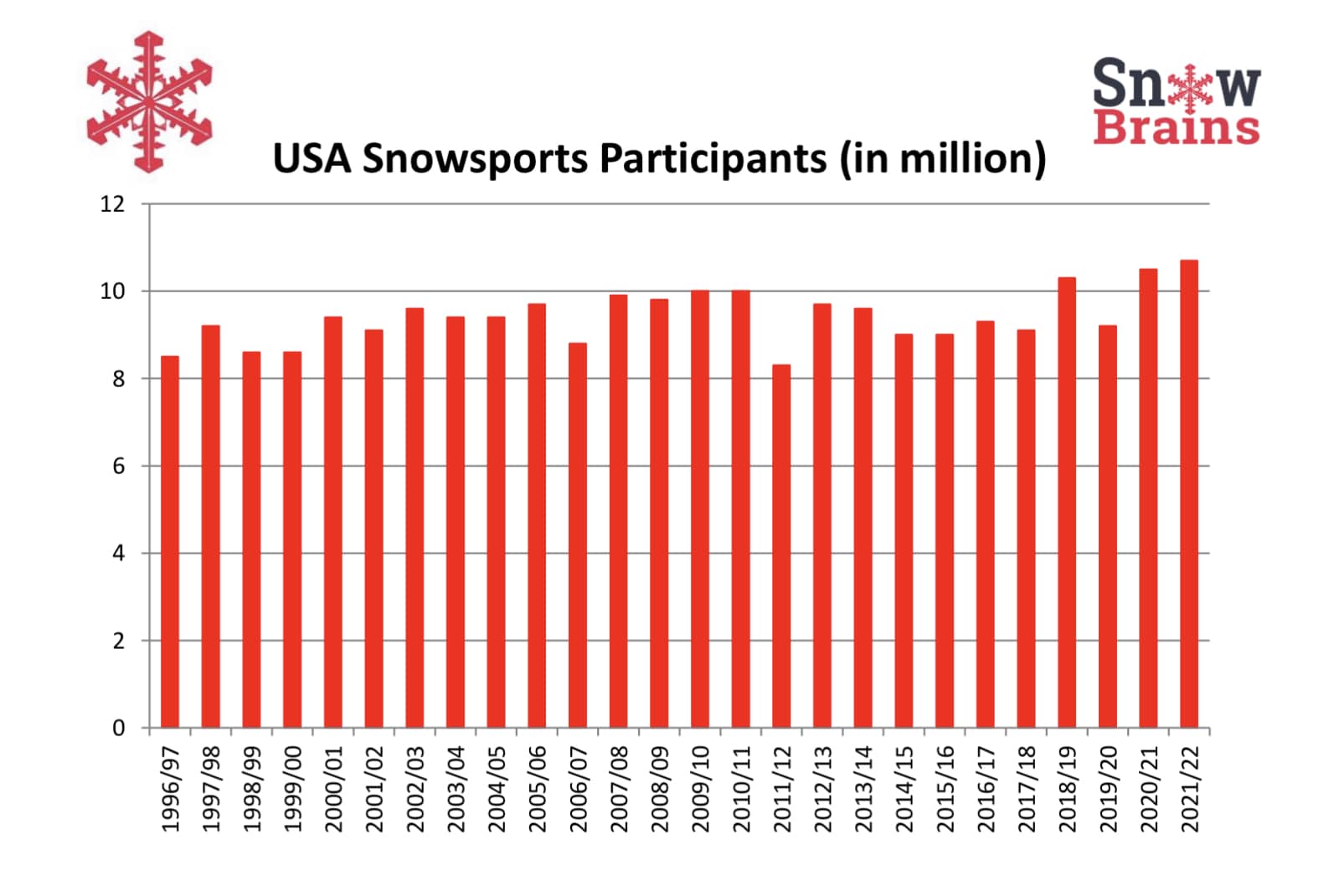

The snowsport participation rate has been pretty steady in the U.S. over the last twenty years, according to data from the NSAA, and hovers at around 3% of the U.S. population. The data for 22/23 will not be released until September this year, but last season NSAA counted 10.7 million active snowsport participants. Given the record skier visits number, however, it seems logical that we can also expect an increase in snowsport participants. While the participation rate in America has remained fairly steady at 3% — it has fluctuated between 2.8%-3.4% in the last 30 years — the demographics of these snowsport participants have changed over the last three decades.

The snowsport industry has undergone a significant transformation in recent years, as the average age of skiers has steadily increased. What was once predominantly a sport enjoyed by the younger generations has become a playground for baby boomers, with millennials exhibiting very different consumer patterns in resorts across America.

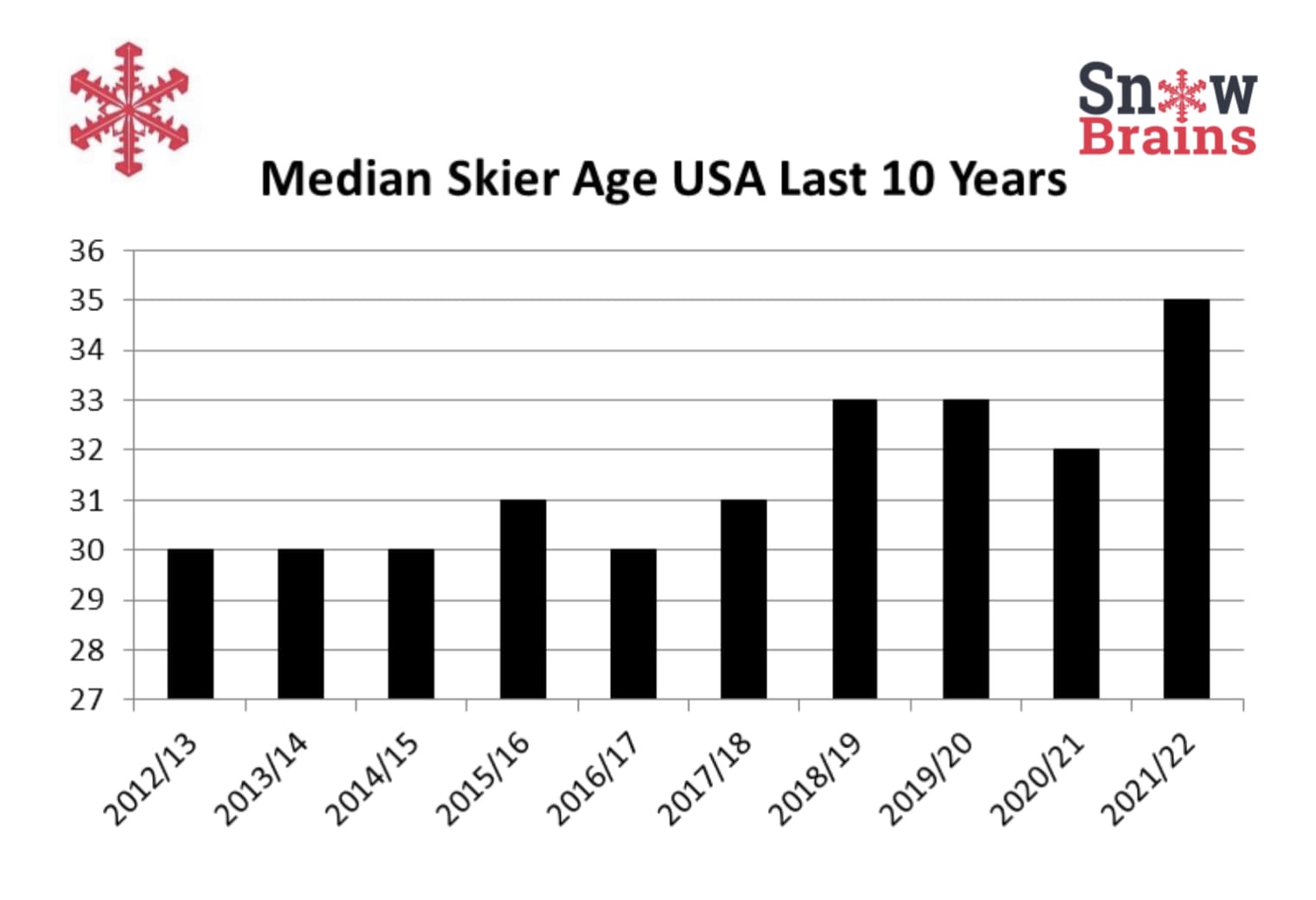

The median age of skiers in North America is 35 and has been increasing steadily from 30 years just ten years ago, according to NSSA. While an increase of five years in median age over ten years may not seem significant, it is important to put this into a longer-term perspective. In the 1960s, the average age of downhill skiers in America was 24, according to the 2022 industry report by Laurent Vanat. While the average is statistically not the same as the median, it is safe to assume the median would have been close to 24, but unfortunately, continuous numbers are not available from either source.

Interestingly, the increase in median age is not due to an increase in median life expectancy. The median life expectancy in the U.S. has more or less stayed the same at around 79 years of age (with a recent downtrend resulting from Covid-19-related excess deaths). The increase in median age lies with the eternal boomer-millennial divide.

Blame it on the Boomers

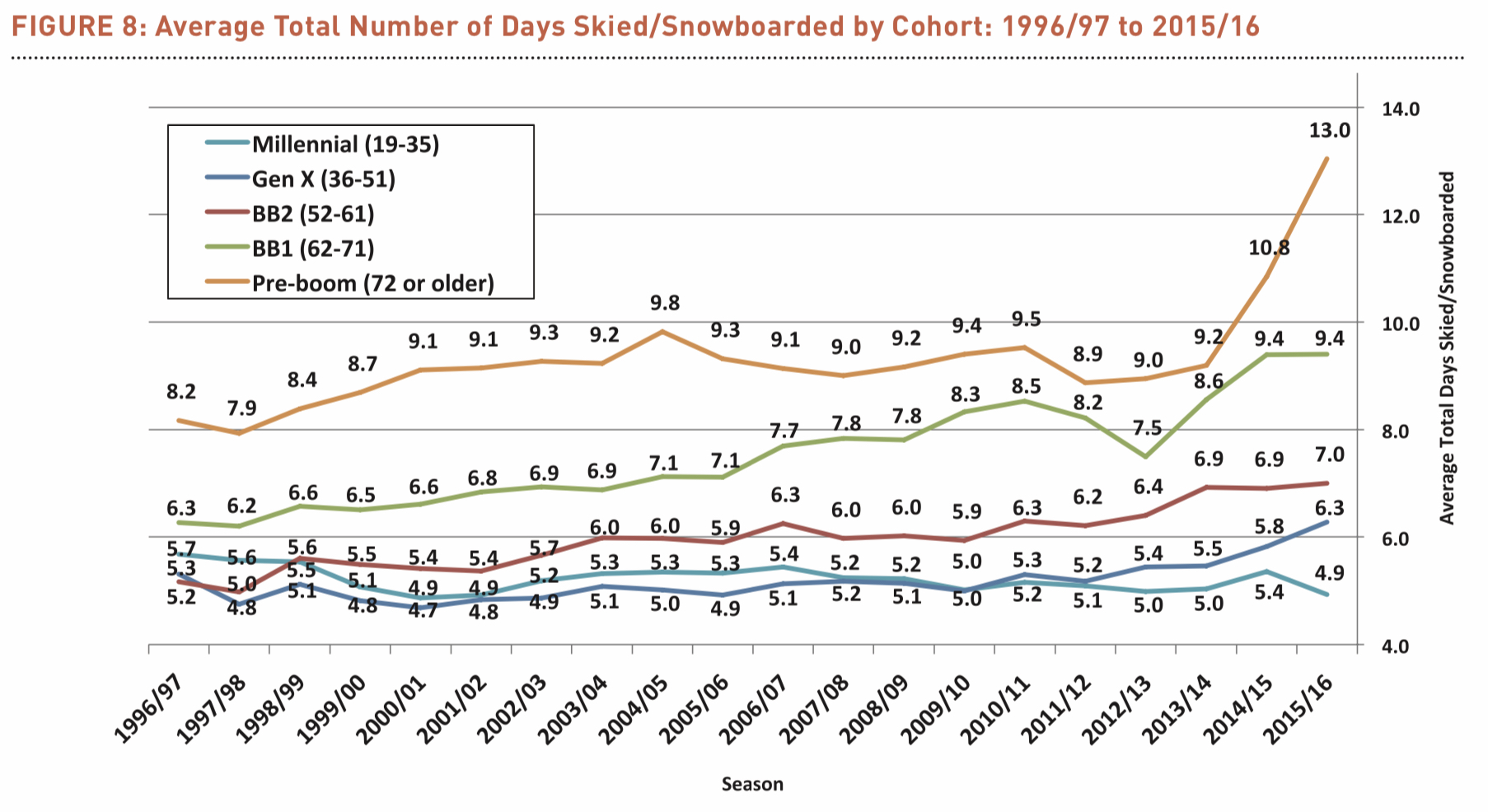

The skiing industry experienced a massive boom in the 1950s and 60s, mainly driven by the baby boomer generation. Baby boomers are defined as those born between 1946 and 1964. In those days, the boomers were young, and their numbers on the mountains across America doubled every five to six years. While younger generations, like Millenials and Gen Z, now make up the largest number of snowsport participants, their activity cannot match the activity level of the baby boomer generation. Jim Powell, Vice President of Marketing at the Park City Chamber/Bureau, said it takes about two millennials to replace every baby boomer hanging up their skis. Millennials ski fewer days on average and spend less money in resorts.

One of the primary drivers behind the rise of older skiers is that many baby boomers have reached retirement age. Unlike the previous generation, many boomers embrace an active and healthy lifestyle and are turning to skiing to stay physically fit and engage in outdoor activities. With more leisure time and increased disposable income, baby boomers are seeking new experiences and adventures. Their financial stability allows them to invest in skiing equipment, season passes, and ski vacations, contributing to the industry’s growth.

Pre-boomers (or Silent Generation) have the highest number of ski days, so even though their numbers of participants is small and steadily declining, they also contribute to pushing up the median age, as NSAA calculates the median age from the skier visits and not the unique snowsport participants. These pre-boomers have been able to keep participating thanks to medical advances, such as artificial hips and knees, that make it possible for skiers to continue enjoying the sport. In addition, new ski technology with shaped skis that make for easier turning, along with better snowmaking and grooming that make skiing much easier than in the 1950s, as well as luxury touches, like high-speed chair lifts and ski valets, have helped predominately the older generations to continue skiing.

Many pre-boomers and baby boomers are drawn to the social aspect of skiing. Ski resorts have transformed into vibrant communities, offering both slopes and amenities such as fine dining, spa facilities, and cultural events. These attractions make skiing an appealing option for baby boomers looking for recreation and social connections. Millennials, however, are not looking for the same experience as boomers and have a different approach to leisure and travel. Millennials have less disposable income and are, therefore, more cost-conscious. They are more likely to seek out unique experiences and explore alternative activities such as adventure sports, eco-tourism, and cultural immersion.

Recognizing the need to attract younger skiers, the skiing industry has tried to bridge the generation gap. In 2017, the NSAA launched a “Path to Growth” program to attract younger generations. Ski resorts have started offering more affordable packages, discounted season passes, and flexible payment options to appeal to millennials’ budget-conscious mindset. They have also expanded their amenities beyond traditional skiing, including snowboarding, snowshoeing, and après-ski events to cater to a broader range of interests.

In addition, ski resorts have embraced technology and social media to connect with younger audiences. They now use digital platforms to advertise and market their offerings, leveraging influencers and user-generated content to create a sense of community and excitement around skiing.

One of the biggest obstacles to growth in the ski industry in the U.S. remains the fact that the conversion rate for beginner skiers and snowboarders is only 19%. In other words, more than 80% of first-timers will drop out after and not try a snowsport again. In any other industry, having an abandonment rate of such proportions would be unthinkable. While many efforts have been made to increase the conversion rate, success has been negligible.

The skiing community must find ways to balance the desires of both baby boomers and millennials, creating an inclusive environment that caters to a diverse range of ages, interests, and budgets. By embracing innovation, affordability, and social engagement, the skiing industry can foster a new generation of skiers while continuing to provide a fulfilling experience for those who have long been passionate about the sport.