Recreational cannabis has been legal in the state of Colorado since 2014. It was the first state to legalize recreational marijuana. In 6 years, sales have never been higher than this past May where they reached more than $192 million.

At the beginning of the pandemic, Colorado was expected to deem cannabis as non-essential but quickly reversed its decision. Colorado was not the only state to deem cannabis (either medical or recreational) operations as essential businesses in the state’s stay-at-home order. You can find a list of states with their specific COVID-19 cannabis decisions at the Marijuana Business Daily.

Record monthly sales were seen in both medical and recreational cannabis. According to the Department of Revenue’s Marijuana Enforcement, the two sectors saw $42,989,322 and $149,186,615 in sales respectively. This was due to COVID-19 forcing many to stay at home and it seems like many are filling their time with marijuana.

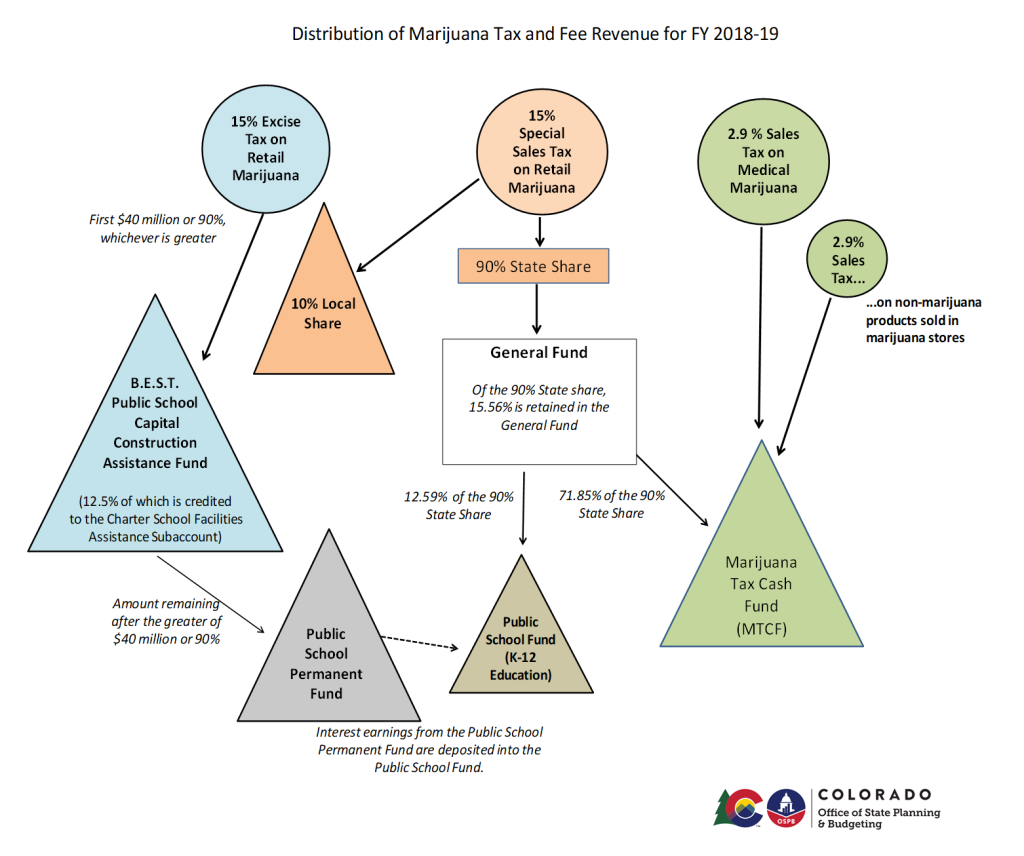

Colorado marijuana taxes are used to help fund a variety of services (mainly education) throughout the state. This increase in sales will also increase tax revenue for the state. While figuring out exactly where tax money from marijuana goes, the state was helpful enough to make a chart to make it easier to understand.