Have you ever looked at the multi-resort season passes like Epic or Ikon and wondered how these deals make financial sense to Vail Resorts or Alterra Corporation? After all, at a day pass price of $225-245 for Vail, the $841 season pass breaks even after just four days. You’d be forgiven to think that most people who buy these multi-resort season passes must ski way beyond their break-even point to maximize their investment. So you may be wondering if there is a trade-off for the vendors that enables them to sell multi-resort season passes that break even after just four days of skiing.

While there are many other benefits to vendors like Vail Resorts or Alterra from selling these season passes, the reality is that they want you to hit the break-even point. This strategy is simple: Hitting break-even ensures that users will continue buying the multi-resort-season pass, as they feel they got ‘value for money’, thus ensuring their continued loyalty.

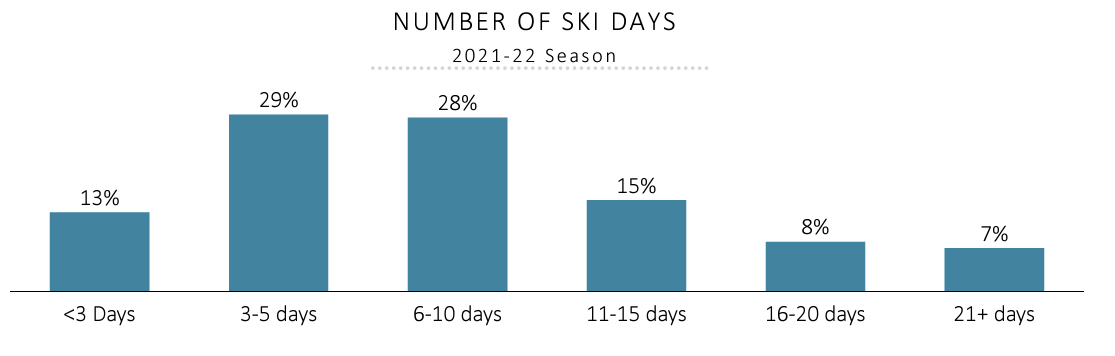

Realistically, data from a study conducted by Langston Group has shown that 57% of all skiers and boarders record 3-10 skier visits. The skier visit number is defined as the days every skier (or boarder) visits a resort. So if you go to a resort for a week, that equals seven skier visits (sorry, boarders, that’s what they are called). Convincing this market segment to purchase a multi-resort season pass has been the key driver for these companies. To this market segment, the break-even point seems achievable and the pass, therefore, good value — even if, at the time of purchase, the consumer is unsure about their plans for the next ski season. However, these passes go on sale when nostalgia about the last season is high, coupled with a time-critical financial incentive that pulls even the biggest skeptics across the line to ‘invest’ in the next season.

A study by Langston Group conducted from December 17, 2022, to February 10, 2023, found that 53% of people who ski or board 3-5 days bought a season pass. What may surprise you even more, is that 37% of those who skied or boarded between 0-2 days also bought a season pass. For this latter group, purchasing a multi-resort season pass like Epic or Ikon made no financial sense, but they had committed so far out they were unsure how many days they would be able or willing to ski.

You would be forgiven to think that people would learn from past behavior and not make the same mistake the following season, but the renewal rate for Epic Passes is increasing. The return rate for Epic Pass holders is double that of those who purchase a day pass at Vail Resort. Epic’s number of season passes sold every year has been increasing. Vail Resorts sold a record 2.3 million Epic passes this past season, up from 2.1 million in 2021/22.

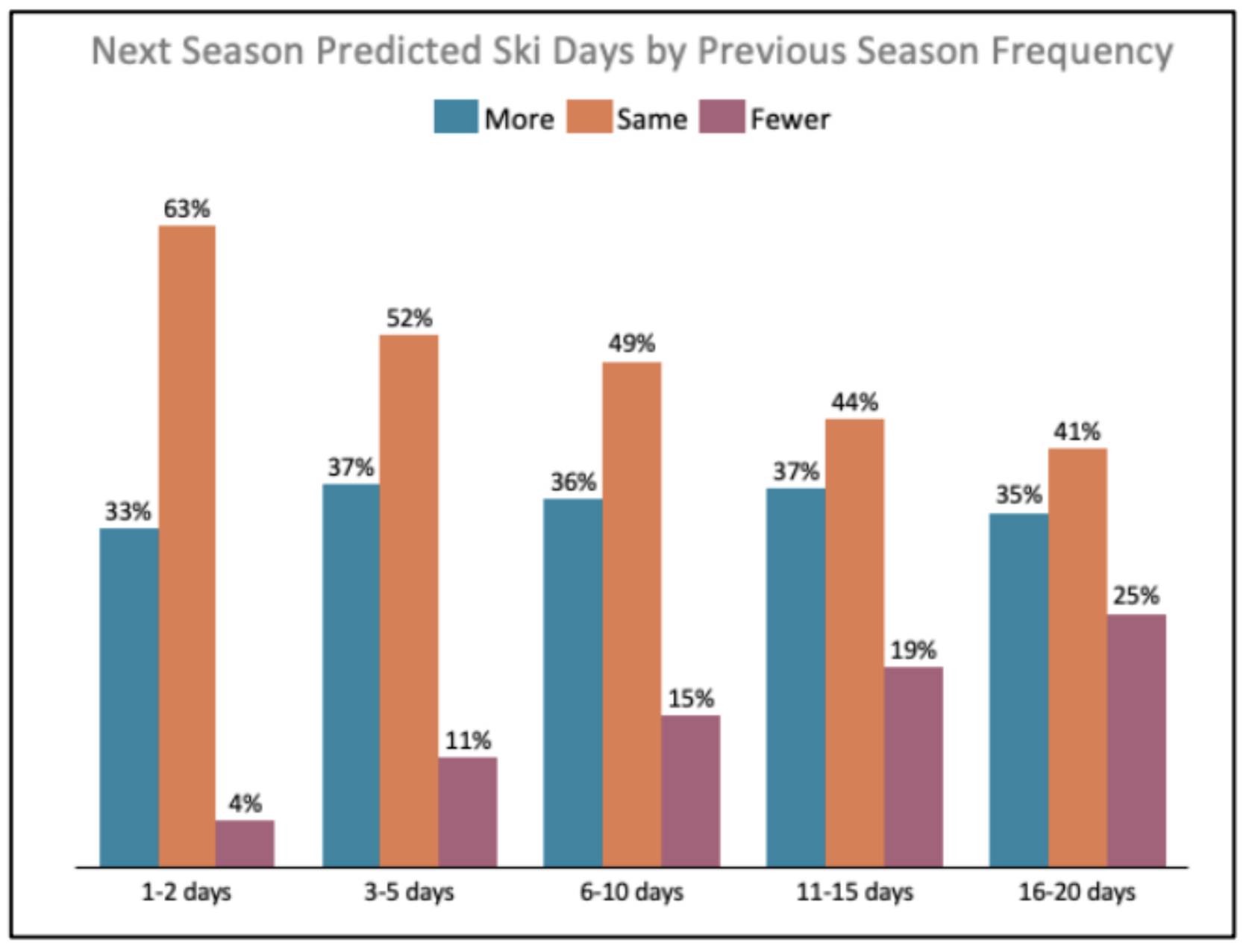

If you’re wondering why we are such suckers, the guys at Langston have a phrase for it; they call it ‘ski optimism’. Across the snowsport industry, users are overly optimistic about how many days they will ski or board the following season. A third of respondents expected to ski or board more the next season, irrespective of the days they were on snow last season. So this ski optimism bias seems quite persistent across the board and probably explains why people commit so early to purchase a multi-resort-season pass.

A concept that behavioral economists refer to as ‘Transactional Utility Theory was pioneered by Noble Prize Winner Richard Thaler. It is a very strategic decision by these vendors who offer multi-resort season passes that the break-even point for a season pass is tangible for users. That way, pass holders feel they got value for their money. Compared to the price of day passes, the season pass seems to be a good deal. Even if you are unsure how many days you will ski or board next season, users are prepared to commit to the next season because it is possible and seems too good a deal to pass up.

According to Thaler, consumers derive pleasure not just from an object’s value but also from the quality of the deal, the transactional utility. In other words, there is more perceived upside than downside for the consumer, as people think of value in relative rather than absolute terms. So if their Epic or Ikon pass hit the break-even point last year, the transactional utility will be high, and you will be more inclined to re-commit. And even if you did not hit the break-even point, it seems possible for next season so that the majority will re-commit.

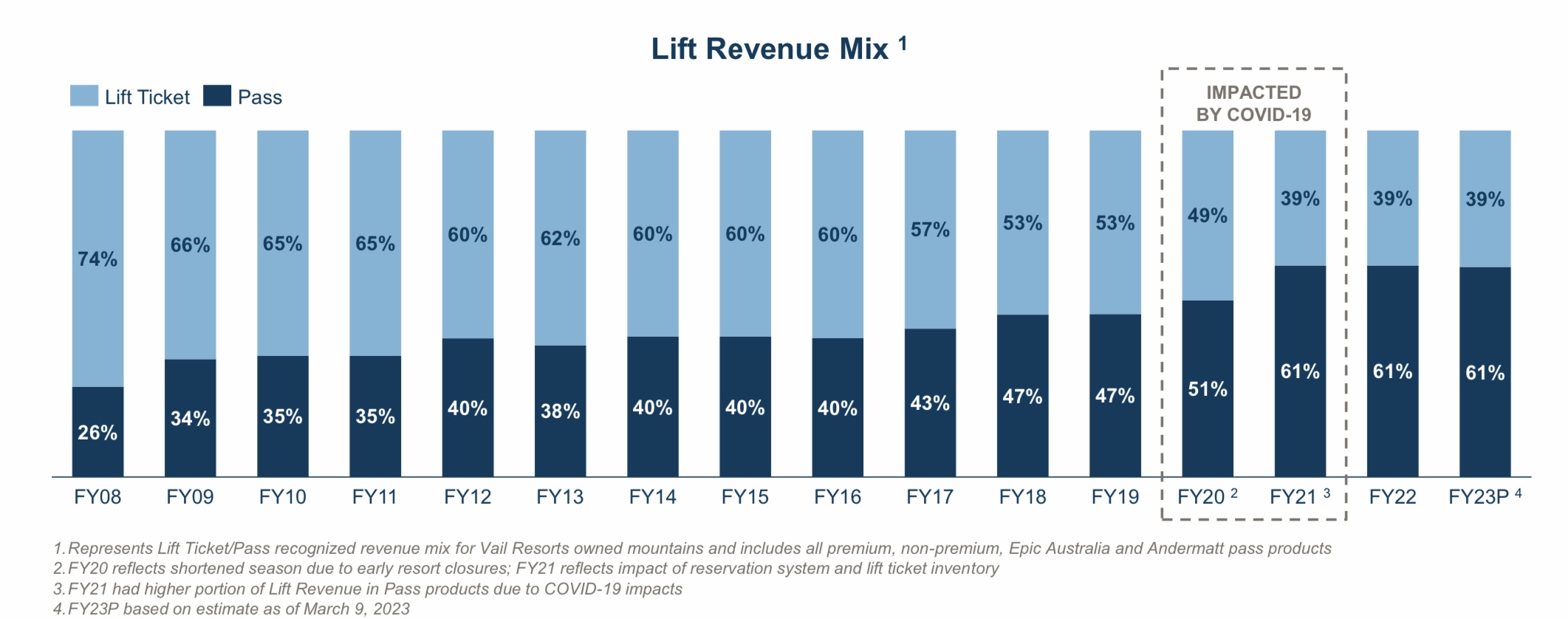

Another reason these season passes are great for resorts is that the most significant fluctuation in revenue results from changes in annual skier visit numbers each year. Annual skier visits in the USA fluctuate between 46-61 million visits yearly. Every year around 10 million people ski or board in the USA. In the years when snowfalls are poor, the number drops by about 10%, while in good years, it can be higher. Even more importantly, these snowsport participants will ski or board on fewer days in poor seasons.

Naturally, ski resorts want to be able to plan their season and have as much predictable income as possible. The financial security of skiers and boarders providing their commitment 6-9 months ahead of the next ski season by purchasing a season pass offers large ski resort operators like Alterra and Vail Resorts the financial stability that allows them to plan for the next season with confidence and enables them to make strategic investments in infrastructure and personnel for the next season.

While the difference between 46 and 61 million skier visits may appear minimal in absolute terms, consider this in percentage terms: there is a 32% difference between a bad year and a good year. With the majority of income coming from lift ticket sales and an operating margin of around 10% in the ski industry, having your income fluctuate by a variable you cannot control — the weather — exposes your business to significant downside risk.

Additionally, guest user data has shown that season pass holders will ski more days on average than those who buy day passes. Epic pass holders ski or board on average 250% more days than customers who purchase lift tickets daily. This, in return, results in a higher average spend per customer, as people consume food on the mountain, stay at resort-owned hotels, and might even purchase lessons.

Pushing more snowsport participants to purchase these season passes to reach the break-even point increases the average consumer’s annual spending on the vendors. The Langston Group study found that consumers’ average yearly spend in the 22/23 season buying day passes was $472. In contrast, multi-resort season pass holders had an average annual spend of $733, or 55% more than the day pass snowsport participants.

If you wonder how Vail Resorts or Alterra figured all this out, the answer is that they utilized user data. Epic pass holders receive a 20% discount on rentals and food in Vail-owned resorts, encouraging pass holders to swipe their cards to reap those discounts. While pass holders receive the valued 20% discount, Vail Resorts gleans incredible insight into their customers’ spending patterns, enabling resorts to make data-driven decisions. Scanning the pass at Vail Resort-owned restaurants, shops, and hotels, in turn, provides invaluable data to Vail Resorts that help improve the customer experience, enables them to measure the success of marketing campaigns, and aids Vail in further driving sales.

Most ski resorts nowadays use RFID chip cards for lift access, so most resorts now collect this user data, enabling them to optimize and personalize marketing campaigns. While this vast data collection seems like a massive invasion of privacy, the massive discounts incentivize pass holders to keep swiping their season pass at the resorts to reap the 20% discounts. This makes this a win-win deal as season pass holders feel they are getting a big enough numerical incentive to divulge this data.

Tourism is also part of the various business models that seem to be booming in a country.

Why is Vail so expensive to ski? Someone is making a great profit on the skiers who buy these passes. Skiing in Switzerland or Austria is far cheaper (day tickets around $50-80, multiday tickets get cheaper).Yes, the flights are expensive but if you ski 7 days it’s cheaper skiing in Europe all in all. These passes are here for the companies to make a profit not to benefit the skiers or ski resorts. It’s sad to see that people fall for this money making machine…

Congratulation!

I skied 69 days this season. 43 days on Epic. Given I get the military veteran season pass rate, my cost per ski visit was $12, not including any meals I purchased. Yep. A great deal.

Yep, works for me, I got 19 Ikon days, 4 non-Ikon days of skiing in this year. I got 17 Ikon days and 7 non-Ikon days, last year. The mtns not on Ikon are slowly getting whittled from my skiing schedule. Next year, I hope to get 24-34 Ikon days, and don’t expect any non-Ikon days. Strangely, all my family and friends have homes or ski at Ikon mtns, so they’re my go-to multipass.

What entices the resorts that are not owned by Vail and Alterra to participate on an Ikon or Epic Pass? Do they revenue share with those resorts?

I have an Ikon Pass that I used 33 days this season and only one day was at a resort owned by Alterra.

This is the first year in a long time I decided not to buy a pass and play it by ear next season. Wish me luck.