When Boyne Resorts partnered with the owners of the Yellowstone Club in 2013 to purchase the existing Moonlight Basin and Spanish Peaks developments, the “Biggest Skiing in America” was officially born at Big Sky Resort. The idea was conceived in 2005 when the 2,000 acres at Moonlight Basin and over 3,000 acres at Big Sky were offered on a single ticket for the first time for just $78. Today, the 2,000 additional acres on the North Face of the mountain and 200 additional acres in the Spanish Peaks area allow for 38 lifts across 5,850 skiable acres at Big Sky Resort. Now, Big Sky, Montana, is one of the most popular ski destinations in North America. Vacationing families, passionate powderhounds, and secluded billionaires alike are all looking to take advantage of this incredible mountain’s expanding infrastructure. But, after 10 years and almost 6,000 acres of skiable terrain, the economic and social implications of an ever-growing corporate presence in town and on the mountain have begun to worry its residents and the snowsports community.

CrossHarbor Capital Partners is an investment firm that began its venture into the town of Big Sky, Montana, with its purchase of the Yellowstone Club in 2009. Since then, the company has purchased more land and property not only on the mountain during its 2013 acquisitions but also downtown, purchasing most of the town center and planning to build 400 new residences there within the next 15 years. Issues like the housing crisis, over-development, and general economic inequality are all too common in ski towns and Big Sky is no stranger to these problems. As they lead the scene in on-mountain advancements, the town has also become one of the most unequal communities in the West. Many believe that as an unincorporated community, the future of the town has fallen into the hands of this private equity firm which has established its influence in every aspect of life in Big Sky.

- Related Article: Big Sky Resort, MT, Begins Summer Activities on Saturday, June 8

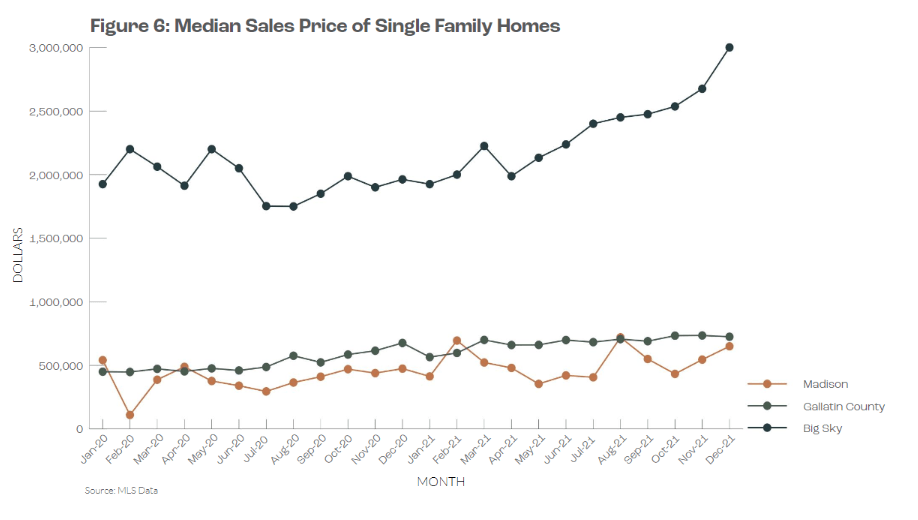

The median price for a single-family home has reached $3 million in the latest economic profile from the Big Sky Chamber. There are over 800 residences at the Yellowstone Club, many of which are owned by moguls and celebrities such as Bill Gates and Tom Brady. With an initiation fee of $300,000 and an annual fee of $36,000, the club employs former Secret Service agents as security and provides private skiing, golfing, and fishing among other amenities. As 2,000 additional private residences continue to be built behind the walls of these private clubs such as Spanish Peaks or the Yellowstone Club, the median household income stands at $100,000. Many workers on the mountain make even less than this and have been struggling for years to secure basics such as adequate housing.

CrossHarbor Capital Partners, through its subsidiary Lone Mountain Land Company, offers the most employee housing options in town. Since 2020, it has “formed a new business division dedicated to developing community housing for the benefit of the Big Sky community,” yet many employees choose to stay in motels or commute from Bozeman instead of the overpriced rooms offered in town. Big Sky Resort has also pushed initiatives to increase the supply and quality of employee housing. Although the new Levinski Lodge apartment-style buildings have provided some good-value relief to a portion of the resort’s workers, questions about additional housing and corporate relationships have yet to be answered.

CrossHarbor is facing increasing pressure to re-evaluate its position in the community from residents of the town who don’t live in its private mansions. CrossHarbor Capital Partners and its clients effectively own the town of Big Sky, Montana. Not only in terms of the physical assets that make up the town but also in the policies and committees formed in the face of no formal government. As an unincorporated community, the local government is comprised of special districts and associations such as the Big Sky Resort Area District which collects and redistributes a 4% luxury goods tax to maintain local services and infrastructure. While the five members of this board are voted for by the community, three of them are connected to CrossHarbor’s network and further investigation reveals deeper corporate involvement in the community.

Many other elected officials of city boards like transportation and sewage also work for CrossHarbor’s companies such as Moonlight Basin. When the Lone Mountain Land Company purchased the remaining undeveloped land in Big Sky’s Town Center, they also became the directors of the Town Center Owner’s Association. Although this could be seen as successful leaders re-investing their time and money into the town, many are hesitant to accept such a powerful influence on the community by the multi-billion dollar company.

CrossHarbor must use its influence to support and sustain the town’s local and seasonal workers in order to maximize its investments and development. Luxury real estate and services have always been a main source of income for ski resorts and their towns but this example is one of the most extreme in America. 74% of the communities’ workers do not live in Big Sky and instead commute from surrounding towns in Gallatin County to serve CrossHarbor’s clubs and clients. Trends have not improved under the company’s overarching ownership and government intervention may be the only way to stop the trajectory of forcing seasonal workers away from the town. Talks of incorporation have begun to spread and government advancements such as community councils or multi-jurisdiction districts have even been suggested in a study from Montana State University. Although the future of Big Sky may seem dark under a corporate shadow, it is safe to say that the experience on Lone Mountain’s slopes is here to stay.

One thought on “The Corporate Shadow Over Big Sky, MT”