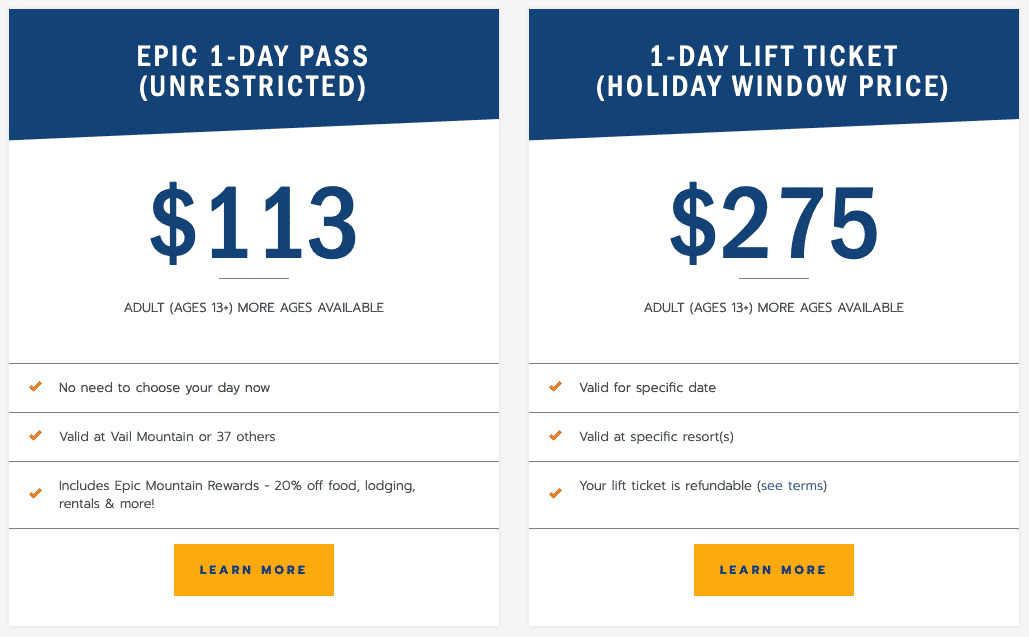

Day tickets for Vail Resorts’ ski areas are now online and available to purchase, giving us the opportunity to see how much they’re going to cost. We’ve not yet reached $300, but we’re not that far off.

Vail Resorts 22/23 single-day peak lift ticket $:

Vail $275

Beaver Creek $275

Park City $259

Breck $255

Northstar $235

Keystone $225

Heavenly $225

Stowe $199

Crested Butte $179

Whistler $175

Kirkwood $165

Okemo $155

Mt Snow $149

Stevens $145

Hunter $129

Sunapee $124[1/3]

— The Storm Skiing Journal & Podcast (@StormSkiJournal) September 2, 2022

Last season Vail Mountain and Beaver Creek in Colorado peaked at $239, and this season a peak lift ticket at these resorts will cost $275; a 15% increase.

A peak lift ticket at Park City, CO, last year was $229. This season will set you back $259, a 13% increase.

And in Breckenridge, CO, a peak lift ticket will cost you $255 this year, an increase of 16% over last season.

In California, a peak lift ticket will cost you $235 ($209 last year) at Northstar, $225 ($199) at Heavenly, and $165 at Kirkwood.

It’s not all megabucks though. Many resorts are well under $100, although Stowe is inching towards being the first New England lift ticket to exceed $200.

Vail Resorts 22/23 single-day peak tickets [2/3]:

Attitash $115

Wildcat $109

Whitetail $94

Liberty $94

Crotched $91

Mt. Brighton $89

Afton Alps $89

Big Boulder $89

Jack Frost $89

Roundtop $89

Wilmot $84

Alpine Valley $69

Boston Mills $64

Brandywine $64

Mad River $64[2/3]

— The Storm Skiing Journal & Podcast (@StormSkiJournal) September 2, 2022

On its own website, Vail Resorts is calling out the high price compared to the Epic Day Pass. Could increasing the prices just be an elaborate ploy to push customers away from day tickets towards its arguably better value Epic Passes?

Skiing isn’t a cheap sport, but it is something we all love to do—and most of the readers on this website aren’t the kind of people who walk up and blindly pay the window price when they want to go skiing. But some people do exactly that. Otherwise, resorts wouldn’t get away with charging those high prices. Call it an ‘ignorance tax.’

Maybe Fail Resorts or Whale Resorts needs to be broken up for anti-trust. Why should Fail Resorts own 4 of the 5 largest ski areas in North America?

Global warming will solve this problem. Ski areas will have a bigger problem than high lift tickets when no more snow arrives. Check out the report for Sandia Peak New Mexico. Just the beginning.

The vail ski resorts created and perfected in Colorado in action.

Keep buying all your superpasses and logging your vertical feet all you corporate sheep.

Cheers to the environmentalist who help put all the red tape in place that make the land these corporations own extremely rare, expensive and high priced and perfectly suited for high dollar condo’s and 2nd home vacation builds.

I believe that you can bust the 300.00/day threshold at Big Sky by purchasing a lift ticket, a gondola ticket, and an early load ticket for the same day. I was looking at some of my old lift tickets the other day, 5.00/day at Killington and 7.00/day at Alta, the good old days.

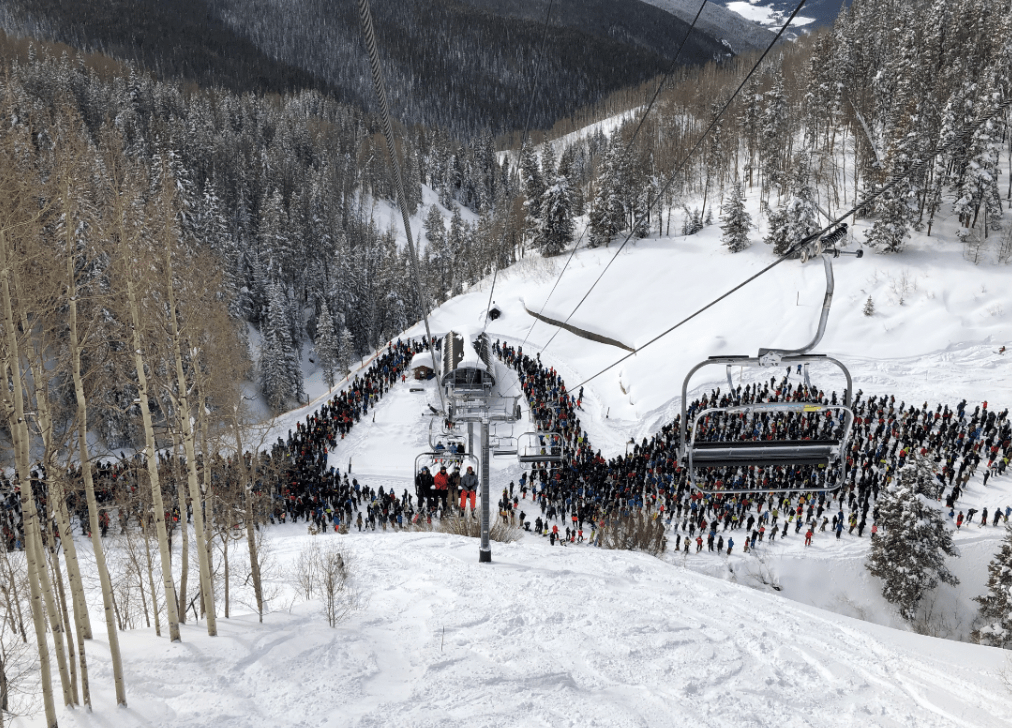

EPIC prices….EPIC lines!!!!!! Vail Resorts….the adventure of a lift line!….Vail, the flattest place on earth!

BTW…Scott who replied something about not wanting to sell day tickets….WRONG. I work in Fail and they do and want to sell them all day long. If you’re already paying $600-$2000 per night what’s an extra $250? Just to park is $50/day and a small lunch without booze will set you back $50. Clearly catering to the top 3%!!

You couldn’t pay ME $275 to stand in that line!

It’s the nature of the ski industry with large corporate ownership. They would just as soon not ever sell a walk up day ticket (or pay someone to staff a ticket window)…they want all their revenue up front from people purchasing early season passes.

If you like to ski you are probably skiing more than once. If you ski 4 days at some of these more expensive places then just get an Epic pass and ski 4 days…or a whole lot more.

High ticket prices are the result of only one thing: Overinvestment in a unit of earning capacity. I have tracked this starting on the late 1960’s