Vail Resorts yesterday reported a disappointing revenue quarter, with sales totals down 26% from the same period last year. Total revenues were $684.6 million, and net attributable income was $147.8 million, down from $206.4 million in the same quarter last year.

- Related: Vail Resorts to Reward Employees With Bonuses for Unprecedented Year – Except Unionized Patrollers

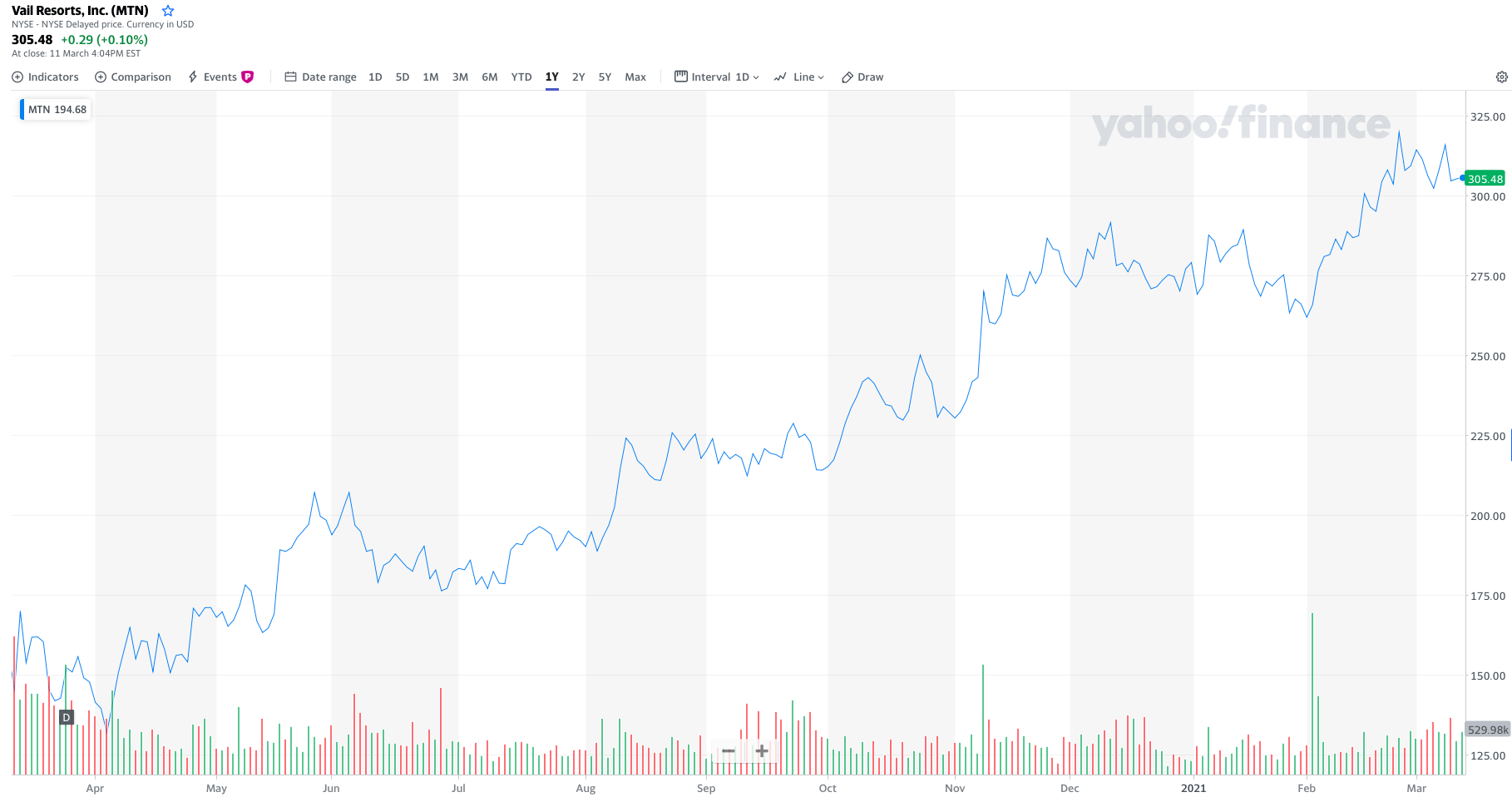

However, Vail Resorts stock was flying in after-hours trading after the company crushed earnings expectations. Sales of $684.6 million beat expectations of $644.7 million. Shares were up 11% to $338. Their highest close on record is $319.72 on Feb. 24. The stock was up 170% from its early pandemic intraday low of $125.

Offering some insights into season-to-date metrics against last year, the following numbers were revealed:

- Total skier visits were down 8.2%

- Total lift ticket revenue was down 8.9%

- Ski school revenue was down 43.2%

- Dining revenue was down 56.9%

- Retail/rental revenue for North American resort and ski area store locations was down 31.6%

Despite the result, CEO Rob Katz was positive:

“Given the challenging operating environment as a result of COVID-19, we are very pleased with our results through this point in the 2020/2021 ski season across our 34 North American resorts. While our results for the second quarter continued to be negatively impacted by COVID-19, total visitation across our North American destination mountain resorts and regional ski areas was only down approximately 5% compared to the same period in the prior year.”

Press release below:

Vail Resorts, Inc. (NYSE: MTN) yesterday reported results for the second quarter of fiscal 2021 ended January 31, 2021, and provided the Company’s ski season-to-date metrics through March 7, 2021, both of which were negatively impacted by COVID-19 and related limitations and restrictions.

Highlights

- Net income attributable to Vail Resorts, Inc. was $147.8 million for the second fiscal quarter of 2021, a decrease of 28.4% compared to the second fiscal quarter of 2020, primarily as a result of the negative impacts of COVID-19.

- Resort Reported EBITDA was $276.1 million for the second fiscal quarter of 2021, compared to a Resort Reported EBITDA of $378.3 million for the second fiscal quarter of 2020, primarily as a result of the negative impacts from capacity restrictions related to COVID-19 and challenging early season conditions, partially offset by disciplined cost management.

- Results continued to improve in January and February following the peak holiday period, with season-to-date total skier visits down 8.2% and total lift revenue down 8.9% through March 7, 2021, compared to the prior year season-to-date period through March 8, 2020. Our ski school, food and beverage, and retail/rental businesses continue to be more significantly impacted by the significant capacity and operating restrictions associated with COVID-19.

- The Company issued guidance for the nine months ended April 30, 2021, and expects Resort Reported EBITDA to be between $560 million and $600 million assuming current regulations, health, and safety precautions and that levels of demand and normal conditions persist through the spring, consistent with current levels.

- We continue to maintain significant liquidity with $1.4 billion of cash on hand as of February 28, 2021, and $597 million of availability under our U.S. and Whistler Blackcomb revolving credit facilities.

Commenting on the Company’s fiscal 2021 second-quarter results, Rob Katz, Chief Executive Officer, said:

“Given the challenging operating environment as a result of COVID-19, we are very pleased with our results through this point in the 2020/2021 ski season across our 34 North American resorts. We have welcomed guests to each of our resorts with no major ongoing disruptions, which has been enabled by our focus on prioritizing the health and safety of our guests, employees, and communities. While our results for the second quarter continued to be negatively impacted by COVID-19, total visitation across our North American destination mountain resorts and regional ski areas was only down approximately 5% compared to the same period in the prior year. The strong visitation for the quarter highlights the underlying resiliency of our business, the loyalty of our guests, and the strong appeal of skiing in guests’ leisure travel plans. As we moved past the peak holiday period, which was constrained by capacity limitations driven by both COVID-19 and below-average snow conditions, we saw improved results in January, particularly with lift ticket sales. While visitation trends improved throughout the quarter, our ancillary lines of business continued to be negatively impacted by COVID-19 related capacity constraints and limitations, particularly in food and beverage and ski school.

“We experienced strong results in the quarter from both our local and destination guests, with local visitation up slightly compared to the same period in the prior year and destination visitation proving more stable than we expected. Destination guests, including international visitors, modestly declined to 53% of our U.S. destination mountain resort skier visits (excluding complimentary access) despite the travel challenges associated with COVID-19, which compares to 57% in the same period in the prior year. International visitation, as expected, decreased significantly due to COVID-19 related travel restrictions. Results at Whistler Blackcomb were disproportionately impacted throughout the second fiscal quarter due to the Canadian border remaining closed to international guests (including guests from the U.S.), with destination guests, including international visitors, declining to 15% of Whistler Blackcomb visits (excluding complimentary access), which compares to 48% in the same period in the prior year.”

“Our season pass unit sales growth of 20% for the fiscal year 2021 created a strong baseline of demand heading into the season across our local and destination audience and will be one of the most important drivers of our performance and relative stability for this season. For the fiscal 2021 second quarter, 71% of our visitation came from season pass holders compared to 59% of visitation in the same period in the prior year. Our growth in pass holders this past year also positions us well as we head into the 2021/2022 season. We remain even more committed to the benefits advanced commitment offers our Company and intend to remain aggressive in providing the best value to skiers and riders who purchase in advance of the season and continuing our strategy to move lift ticket purchasers into our pass program. We are excited to launch our 2021/2022 lineup of Epic Pass products on March 23, 2021.

“We maintained disciplined cost controls throughout the quarter as we operated the business at reduced capacity. Resort Reported EBITDA margin for the fiscal 2021 second quarter was 40.3% compared to the prior-year period of 40.9%, while Resort net revenue decreased $240.1 million over the same period. These results reflect our rigorous approach to cost management and we exceeded our expectations for profitability at these revenue levels, relative to the illustrative model previously outlined in our September 2020 earnings release.”

Season-to-Date Metrics through March 7, 2021, & Interim Results Commentary

The Company reported certain ski season metrics for the comparative periods from the beginning of the ski season through March 7, 2021, and for the prior-year period through March 8, 2020. The reported ski season metrics are for our North American destination mountain resorts and regional ski areas and exclude the results of our Australian ski areas in both periods. The reported ski season metrics include growth for season pass revenue based on estimated fiscal year 2021 North American season pass revenue compared to fiscal year 2020 North American season pass revenue. Fiscal year 2020 season pass revenue was adjusted to exclude the impact of the deferral of pass product revenue as a result of pass holder credits offered to 2019/2020 North American pass holders. Fiscal year 2021 season pass revenue does not include the pass product revenue recognized in the first quarter of fiscal year 2021 as a result of unutilized pass holder credits. This approach results in a year-over-year comparison of season pass revenue exclusive of the impact of discounts provided to our 2019/2020 pass holders. The metrics include all North American destination mountain resorts and regional ski areas and are adjusted to eliminate the impact of foreign currency by applying current period exchange rates to the prior period for Whistler Blackcomb’s results. The data mentioned in this release is interim period data and is subject to fiscal quarter end review and adjustments.

- Season-to-date total skier visits were down 8.2% compared to the prior year season-to-date period.

- Season-to-date total lift ticket revenue, including an allocated portion of season pass revenue for each applicable period, was down 8.9% compared to the prior year season-to-date period.

- Season-to-date ski school revenue was down 43.2% and dining revenue was down 56.9% compared to the prior year season-to-date period. Retail/rental revenue for North American resort and ski area store locations was down 31.6% compared to the prior year season-to-date period.

Commenting on the season-to-date metrics, Katz said:

“Our results continued to improve in January and February as we expanded capacity with more open terrain as conditions improved and as certain COVID-19 related restrictions eased. Additionally, as more reservations became available after the peak holiday period, we have seen a significant improvement in lift ticket purchases. Our ski school, food and beverage and retail/rental businesses continue to be more significantly impacted than visitation due to the significant capacity and operating restrictions associated with COVID-19. While our U.S. resorts saw material improvements in financial performance since the peak holiday period, Whistler Blackcomb’s financial performance continues to be severely impacted by the continued closure of Canadian borders to international travel, a trend that will likely continue through the rest of the season.”

Operating Results

A more complete discussion of our operating results can be found within the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of the Company’s Form 10-Q for the second fiscal quarter ended January 31, 2021, which was filed today with the Securities and Exchange Commission.

The following are segment highlights:

Mountain Segment

- Total lift revenue decreased $53.6 million, or 11.1%, compared to the same period in the prior year, to $430.8 million for the three months ended January 31, 2021, primarily due to limitations and restrictions on our North American operations due to the impacts of COVID-19, which resulted in a decrease in non-pass visitation. Ski school revenue decreased $46.4 million, or 45.1%, dining revenue decreased $43.9 million, or 58.0%, and retail/rental revenue decreased $43.6 million, or 32.6%, all primarily as a result of COVID-19 related limitations, restrictions for our North American resorts.

- Operating expense decreased $113.6 million, or 24.0%, primarily due to cost discipline efforts associated with lower levels of operations and limitations and restrictions on our North American winter operations resulting from COVID-19.

- Mountain Reported EBITDA decreased $89.5 million, or 24.0%, for the second quarter compared to the same period in the prior year, which includes $5.5 million of stock-based compensation expense for the three months ended January 31, 2021, compared to $4.6 million in the same period in the prior year. Results were negatively impacted by COVID-19 related limitations and restrictions, partially offset by disciplined cost management.

Lodging Segment

- Lodging segment net revenue (excluding payroll cost reimbursements) for the three months ended January 31, 2021, decreased $34.6 million, or 45.8%, as compared to the same period in the prior year, primarily due to the operational restrictions and limitations of our North American lodging properties as a result of COVID-19.

- Lodging Reported EBITDA for the three months ended January 31, 2021, decreased $12.8 million, or 242.2%, for the second quarter compared to the same period in the prior year, which includes $1.0 million of stock-based compensation expense for the three months ended January 31, 2021, compared to $0.9 million in the same period in the prior year. Results were impacted by operational restrictions and limitations of our North American lodging properties as a result of COVID-19.

Resort – Combination of Mountain and Lodging Segments

- Resort net revenue was $684.3 million for the three months ended January 31, 2021, a decrease of $240.1 million as compared to resort net revenue of $924.4 million for the same period in the prior year.

- Resort Reported EBITDA was $276.1 million for the three months ended January 31, 2021, a decrease of $102.3 million, or 27.0%, compared to the same period in the prior year.

Total Performance

- Total net revenue decreased $240.0 million, or 26.0%, to $684.6 million for the three months ended January 31, 2021, as compared to the same period in the prior year.

- Net income attributable to Vail Resorts, Inc. was $147.8 million, or $3.62 per diluted share, for the second quarter of fiscal 2021 compared to net income attributable to Vail Resorts, Inc. of $206.4 million, or $5.04 per diluted share, in the second fiscal quarter of the prior year.

Calendar Year 2021 Capital Expenditures

Regarding calendar year 2021 capital expenditures, Katz said:

“We remain committed to reinvesting in our resorts, creating an experience of a lifetime for our guests, and generating strong returns for our shareholders. We plan to maintain a disciplined approach to capital investments, keeping our core capital at reduced levels given the continued uncertainty due to COVID-19. We have increased our core capital plan by approximately $5 million based on our updated outlook and now expect to invest approximately $115 million to $120 million excluding one-time items associated with integrations of $5 million and $12 million of reimbursable investments, as well as real estate-related capital.

“As previously announced, the calendar year 2021 capital plan includes several signature investments, which were previously deferred from calendar year 2020 as a result of COVID-19 and are subject to regulatory approvals. In Colorado, we are moving forward with the 250-acre lift-served terrain expansion in the signature McCoy Park area of Beaver Creek, further differentiating the resort’s high-end, family-focused experience. We also plan to add a new four-person high-speed lift at Breckenridge to serve the popular Peak 7, replace the Peru lift at Keystone with a six-person high-speed chairlift, and replace the Peachtree lift at Crested Butte with a new three-person fixed-grip lift.

“At Okemo, we plan to complete a transformational investment including upgrading the Quantum lift from a four-person to a six-person high-speed chairlift, relocating the existing four-person Quantum lift to replace the Green Ridge three-person fixed-grip chairlift. These investments will greatly improve uplift capacity, further, enhance the guest experience and complete our $35 million capital plan for Triple Peaks.

“We remain highly focused on investments that will further our company-wide technology enhancements to support our data-driven approach, guest experience, and corporate infrastructure, including investing in a number of upgrades to the infrastructure of our guest contact centers and bring a best-in-class approach to how we service our guests through those channels. We will also continue to invest in ongoing maintenance capital to support our infrastructure across our resorts.

“Including one-time items associated with integrations of $5 million and $12 million of reimbursable investments, as well as real estate-related capital, we expect our total capital plan to be approximately $135 million to $140 million.”

Liquidity

The Company continues to maintain significant liquidity. Our total cash and revolver availability as of February 28, 2021was approximately $2.0 billion, with $1.4 billion of cash on hand, $419 million of U.S. revolver availability under the Vail Holdings Credit Agreement, and $179 million of revolver availability under the Whistler Credit Agreement. As of January 31, 2021, our Net Debt was 4.2 times trailing twelve months Total Reported EBITDA. As previously announced, the Company raised $575 million of 0.0% convertible notes in December 2020, which provides added flexibility in terms of our ability to pursue high-impact acquisitions as well as reinvest in our resort portfolio. We remain confident in the strong cash flow generation and stability of our business model, and we will continue to be disciplined stewards of our capital with a focus on high-return capital projects, continuous investment in our people, and strategic acquisition opportunities. While we are not reinstating the dividend this quarter, we remain committed to returning capital to shareholders, and our Board of Directors will continue to closely monitor the economic and public health outlook on a quarterly basis to assess the appropriate time to reinstate the dividend.”

Outlook

Katz said:

“As we approach the end of the North American ski season, we are providing guidance for the nine-month period ending April 30, 2021. We expect net income attributable to Vail Resorts, Inc. to be between $204 million and $247 million and Resort Reported EBITDA is expected to be between $560 million and $600 million, assuming current regulations, health and safety precautions and that levels of demand and normal conditions persist through the spring, consistent with current levels. Given the ongoing uncertainty of COVID-19, we will not be providing full-year guidance for fiscal 2021 at this time as we continue to evaluate the potential economic and operational impacts of COVID-19 on our fiscal 2021 fourth-quarter results, particularly for our three resorts in Australia and our primary summer operations in North America, which we currently anticipate fully opening around our typical opening dates with certain capacity constraints associated with COVID-19.”

Could very well have to do with the FACT that they don’t care about their customers, especially the locals w/ a pass. At Heavenly, the Sky Chair is closed more than it is open and lines during the week can be 20-40 minutes long. Not renewing next season