Vail Resorts announced its financial results for the first quarter of fiscal 2025 on Monday, which ended on October 31.

The company reported a net loss of $172.8 million, slightly improved from $175.5 million in the same period last year, with total net revenue increasing by 0.7% to $260.3 million. Despite challenging weather conditions in Australia and industry normalization impacting demand, the company saw growth in North American summer operations and lodging results while reporting a 4% increase in season pass sales dollars for the upcoming 2024/2025 ski season.

Here are the key highlights:

Overall Performance

– Net loss attributable to Vail Resorts, Inc. was $172.8 million, compared to $175.5 million in the same period last year

– Total net revenue increased by $1.7 million (0.7%) to $260.3 million

– Resort Reported EBITDA loss was $139.7 million, compared to $139.8 million last year

Mountain Segment

– Mountain segment net revenue increased by $0.8 million (0.5%) to $173.3 million

– Mountain Reported EBITDA loss increased by $4.5 million (3.3%) to $144.1 million

– Lift revenue decreased by 10.9% to $40.4 million

– Total skier visits decreased by 16.7%

– Effective Ticket Price (ETP) increased by 6.9% to $73.76

Lodging Segment

– Lodging segment net revenue increased by $5.4 million (6.9%) to $83.8 million

– Lodging Reported EBITDA improved to $4.4 million, compared to a loss of $0.2 million last year

– Owned hotel room revenue increased by 11.5%

– Owned hotel RevPAR increased by 12.5% to $178.87

Real Estate Segment

– Real Estate Reported EBITDA increased by $9.7 million to $15.1 million

– Recorded a gain on sale of real property for $16.5 million related to the East Vail property

Season Pass Sales

– Pass product sales through December 3, 2024, decreased approximately 2% in units

– Pass product sales increased approximately 4% in sales dollars

– Pass product sales for the 2024/2025 North American ski season have grown 59% in units and 47% in sales dollars over the last four years

Capital Investments

– Plans to invest approximately $249 million to $254 million in calendar year 2025

– Announced multi-year transformational investment plans for Park City Mountain and Vail Mountain

The full press release is below:

BROOMFIELD, Colo., Dec. 9, 2024 /PRNewswire/ — Vail Resorts, Inc. (NYSE: MTN) today reported results for the first quarter of fiscal 2025 ended October 31, 2024, provided season pass sales results for the 2024/2025 season, updated fiscal 2025 net income attributable to Vail Resorts, Inc. guidance and reaffirmed fiscal 2025 Resort Reported EBITDA guidance, announced capital investment plans for calendar year 2025, declared a dividend payable in January 2025, and announced first quarter share repurchases.

Highlights

- Net loss attributable to Vail Resorts, Inc. was $172.8 million for the first quarter of fiscal 2025 compared to net loss attributable to Vail Resorts, Inc. of $175.5 million in the same period in the prior year.

- Resort Reported EBITDA loss was $139.7 million for the first quarter of fiscal 2025, which included $2.7 million of one-time costs related to the previously announced two-year resource efficiency transformation plan and $0.9 million of acquisition and integration related expenses, compared to a Resort Reported EBITDA loss of $139.8 million for the first quarter of fiscal 2024, which included $1.8 million of acquisition and integration related expenses.

- Pass product sales through December 3, 2024 for the upcoming 2024/2025 North American ski season decreased approximately 2% in units and increased approximately 4% in sales dollars as compared to the period in the prior year through December 4, 2023. Pass product sales are adjusted to eliminate the impact of changes in foreign currency exchange rates by applying current U.S. dollar exchange rates to both current period and prior period sales for Whistler Blackcomb.

- The Company has made certain adjustments to its guidance for net income attributable to Vail Resorts, Inc. primarily related to a gain recorded during the first quarter of fiscal 2025, which impacted Real Estate Reported EBITDA. For fiscal 2025, the Company now expects $240 million to $316 million of net income attributable to Vail Resorts, Inc. and reaffirmed its Resort Reported EBITDA guidance of $838 million to $894 million.

- The Company declared a quarterly cash dividend of $2.22 per share of Vail Resorts’ common stock that will be payable on January 9, 2025 to shareholders of record as of December 26, 2024 and repurchased approximately 0.1 million shares during the quarter at an average price of approximately $174 for a total of $20 million.

Commenting on the Company’s fiscal 2025 first quarter results, Kirsten Lynch, Chief Executive Officer, said, “Our first fiscal quarter historically operates at a loss, given that our North American and European mountain resorts are generally not open for ski season. The quarter’s results were driven by winter operations in Australia and summer activities in North America, including sightseeing, dining, retail, lodging, and administrative expenses.

“Resort Reported EBITDA was consistent with the prior year, driven by growth in our North American summer business from increased activities spending and lodging results. This growth was offset by a decline in Resort Reported EBITDA of $9 million compared to the prior year from our Australian resorts due to record low snowfall and lower demand, cost inflation, the inclusion of Crans-Montana, and approximately $2.7 million of one-time costs related to the two-year resource efficiency transformation plan and $0.9 million of acquisition and integration related expenses.”

Regarding the Company’s resource efficiency transformation plan, Lynch said, “Vail Resorts continues to make progress on its two-year resource efficiency transformation plan, which was announced in our September 2024 earnings. The two-year Resource Efficiency Transformation Plan is designed to improve organizational effectiveness and scale for operating leverage as the Company grows globally. Through scaled operations, global shared services, and expanded workforce management, the Company expects $100 million in annualized cost efficiencies by the end of its 2026 fiscal year. We will provide updates as significant milestones are achieved.”

Turning to season pass results, Lynch said, “Our season pass sales highlight the compelling value proposition of our pass products and our commitment to continually investing in the guest experience at our resorts. Over the last four years, pass product sales for the 2024/2025 North American ski season have grown 59% in units and 47% in sales dollars. For the upcoming 2024/2025 North American ski season, pass product sales through December 3, 2024 decreased approximately 2% in units and increased approximately 4% in sales dollars as compared to the period in the prior year through December 4, 2023. This year’s results benefited from an 8% price increase, partially offset by unit growth among lower priced Epic Day Pass products. Pass product sales are adjusted to eliminate the impact of changes in foreign currency exchange rates by applying an exchange rate of $0.71 between the Canadian dollar and U.S. dollar in both periods for Whistler Blackcomb pass sales. For the period between September 21, 2024 and December 3, 2024, pass product sales trends improved relative to pass product sales through September 20, 2024, with unit growth of approximately 1% and sales dollars growth of approximately 7% as compared to the period in the prior year from September 23, 2023 through December 4, 2023, due to expected renewal strength, which we believe reflects delayed decision making.

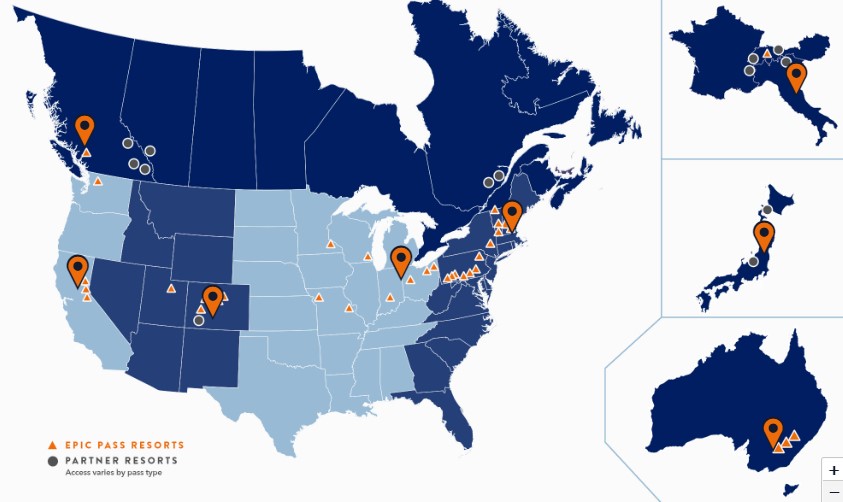

“Our North American pass sales highlight strong loyalty with growth among renewing pass holders across all geographies. For the full selling season, the Company acquired a substantial number of new pass holders, however the absolute number of new guests was smaller compared to the prior year, driving the overall unit decline for the full selling season. New pass holders come from lapsed guests, prior year lift ticket guests, and new guests to our database. The Company achieved growth from lapsed guests, who previously purchased a pass or lift ticket but did not buy a pass or lift ticket in the previous season. The decline in new pass holders compared to the prior year was driven by fewer guests who purchased lift tickets in the past season and from guests who are completely new to our database, which we believe was impacted by last season’s challenging weather and industry normalization. Epic Day Pass products achieved unit growth driven by the strength in renewing pass holders. We expect to have approximately 2.3 million guests committed to our 42 North American, Australian, and European resorts in advance of the season in non-refundable advance commitment products this year, which are expected to generate over $975 million of revenue and account for approximately 75% of all skier visits (excluding complimentary visits).”

Lynch continued, “Heading into the 2024/2025 ski season, we are encouraged by our strong base of committed guests, providing meaningful stability for our Company. Additionally, early season conditions have allowed us to open some resorts earlier than anticipated, including Whistler Blackcomb, Heavenly, Northstar, Kirkwood, and Stevens Pass. Early season conditions have also enabled our Rockies resorts to open with significantly improved terrain relative to the prior year, including the opening of the legendary back bowls at Vail Mountain opening the earliest since 2018. Our resorts in the East are experiencing typical seasonal variability for this point in the year, with all resorts planned to open ahead of the holidays. We are continuing to hire for the winter season, and are on track with our staffing plans and have achieved a strong return rate of our frontline employees from the prior season. Lodging bookings at our U.S. resorts for the upcoming season are consistent with last year. At Whistler Blackcomb, lodging bookings for the full season are lagging prior year levels, which may reflect delayed decision making following challenging conditions in the prior year.”

Operating Results

A more complete discussion of our operating results can be found within the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of the Company’s Form 10-Q for the first fiscal quarter ended October 31, 2024, which was filed today with the Securities and Exchange Commission. The following are segment highlights:

Mountain Segment

- Mountain segment net revenue increased $0.8 million, or 0.5%, to $173.3 million for the three months ended October 31, 2024 as compared to the same period in the prior year, primarily driven by an increase in summer visitation at our North American resorts as a result of improved weather conditions compared to the prior year, which generated increases in on-mountain summer activities revenue, sightseeing revenue, and dining revenue. These increases were partially offset by a decrease in lift revenue from our Australian resorts as a result of reduced visitation from weather-related challenges that impacted terrain and resulted in early closures in the current year, and a decrease in retail/rental revenue driven by the impact of broader industry-wide customer spending trends which negatively impacted retail demand, particularly at our Colorado city store locations.

- Mountain Reported EBITDA loss was $144.1 million for the three months ended October 31, 2024, which represents a decrease of $4.5 million, or 3.3%, as compared to Mountain Reported EBITDA loss for the same period in the prior year, primarily driven by our Australian operations, which experienced weather-related challenges that impacted terrain and resulted in early closures, as well as incremental off-season losses from the addition of Crans-Montana (acquired May 2, 2024), partially offset by an increase in summer operations at our North American resorts, which benefited from warm weather conditions late in the season. Mountain segment results also include one-time operating expenses attributable to our resource efficiency transformation plan of $2.0 million for the three months ended October 31, 2024, as well as acquisition and integration related expenses of $0.9 million and $1.8 million for the three months ended October 31, 2024 and 2023, respectively.

Lodging Segment

- Lodging segment net revenue (excluding payroll cost reimbursements) increased $5.4 million, or 6.9%, to $83.8 million for the three months ended October 31, 2024 as compared to the same period in the prior year, primarily driven by positive weather conditions in the Grand Teton region, which enabled increased room pricing and drove increases in owned hotel rooms revenue. Additionally, dining revenue and golf revenue increased each primarily as a result of increased summer visitation at our North American mountain resort properties.

- Lodging Reported EBITDA was $4.4 million for the three months ended October 31, 2024, which represents an increase of $4.6 million, as compared to Lodging Reported EBITDA loss for the same period in the prior year, primarily as a result of favorable weather conditions which drove increased visitation in the Grand Teton region and at our mountain resort properties. Lodging segment results also include one-time operating expenses attributable to our resource efficiency transformation plan of $0.7 million for the three months ended October 31, 2024.

Resort – Combination of Mountain and Lodging Segments

- Resort net revenue was $260.2 million for the three months ended October 31, 2024, an increase of $5.9 million as compared to Resort net revenue of $254.3 million for the same period in the prior year.

- Resort Reported EBITDA loss was $139.7 million for the three months ended October 31, 2024, compared to Resort Reported EBITDA loss of $139.8 million for the same period in the prior year.

Real Estate Segment

- Real Estate Reported EBITDA was $15.1 million for the three months ended October 31, 2024, an increase of $9.7 million as compared to Real Estate Reported EBITDA of $5.4 million for the same period in the prior year. During the three months ended October 31, 2024, the Company recorded a gain on sale of real property for $16.5 million related to the resolution of the October 2023 Eagle County District Court final ruling and valuation regarding the Town of Vail’s condemnation of the Company’s East Vail property that was planned for Vail Resorts’ incremental affordable workforce housing project, as compared to the same period in the prior year, during which we recorded a gain on sale of real property for $6.3 million related to a land parcel sale in Beaver Creek, Colorado.

Total Performance

- Total net revenue increased $1.7 million, or 0.7%, to $260.3 million for the three months ended October 31, 2024 as compared to the same period in the prior year.

- Net loss attributable to Vail Resorts, Inc. was $172.8 million, or a loss of $4.61 per diluted share, for the first quarter of fiscal 2025 compared to a net loss attributable to Vail Resorts, Inc. of $175.5 million, or a loss of $4.60 per diluted share, in the prior year.

Outlook

The Company’s Resort Reported EBITDA guidance for the year ending July 31, 2025 is unchanged from the prior guidance provided on September 26, 2024. The Company is updating its guidance for net income attributable to Vail Resorts, Inc., which it now expects to be between $240 million and $316 million, up from the prior guidance range of $224 million to $300 million. The primary difference is due to a $17 million increase from the gain on sale of real property related to the resolution of the October 2023 Eagle County District Court final ruling and valuation regarding the Town of Vail’s condemnation of the Company’s East Vail property that was planned for Vail Resorts’ incremental affordable workforce housing project, a transaction that has been recorded as Real Estate Reported EBITDA. Additionally, the guidance is updated to include a decrease in expected interest expense of approximately $2 million which assumes that interest rates remain at current levels for the remainder of fiscal 2025. These changes have no impact on expected Resort Reported EBITDA. The Company continues to expect Resort Reported EBITDA for fiscal 2025 to be between $838 million and $894 million, including approximately $27 million of cost efficiencies and an estimated $15 million in one-time costs related to the multi-year resource efficiency transformation plan, and an estimated $1 million of acquisition and integration related expenses specific to Crans-Montana. As compared to fiscal 2024, the fiscal 2025 guidance includes the assumed benefit of a return to normal weather conditions after the challenging conditions in fiscal 2024, more than offset by a return to normal operating costs and the impact of the continued industry normalization, impacting demand. Additionally, the guidance reflects the negative impact from the record low snowfall and related shortened season in Australia in the first quarter of fiscal 2025, which negatively impacted demand and resulted in a $9 million decline of Resort Reported EBITDA compared to the prior year period. After considering these items, we expect Resort Reported EBITDA to grow from price increases and ancillary spending, the resource efficiency transformation plan, and the addition of Crans-Montana for the full year.

The guidance also assumes (1) a continuation of the current economic environment, (2) normal weather conditions for the 2024/2025 North American and European ski season and the 2025 Australian ski season, and (3) the foreign currency exchange rates as of our original fiscal 2025 guidance issued September 26, 2024.

Foreign currency exchange rates have experienced recent volatility. Relative to the current guidance, if the currency exchange rates as of yesterday, December 8, 2024 of $0.71 between the Canadian Dollar and U.S. Dollar related to the operations of Whistler Blackcomb in Canada, $0.64 between the Australian Dollar and U.S. Dollar related to the operations of Perisher, Falls Creek and Hotham in Australia, and $1.14 between the Swiss Franc and U.S. Dollar related to the operations of Andermatt-Sedrun and Crans-Montana in Switzerland were to continue for the remainder of the fiscal year, the Company expects this would have an impact on fiscal 2025 guidance of approximately negative $5 million for Resort Reported EBITDA.

Capital Investments

Vail Resorts is committed to enhancing the guest experience and supporting the Company’s growth strategies through significant capital investments. For calendar year 2025, the Company plans to invest approximately $198 million to $203 million in core capital, before $45 million of growth capital investments at its European resorts, including $41 million at Andermatt-Sedrun and $4 million at Crans-Montana, and $6 million of real estate related capital projects to complete multi-year transformational investments at the key base area portals of Breckenridge Peak 8 and Keystone River Run, and planning investments to support the development of the West Lionshead area into a fourth base village at Vail Mountain. Including European growth capital investments, and real estate related capital, the Company plans to invest approximately $249 million to $254 million in calendar year 2025. Projects in the calendar year 2025 capital plan described herein remain subject to approvals.

In calendar year 2025, the Company will embark on two multi-year transformational investment plans at Park City Mountain and Vail Mountain.

Park City Mountain – The transformation of Park City Mountain’s Canyons Village is underway to support a world-class luxury base village experience. These investments will support Park City Mountain in welcoming athletes and fans from across the world who visit the resort as it serves as a venue for the 2034 Olympic Winter Games. As announced in September, we are replacing the Sunrise lift with a new 10-person gondola in partnership with the Canyons Village Management Association in calendar year 2025, which will provide improved access and enhanced guest experience for existing and future developments within Canyons Village. The Company also plans to enhance the beginner and children’s experience by expanding the existing Red Pine Lodge restaurant to upgrade the dining experience for ski and ride school guests, and by improving the teaching terrain surrounding the Red Pine Lodge. These investments are further supported by the construction of the Canyons Village Parking Garage, a new covered parking structure with over 1,800 stalls being developed by TCFC, the master developer of the Canyons Village, which is expected to break ground in spring 2025. Planning of additional investments at Park City Mountain across the mountain experience is underway and additional projects will be announced in the future.

Vail Mountain – In October 2024, the Company announced the development of West Lionshead area into a fourth base village at Vail Mountain in partnership with the Town of Vail and East West Partners. The new base village will reinforce Vail Mountain’s status as a world-class destination, and is anticipated to feature access to the resort’s 5,317 acres of legendary terrain, plus new lodging, restaurants, boutiques, and skier services, as well as community benefits such as workforce housing, public spaces, transit, and parking. In addition, the Company is developing a multi-year plan to invest in base area improvements, lift upgrades, and across the beginner ski and ride school and dining experiences. In calendar year 2025, the Company is planning to renovate guestrooms and common spaces at its luxury Vail hotel, the Arrabelle at Vail Square. Additionally, in calendar year 2025 the Company plans to invest in real estate planning to develop the West Lionshead area.

In addition to embarking on two multi-year transformational investment plans, the Company is planning significant investments across the guest experience in calendar year 2025, including:

Andermatt-Sedrun – The Company plans to replace the four-person fixed grip Calmut lift and the four-person fixed grip Cuolm lift with two new six-person high speed lifts that will increase capacity and significantly improve the guest experience at the Val Val area. The Company also plans to upgrade and expand snowmaking infrastructure at the Gemsstock area on the western side of the resort to enhance the consistency of the guest experience, particularly in the early season, and significantly improve energy efficiency. In addition, the Company plans to complete the previously announced upgrade of the Sedrun-Milez snowmaking infrastructure and improvements to the Milez and Natschen restaurants. Through calendar year 2025, Vail Resorts will have invested approximately CHF 50 million of a total CHF 110 million capital that was invested as part of the purchase of the Company’s majority ownership stake in Andermatt-Sedrun.

Perisher – At Perisher in Australia, the Company plans to replace the Mt Perisher Double and Triple Chairs with a new six-person high speed lift, following the capital spending in calendar year 2024 that is continuing into calendar year 2025 to be completed in time for the 2025 winter season in Australia.

Technology – The Company will be investing in additional new functionality for the My Epic App, including new tools to better communicate with and personalize the experience for our guests. Building on the pilot of My Epic Assistant, a new guest service technology within the My Epic App powered by advanced AI and resort experts, at four resorts for the upcoming 2024/2025 ski season, the Company is planning to invest in more advanced AI capabilities in calendar year 2025.

Dining – The Company plans to invest in physical improvements to dining outlets at its largest destination resorts to improve throughput.

Commitment to Zero – The Company plans to continue investing in waste reduction and emissions reduction projects across its resorts to achieve its goal of zero net operating footprint by 2030.

Breckenridge – The Company is making real estate related investments to complete the multi-year transformation of the Breckenridge Peak 8 base area, where the Company has enhanced the beginner and children’s experience and increased uphill capacity with the introduction of a new four-person high speed 5-Chair, new teaching terrain, and a transport carpet from the base, making the beginner experience more accessible.

Keystone – The Company is investing in acquisition and build out costs for skier services that will reside in the newly developed Kindred Resort at Keystone, a family-friendly luxury ski-in, ski-out lodging residence and Rock Resorts-branded hotel at the base of the River Run Gondola, including new restaurants, a full-service spa, pool and hot tub facilities, and the new home for the Keystone Ski & Ride School, and a retail and rental shop. The Kindred development follows the transformational lift-served terrain expansion project in Bergman Bowl, increasing lift-served terrain by 555 acres with the addition of a new six-person high speed lift, which was completed for the 2023/2024 North American ski season.

In addition to the investments planned for calendar year 2025, the Company is completing significant investments that will enhance the guest experience for the upcoming 2024/2025 North American and European ski season. As previously announced, the Company expects its capital plan for calendar year 2024 to be approximately $189 million to $194 million, excluding $13 million of incremental capital investments in premium fleet and fulfillment infrastructure to support the official launch of My Epic Gear for the 2024/2025 winter season at 12 destination and regional resorts across North America, $7 million of growth capital investments at Andermatt-Sedrun, $2 million of maintenance and $2 million of integration investments at Crans-Montana, and $3 million of reimbursable capital. Including these one-time investments, the Company’s total capital plan for calendar year 2024 is now expected to be approximately $216 million to $221 million.