During its earnings call yesterday, Vail Resorts reported a loss of $140.8 million for the fiscal fourth quarter, which ended July 31st. Covid-19 related closures in Australia significantly impacted this summer’s balance sheet.

- Related: Vail Resorts Announces $320 Million ‘Epic Lift Upgrade’ With 19 New Chairlifts Across 14 Resorts

The company posted $204.2 million in revenue for the quarter, up from about $77 million during the same period last year, and higher than analysts’ forecasts of $177 million.

“We are pleased with the strong demand across our North American summer operations during the fourth quarter, which exceeded our expectations and which we believe highlights our guests’ continued affinity for outdoor experiences.”

– Vail CEO Rob Katz

For the fiscal year as a whole, Vail Resorts had sales of $1.65 billion, up from $1.58 billion in 2020, due in part to a strong ski season at Colorado and Utah resorts. The company reported profit of $127.9 million, or $3.13 per share.

Without revealing actual sales numbers, the company shared that volume sales of its Epic Pass for the 21/22 season are up 42% over the previous season.

The company has $1.2 billion cash on hand.

The fiscal year 2021 by the numbers:

- Lift revenue: increased $163.5-million / 17.9%

- Ski school revenue: decreased $44.9-million / 23.7%

- Dining revenue: decreased $70.4-million / 43.8%

- Retail/rental revenue: decreased $42.3-million / 15.67%

- Lodging revenue: decreased $26.4-million / 11.1%

- Resort revenue: decreased $50.9-million / 2.6%

- Net revenue: decreased $54-million / 2.7%

- Net income: increased $29.1-million / 29.45%

Vail Resorts shares hit $327.71 yesterday marking a 43% rise over the last year.

Full earnings call press release below:

Vail Resorts Reports Fiscal 2021 Fourth Quarter and Full Year Results, Provides Fiscal 2022 Outlook, Announces Transformational Capital Plan and Declares Dividend

BROOMFIELD, Colo., Sept. 23, 2021 /PRNewswire/ — Vail Resorts, Inc. (NYSE: MTN) today reported results for the fourth quarter and fiscal year ended July 31, 2021, which were negatively impacted by COVID-19 and related limitations and restrictions, and reported results of season-to-date season pass sales. Vail Resorts also provided its outlook for the fiscal year ending July 31, 2022, announced a one-time transformational capital plan for calendar year 2022, and declared a dividend payable in October 2021.

Highlights

- Net income attributable to Vail Resorts, Inc. was $127.9 million for fiscal 2021, an increase of 29.4% compared to fiscal 2020. Fiscal 2021 was negatively impacted by COVID-19 and related limitations and restrictions, including the early closure of Whistler Blackcomb on March 30, 2021 and “stay at home” orders and periodic resort closures impacting our Australian ski areas. The prior year period was negatively impacted by the early closure of the Company’s North American destination mountain resorts and regional ski areas on March 15, 2020 due to COVID-19 (the “Resort Closures”).

- Resort Reported EBITDA was $544.7 million for fiscal 2021, an increase of 8.2% compared to fiscal 2020. Fiscal 2021 was negatively impacted by COVID-19 and related limitations and restrictions. The prior year period was primarily impacted by the Resort Closures, which included the resulting deferral of approximately $120.9 million of pass product revenue and $2.9 million of related deferred costs from fiscal 2020 to fiscal 2021 as a result of pass holder credits offered to 2019/2020 North American pass product holders.

- Pass product sales through September 17, 2021 for the upcoming 2021/2022 North American ski season increased approximately 42% in units and approximately 17% in sales dollars as compared to the period in the prior year through September 18, 2020, without deducting for the value of any redeemed credits provided to certain North American pass product holders in the prior period. To provide a comparison to the season pass results released on June 7, 2021, pass product sales through September 17, 2021 increased approximately 67% in units and approximately 45% in sales dollars as compared to the period through September 20, 2019, with pass product sales adjusted to include Peak Resorts pass sales in both periods. Pass product sales are adjusted to eliminate the impact of foreign currency by applying an exchange rate of $0.79 between the Canadian dollar and U.S. dollar in all periods for Whistler Blackcomb pass sales.

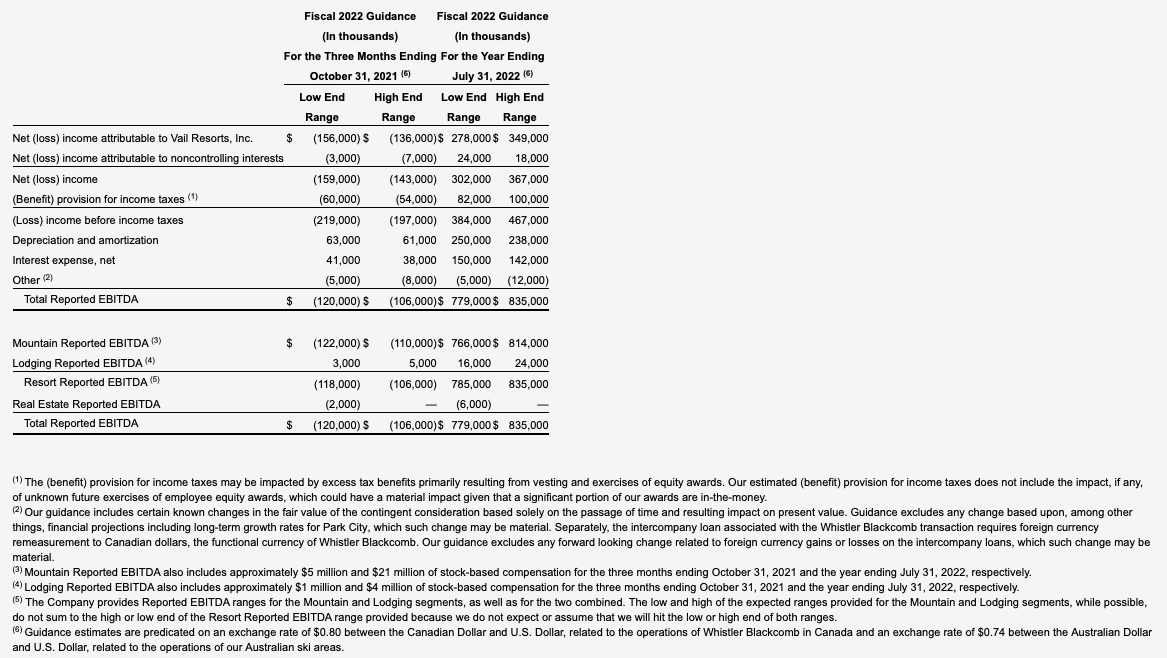

- The Company issued its fiscal 2022 guidance range and expects Resort Reported EBITDA to be between $785 million and $835 million. The guidance includes an expectation that Resort Reported EBITDA for the first quarter of fiscal 2022 will be between negative $118 million and negative $106 million, which includes the negative impact from COVID-19 resort closures in Australia. Fiscal 2022 guidance assumes, among other assumptions described below, no material impacts associated with COVID-19 for the 2021/2022 North American ski season or the 2022 Australian ski season, other than an expected slower recovery for international visitation and group/conference business.

- The Company continues to maintain significant liquidity with $1.2 billion of cash on hand as of July 31, 2021 and $613 million of availability under our U.S. and Whistler Blackcomb revolving credit facilities. The Company declared a cash dividend of $0.88 per share payable in October 2021 and plans to exit the temporary waiver period under the Vail Holdings, Inc. revolving credit facility (“VHI Credit Agreement”) effective October 31, 2021.

- The Company announced a transformational $315 million to $325 million capital plan for calendar year 2022 focused on the addition and/or upgrade of 19 new chairlifts and other improvements to enhance the guest experience ahead of the 2022/2023 North American ski season.

Commenting on the Company’s fiscal 2021 results, Rob Katz, Chief Executive Officer, said, “Given the continued challenges associated with COVID-19, we are pleased with our operating results for the year. Our results highlighted our data-driven marketing capabilities, the value of our pass products, the resiliency of demand for the experiences we offer throughout our network of world-class resorts and our disciplined cost controls.

“Results continued to improve as the 2020/2021 North American ski season progressed, primarily as a result of stronger destination visitation at our Colorado and Utah resorts. Excluding Peak Resorts, total skier visitation at our U.S. destination mountain resorts and regional ski areas for fiscal 2021 was only down 6% compared to fiscal 2019. Whistler Blackcomb’s performance was disproportionately negatively impacted due to the closure of the Canadian border to international guests, including guests from the U.S., and the resort closing earlier than expected on March 30, 2021 following a provincial health order issued by the government of British Columbia. Whistler Blackcomb’s total skier visitation for fiscal 2021 declined 51% compared to fiscal 2019. Our ancillary lines of business were more significantly and negatively impacted by COVID-19 related capacity constraints and limitations throughout the 2020/2021 North American ski season. We generated Resort Reported EBITDA margin of 28.5% driven by our disciplined cost controls as well as a higher proportion of lift revenue relative to ancillary lines of business compared to prior periods.”

Regarding the Company’s fiscal 2021 fourth quarter results, Katz said, “We are pleased with the strong demand across our North American summer operations during the fourth quarter, which exceeded our expectations and which we believe highlights our guests’ continued affinity for outdoor experiences. In Australia, we experienced strong demand trends at the beginning of the 2021 Australian ski season. However, subsequent COVID-19 related stay-at-home orders and temporary resort closures negatively impacted financial results for the fourth quarter by approximately $8 million relative to our guidance expectations issued on June 7, 2021. Fourth quarter results were also negatively impacted relative to our June 7, 2021 guidance by a one-time $13.2 million charge for a contingent obligation with respect to certain litigation matters.”

Katz continued, “We remain focused on our disciplined approach to capital allocation, prioritizing our investments in our people, as well as high-return capital projects, strategic acquisition opportunities, and returning capital to shareholders. Our liquidity position remains strong, and we are confident in the free cash flow generation and stability of our business model. Our total cash and revolver availability as of July 31, 2021 was approximately $1.9 billion, with $1.2 billion of cash on hand, $418 million of revolver availability under the VHI Credit Agreement, and $195 million of revolver availability under the Whistler Blackcomb Credit Agreement. As of July 31, 2021, our Net Debt was 3.0 times trailing twelve months Total Reported EBITDA. Given our strong balance sheet and outlook, we are pleased to announce that the Company plans to exit the temporary waiver period under the VHI Credit Agreement effective October 31, 2021, declared a cash dividend of $0.88 per share payable in October 2021, and announced a transformational $315 million to $325 millioncapital plan for calendar year 2022 to add or upgrade 19 new chairlifts and make other investments to enhance the guest experience and are expected to generate strong returns for our shareholders.”

Operating Results

A more complete discussion of our operating results can be found within the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of the Company’s Form 10-K for the fiscal year ended July 31, 2021, which was filed today with the Securities and Exchange Commission. The discussion of operating results below compares the results for the fiscal year ended July 31, 2021 to the fiscal year ended July 31, 2020, unless otherwise noted. The following are segment highlights:

Mountain Segment

- Total lift revenue increased $163.5 million, or 17.9%, to $1,076.6 million primarily due to strong North American pass sales growth for the 2020/2021 ski season, including the deferral impact of the pass holder credits offered to 2019/2020 North American pass product holders from fiscal 2020 to fiscal 2021 as a result of the Resort Closures, partially offset by a decrease in non-pass visitation due to limitations and restrictions on our North American operations due to the impacts of COVID-19, which disproportionately impacted Whistler Blackcomb.

- Ski school revenue decreased $44.9 million, or 23.7%, dining revenue decreased $70.4 million, or 43.8%, and retail/rental revenue decreased $42.3 million, or 15.7%, each primarily as a result of by COVID-19 related capacity limitations and restrictions in the current year, partially offset by the Company operating for the full U.S. ski season in the current year as compared to the impact of the Resort Closures in the prior year.

- Operating expense decreased $65.9 million, or 5.4%, which was primarily attributable to cost discipline efforts in the current year associated with lower levels of operations and limitations, restrictions and closures of resort operations resulting from COVID-19.

- Mountain Reported EBITDA increased $50.3 million, or 10.1%, which includes $20.3 million of stock-based compensation for fiscal 2021 compared to $17.4 million in the prior year.

Lodging Segment

- Lodging segment net revenue (excluding payroll cost reimbursements) decreased $26.4 million, or 11.1%, primarily due to operational restrictions and limitations of our North American lodging properties in the current year as a result of the ongoing impacts of COVID-19, partially offset by stronger summer demand in the U.S. during the fourth quarter of fiscal 2021.

- Lodging Reported EBITDA decreased $9.0 million, which includes $3.8 million of stock-based compensation expense in fiscal 2021 compared to $3.4 million of stock-based compensation expense in fiscal 2020.

Resort – Combination of Mountain and Lodging Segments

- Resort net revenue was $1,907.9 million for fiscal 2021, a decrease of $50.9 million, or 2.6%, compared to resort net revenue of $1,958.9 million for fiscal 2020. Fiscal 2021 revenue included approximately $12 million of favorability from currency translation, which the Company calculated on a constant currency basis by applying current period foreign exchange rates to the prior period results.

- Resort Reported EBITDA was $544.7 million for fiscal 2021, an increase of $41.3 million, or 8.2%, compared to fiscal 2020. Fiscal 2021 includes the impact from the deferral of $118 million of pass product revenue and related deferred costs from fiscal 2020 to fiscal 2021 as a result of credits offered to 2020/2021 North American pass product holders, a one-time $13.2 million charge for a contingent obligation with respect to certain litigation matters, and approximately $2 million of favorability from currency translation from Whistler Blackcomb, which the Company calculated on a constant currency basis by applying current period foreign exchange rates to prior period results.

Total Performance

- Total net revenue decreased $54.0 million, or 2.7%, to $1,909.7 million.

- Net income attributable to Vail Resorts, Inc. was $127.9 million, or $3.13 per diluted share, for fiscal 2021 compared to net income attributable to Vail Resorts, Inc. of $98.8 million, or $2.42 per diluted share, in fiscal 2020. Net income attributable to Vail Resorts, Inc. for fiscal 2021 and fiscal 2020 included tax benefits of approximately $17.9 millionand $8.0 million, respectively, related to employee exercises of equity awards (primarily related to the CEO’s exercise of SARs). Additionally, fiscal 2021 net income attributable to Vail Resorts, Inc. included approximately $3 million of unfavorability from currency translation, which the Company calculated by applying current period foreign exchange rates to the prior period results.

Season Pass Sales

Commenting on the Company’s season pass sales for the upcoming 2021/2022 North American ski season, Katz said, “We are very pleased with the results of our season pass sales to date, which continue to demonstrate the strength of our data-driven marketing initiatives and the compelling value proposition of our pass products, driven in part by the 20% reduction in all pass prices for the upcoming season. Pass product sales through September 17, 2021 for the upcoming 2021/2022 North American ski season increased approximately 42% in units and approximately 17% in sales dollars as compared to the period in the prior year through September 18, 2020, without deducting for the value of any redeemed credits provided to certain North American pass holders in the prior period. To provide a comparison to the season pass results released on June 7, 2021, pass product sales through September 17, 2021 for the upcoming 2021/2022 North American ski season increased approximately 67% in units and approximately 45% in sales dollars as compared to sales for the 2019/2020 North American ski season through September 20, 2019, with pass product sales adjusted to include Peak Resorts pass sales in both periods. Pass product sales are adjusted to eliminate the impact of foreign currency by applying an exchange rate of $0.79 between the Canadian dollar and U.S. dollar in all periods for Whistler Blackcomb pass sales.”

Katz continued, “We saw strong unit growth from renewing pass holders and significantly stronger unit growth from new pass holders, which include guests in our database who previously purchased lift tickets or passes but did not buy a pass in the previous season and guests who are completely new to our database. Our strongest unit growth was from our destination markets, including the Northeast, and we also had very strong growth across our local markets. The majority of our absolute unit growth came from our core Epic and Epic Local pass products and we also saw even higher percentage growth from our Epic Day Pass products. Compared to the period ended September 18, 2020, effective pass price decreased 17%, despite the 20% price decrease we implemented this year and the significant growth of our lower priced Epic Day Pass products, which continue to represent an increasing portion of our total advance commitment product sales.

“We are very pleased with the performance of our pass product sales efforts to date, which exceeded our original expectations for the impact of the 20% price reduction, particularly in the growth of new pass holders and in the trade up we are seeing from pass holders into higher priced products. As we enter the final period for pass product sales, we feel good about the current trends we are seeing. However, it is important to point out that we know a portion of the growth we have seen to date represents certain pass product holders purchasing their pass earlier in the selling season than in the prior year period and we saw strong growth in the late fall in the prior year period due to concerns around COVID-19, including questions about resort access as a result of our mountain access reservation system. Given these factors and the other changing economic and COVID-related dynamics, it is difficult to provide specific guidance on our final growth rates, which may decline from the rates we reported today.”

Capital Investments

Commenting on the Company’s capital investments, Katz said, “As previously announced, we are on track to complete several signature investments in advance of the 2021/2022 North American ski season. In Colorado, we are completing a 250 acre lift-served terrain expansion in the signature McCoy Park area of Beaver Creek, further differentiating the resort’s high-end, family focused experience. We are also adding a new four-person high speed lift at Breckenridge to serve the popular Peak 7, replacing the Peru lift at Keystonewith a six-person high speed chairlift, and replacing the Peachtree lift at Crested Butte with a new three-person fixed-grip lift. At Okemo, we are completing a transformational investment including upgrading the Quantum lift to replace the Green Ridge three-person fixed-grip chairlift. In addition to the transformational investments that will greatly improve uplift capacity, we are continuing to invest in company-wide technology enhancements, including investing in a number of upgrades to bring a best-in-class approach to how we service our guests through these channels.

“We are encouraged by the outlook for our long-term growth and the financial stability we have created. The success of our advance commitment strategy, the expansion of our network and our focus on creating an outstanding guest experience remain at the forefront of our efforts. Toward that end, we are launching an ambitious capital investment plan for calendar year 2022 across our resorts to significantly increase lift capacity and enhance the guest experience as we drive increased loyalty from our guests and continuously improve the value proposition of our advance commitment products. These investments are also expected to drive strong financial returns for our shareholders. The plan includes the installation of 19 new or replacement lifts across 14 of our resorts that collectively will increase lift capacity in those lift locations by more than 60% and a transformational lift-served terrain expansion at Keystone, as well as additional projects that will be announced in December 2021 and March 2022. All of the projects in the plan are subject to regulatory approvals.

“We expect our capital plan for calendar year 2022 will be approximately $315 million to $325 million, excluding any real estate related capital or reimbursable investments. This is approximately $150 million above our typical annual capital plan, based on inflation and previous additions for acquisitions, and includes approximately $20 million of incremental spending to complete the one-time capital plans associated with the Peak Resorts and Triple Peaks acquisitions. Given our recent financings and strong liquidity, the outlook for our business driven by the growth of our advance commitment strategy, and the tax benefit in 2022 from additional accelerated depreciation on U.S. investments, we believe this is the right time for our Company to make a significant investment in the guest experience at our resorts and expect this one-time increase in discretionary investments will drive an attractive return for our shareholders. Additional details associated with our calendar year 2022 capital plan can be found in our capital press release issued on September 23, 2021. We also intend to return our capital spending to our typical long-term plan in our calendar year 2023 capital plan, with the potential for reduced spending given the number of projects we would complete in calendar year 2022. We will be providing further detail on our calendar year 2022 capital plan in December 2021.”

Return of Capital

Commenting on the Company’s return of capital, Katz said, “The Company plans to exit the waiver period under the VHI Credit Agreement effective October 31, 2021, reinstating the required quarterly compliance with our financial maintenance covenants beginning with the first quarter of fiscal year 2022. We are also pleased to announce that the Board of Directors has reinstated our quarterly dividend by declaring a cash dividend on Vail Resorts’ common stock of $0.88 per share, payable on October 22, 2021 to shareholders of record on October 5, 2021. This dividend payment equates to 50% of pre-pandemic levels and reflects our continued confidence in the strong free cash flow generation and stability of our business model despite the ongoing risks associated with COVID-19. Our Board of Directors will continue to closely monitor the economic and public health outlook on a quarterly basis to assess the level of our quarterly dividend going forward.”

Guidance

Commenting on guidance for fiscal 2022, Katz said, “As we head into fiscal 2022, we are encouraged by the robust demand from our guests, the strength of our advance commitment product sales and our continued focus on enhancing the guest experience while maintaining our cost discipline. Our guidance for net income attributable to Vail Resorts, Inc. is estimated to be between $278 million and $349 million for fiscal 2022. We estimate Resort Reported EBITDA for fiscal 2022 will be between $785 million and $835 million. We estimate Resort EBITDA Margin for fiscal 2022 to be approximately 32.1%, using the midpoint of the guidance range, which is negatively impacted as a result of COVID-19 impacts associated with Australia in the first quarter of fiscal 2022 and the anticipated slower recovery in international visitation and group/conference business. We estimate Real Estate Reported EBITDA for fiscal 2022 to be between negative $6 million and $0 million. The guidance assumes normal weather conditions, a continuation of the current economic environment and no material impacts associated with COVID-19 for the 2021/2022 North American ski season or the 2022 Australian ski season other than an expected slower recovery for international visitation, which is expected to have a disproportionate impact at Whistler Blackcomb, and group/conference business, which is expected to have a disproportionate impact in our Lodging segment. At Whistler Blackcomb, we estimate the upcoming winter season will generate approximately $27 million lower Resort Reported EBITDA relative to the comparable period in fiscal 2019, primarily driven by the anticipated reduction in international visitation.

“Fiscal 2022 guidance includes an expectation that the first quarter of fiscal 2022 will generate net loss attributable to Vail Resorts, Inc. between $156 million and $136 million and Resort Reported EBITDA between negative $118 million and negative $106 million. We estimate the negative impacts of COVID-19 in Australia and the associated limitations and restrictions, including the current lockdowns, will have a negative Resort Reported EBITDA impact of approximately $41 million in the first quarter of fiscal 2022 as compared to the first quarter of fiscal 2020.

“There continues to be uncertainty regarding the ultimate impact of COVID-19 on our business results in fiscal year 2022, including any response to changing COVID-19 guidance and regulations by the various governmental bodies that regulate our operations and resort communities, as well as changes in consumer behavior resulting from COVID-19, which are not factored into the guidance and could negatively impact it. The guidance assumes an exchange rate of $0.80 between the Canadian Dollar and U.S. Dollar related to the operations of Whistler Blackcomb in Canada and an exchange rate of $0.74 between the Australian Dollar and U.S. Dollar related to the operations of Perisher, Falls Creek and Hotham in Australia.”

The following table reflects the forecasted guidance range for the Company’s fiscal 2022 first quarter ending October 31, 2021 and full year ending July 31, 2022, for Reported EBITDA (after stock-based compensation expense) and reconciles net (loss) income attributable to Vail Resorts, Inc. guidance to such Reported EBITDA guidance.