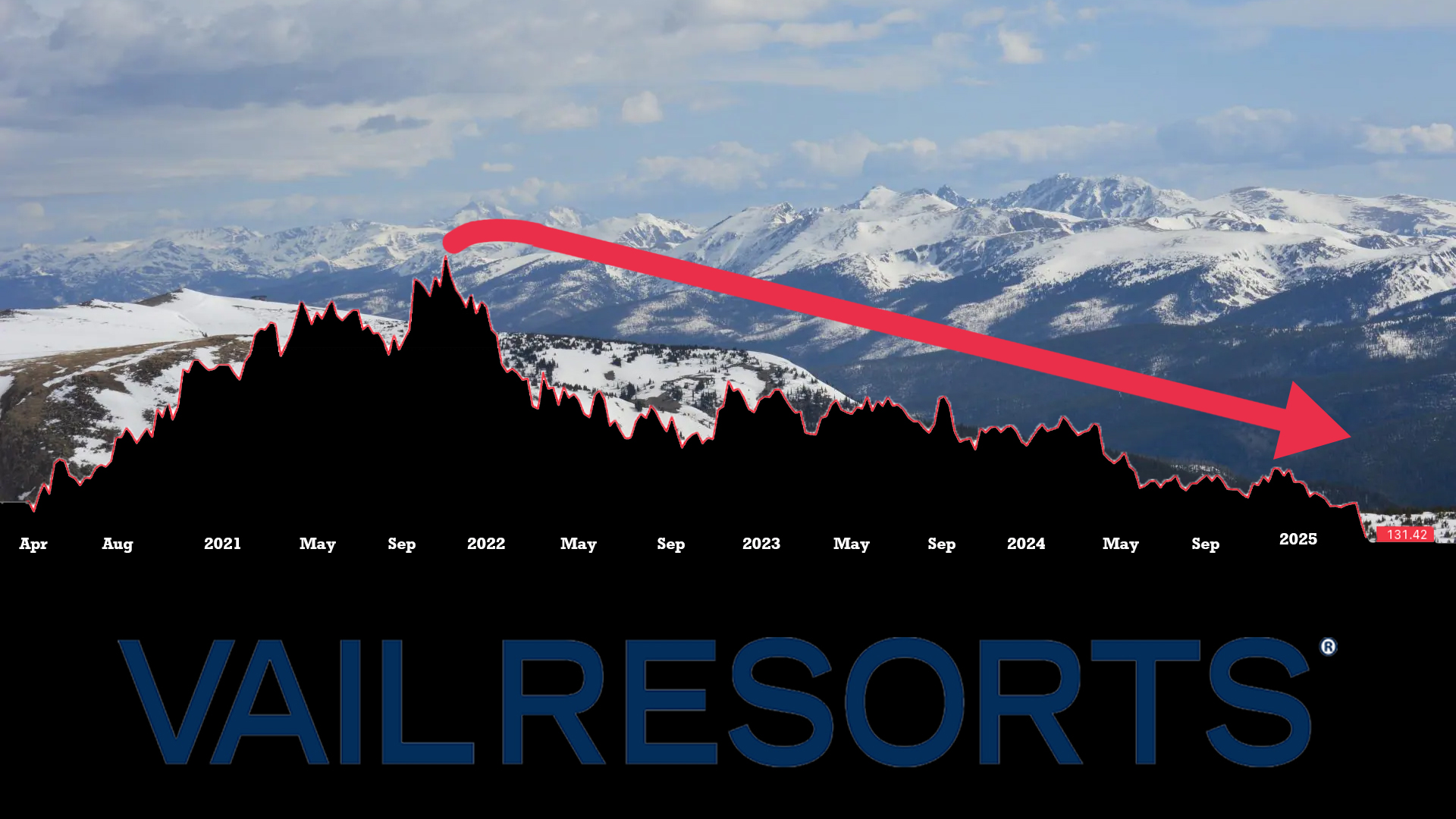

Vail Resorts, the largest ski resort operator in North America, which owns and operates 41 ski areas across the U.S., Canada, and Australia, has seen its stock plummet nearly 20% in the span of one week. As of Monday, April 8, 2025, shares of the publicly traded company (NYSE: MTN) are down to $131.42, marking their lowest level in over four years and a 60% decline from the company’s all-time high.

The sharp downturn comes in the wake of two developments: a disappointing stretch of earnings and visitation data from the 2024-25 ski season, and a sweeping new round of import tariffs imposed by the Trump administration. On April 5, a 10% global tariff took effect, followed by a steeper 20% tariff on European Union goods on April 9. For a resort operator that relies on European-made equipment—like ski lifts, snowmaking infrastructure, grooming machines, and technical gear—the impact is immediate and costly.

This matters because the price of doing business in the ski industry is about to go up, and those costs will ripple outward. Vail, which services millions of skiers and snowboarders annually across resorts like Vail, Breckenridge, Whistler Blackcomb, Park City, and Stowe, now faces ballooning capital expenses just as it tries to stabilize after a turbulent few years. The company is still recovering from several years of pandemic-related disruptions, rising operating costs, and pushback from both investors and local communities. With tariffs threatening to inflate the cost of future projects, the company may need to revisit or delay upgrades and expansions planned at several resorts.

It’s not just a corporate problem. These decisions affect the flow of tourism in dozens of ski towns, the employment of thousands of seasonal and year-round workers, and the broader economy of the American outdoor recreation sector, which contributes more than $1 trillion annually. In short: what happens to Vail doesn’t stay in Vail—it affects the outdoor recreation economy at large.

2 thoughts on “Vail Resorts’ Stock Tanks Nearly 20% in Last Week Amid Tariff Concerns and Investor Scrutiny”