I am a big fan of reciprocal pass agreements. My hometown mountain has anywhere from three to five of these agreements every year. I can take advantage of these pacts each season and ski a new area for “free.” These agreements are a great way for ski resorts to add value to their season pass holders. For no extra cost, the reciprocal resorts simply agree to let pass holders at the other resort ski and ride for a limited number of days for free. It is a win-win.

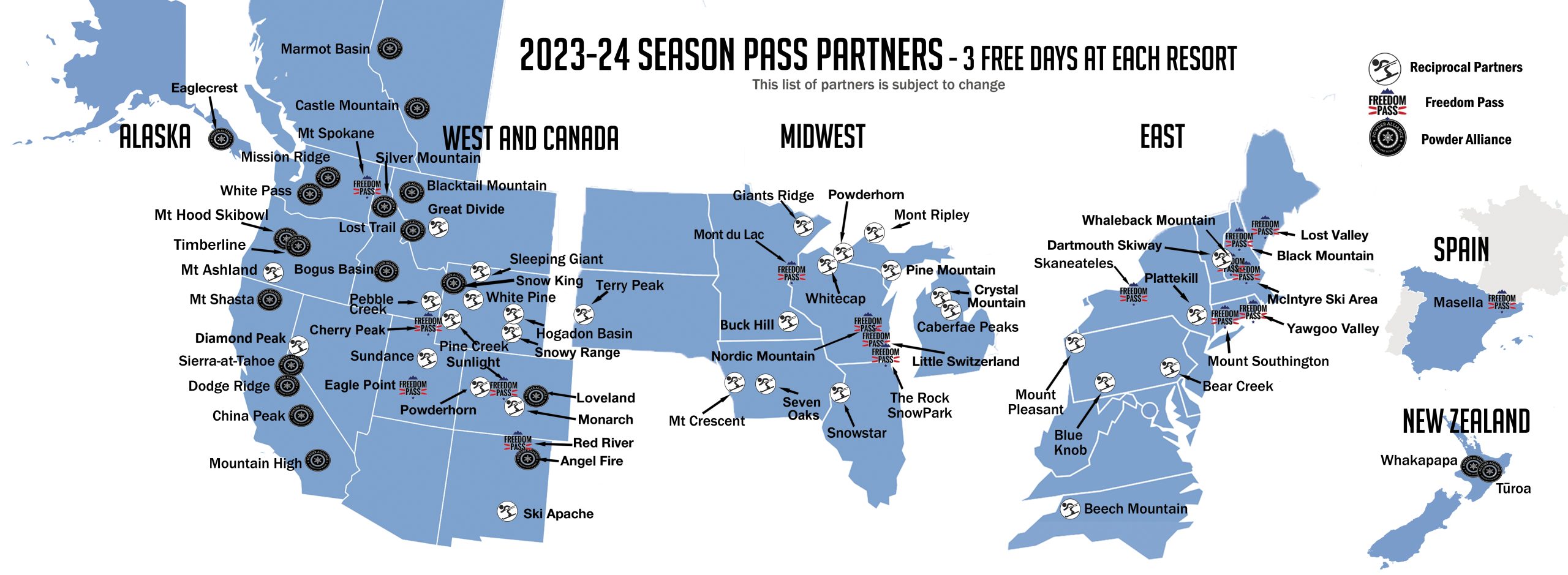

No other ski area does reciprocal pass agreements better than Ski Cooper. Last season they had nearly 60 ski areas for its pass holders to explore in every ski region of America.

Recently, Ski Cooper joined the Powder Alliance, which instantly added 15 resorts to its portfolio, bringing the total number available on its season pass to 74 ski areas. All for the bargain price of $379.

Was this the original purpose of these agreements?

Ski Cooper has more resorts than Epic or Ikon Passes, but they don’t claim to be a national multi-mountain product. Some critics conjecture they are, and that they have drifted away from the actual intent of what these agreements were for.

For this reason, Ski Cooper has become a legitimate competitor to the Indy Pass. Both passes are starting to look more and more alike. Indy Pass grants you over 100 resorts that allow you two days at each resort. Ski Cooper, now with 74 partners, grants pass holders three days at each resort. The price of each pass is comparable with the Indy+ Pass, with no blackout dates, costing slightly more than a Ski Cooper pass.

It has come to the point where Indy Pass has officially accused Ski Cooper of gaming reciprocal agreements to the detriment of independent ski areas. The reason is that it has the potential to directly take revenue away from them.

How does this hurt independent ski areas?

Many people who don’t even live near Ski Cooper buy the season pass. Then they simply use it to ski at the resorts located in their region. The cost is more economical than purchasing a local season pass or buying day tickets. All the money goes to Ski Cooper, and to our knowledge, not one of the visited ski areas receives any compensation.

Indy Pass, on the other hand, distributes 85% of its revenue to its partner resorts, while only keeping 15% to cover marketing, overhead, and other operating expenses. This is a great benefit for any resort that joins the Indy Pass as every ticket redeemed at their resort adds revenue to their bottom line.

Additionally, Indy Pass attempts to not have too many resorts on their pass near each other. This is difficult sometimes, especially in the Northeast, but it ensures that the pass is not used as a replacement for a season pass at someone’s local ski hill. It is truly meant to be a supplemental pass so that a local mountain can still keep its base of season pass holders.

It is important to note that Ski Cooper has done nothing unauthorized. In fact, it’s an attractive product and a shrewd business strategy. They can make these agreements with whatever resorts are willing. However, industry insiders wonder if some of Ski Cooper’s partners will back out of the agreements because they aren’t getting any benefit. They may see this as a win-lose situation where they are only seen as another feather in the cap of Ski Cooper’s portfolio of partners.

How will this play out?

Thirty-three resorts are both on Indy Pass and Ski Cooper. These resorts are potentially at a crossroads to decide if it makes sense to be on both. Consumers may decide to buy a Ski Cooper pass rather than an Indy Pass which could potentially take revenue away from the other independent resorts. Some have already withdrawn, but Ski Cooper has more than made up for losses by adding new partners.

Another path forward could be for other independent areas to aggressively increase their reciprocal agreements to align with what Ski Cooper offers. This would level out the playing field as consumers would then have to weigh the costs and benefits more closely. They would be more likely to buy a season pass at their local hill if it had similar agreements in place.

The Indy Pass has been so popular that it is currently not on sale. However, they plan to offer more passes before the winter; anyone interested should get on the waitlist. Meanwhile, you can still buy a Ski Cooper season pass. Prices increase on August 1.

Whatever happens, the independent spirit of skiing is strong. The competitive landscape tends to act efficiently, and consumers and ski area operators will make decisions that are best for them. Every year these agreements change, so it will be compelling to see how it unfolds.