There were 473 ski areas in the United States that operated during the 2022-23 season. In 1970, there were over 1,000. Over the last 10 years, the number has fluctuated mostly in the 470 range. Some new resorts have opened, some have closed, and even others have re-opened.

Of the 473 ski areas that operated last season, 103 of those are owned by only 11 corporations. This is approximately 22% of all resorts and represents a substantial part. However, it also means that roughly 78% of the ski areas are still independently owned.

Over the last decade, there has been a trend toward ski resort consolidation as corporations add ski areas to their portfolios. This movement demands the questions of why is this happening, what are the pros and cons of consolidation, and what is the future of ski resort ownership and viability?

Why is Ownership Consolidation Happening?

Business Sense

One evident reason for the consolidation of ski resorts is money. If one operation can take over another and increase its future revenue and profit, then that is strictly a business decision.

This is a primary driver according to one industry professional. Doug Fish is the founder of the Indy Pass, a multi-resort pass that includes over 120 independently owned resorts, and believes the major reason is financial. He had this insight on why we are seeing this trend “I think [consolidation] is happening because it’s a sound business model,” Fish said. “If you’re at a reasonable elevation or latitude and you know what you’re doing, the ski business is extremely lucrative.”

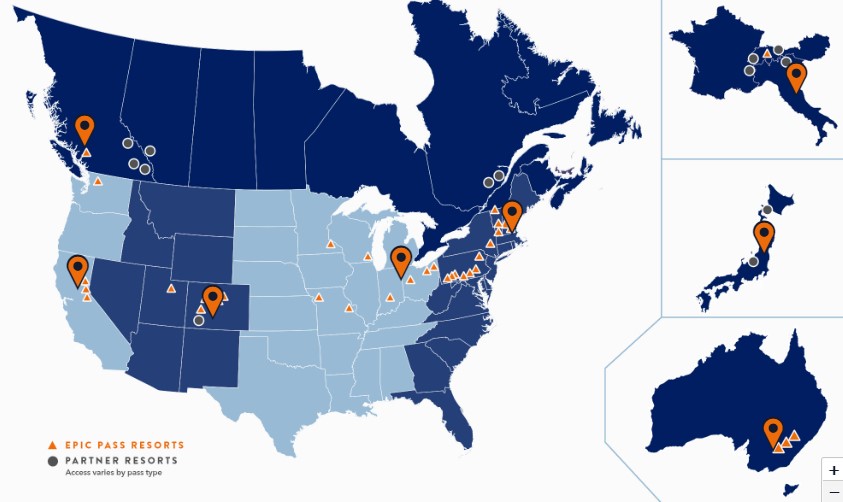

The biggest player in this area is Vail Resorts Inc. Since 2014, Vail has spent almost $2 billion on acquisitions. During this time, it has managed to acquire an impressive number of premier resorts throughout the world like Whistler Blackcomb, Park City Mountain Resort, and Stowe Mountain Resort.

Vail’s strategy appears to be working. Total sales for the company in the last fiscal year was $2.5 billion and net revenue was $347.9 million. The company also had $1.1 billion cash on hand at the end of the fiscal year. What will they do with that money? One can only guess.

- Related: Vail Resorts’ 4th Qtr 2022 Results | Closes Out the Year With $2.5 Billion Sales, Best Since 2009

Another reason for consolidation that has to do with money is some resorts could be struggling financially or aren’t willing to make appropriate investments to stay in business. The most common cause of financial distress is mismanagement and expensive infrastructure needs. This could be new lifts, maintenance, repairs, and snowmaking equipment. A new lift alone could cost upwards of $10 million. Other reasons could be dwindling snow or competition from other ski areas.

The increased costs may be the biggest contributing factor. Stephen Kircher is the CEO and President of Boyne Resorts, the third-largest ski corporation based on skier visits in the US. They are also one of the most geographically diverse North American ski resort companies with resorts like Big Sky, MT, Brighton Resort, UT, and Sugarloaf, ME under their management. He had this to say about how costs have changed:

“The cost of investment and underlying infrastructure costs have gone up way faster than inflation, lift technology in particular. There was a huge fallout of ski resorts in the 70s and 80s because they didn’t step up and invest and couldn’t do it, and when they got behind the curve they couldn’t compete anymore, and they went away. I would propose that if you’re not in the same mindset now, you could also be left behind. Whether you’re a conglomerate or individual resort, it’s an important time to invest in all the things that will make you viable going forward.”

When a ski area is struggling or doesn’t want to deal with expensive infrastructure investments, being bought by a more financially secure operation could be the only option, besides ceasing operations.

Climate Change

Since 1982, the average length of the ski season has been reduced by 34 days due to the changing climate. When resorts have fewer days to operate it lowers potential revenue. Missing an entire month of operations could be the difference between being profitable or ending in the red.

To combat this trend, resorts have become more reliant on snowmaking capabilities. The capital required to operate a ski resort has substantially increased and a big part of that is snowmaking infrastructure. It is estimated that snowmaking can be responsible for up to 15% of the total operating expenses of a ski resort.

“The other issue that is requiring ski resorts to do things differently is climate change,” Fish said. “If it weren’t for snowmaking there would be no skiing in the Midwest and the season would be two months long. Half the resorts in New England would be closed. So, if you’re going to be in the ski resort business you better budget in snowmaking and you better have a lot of it and be constantly investing in snowmaking because [climate change] is only going to get worse in our lifetimes.”

One independent resort that knows this all too well is Caberfae Peaks Ski Resort located in Northern Michigan. Pete Meyer is the General Manager and has 20 years of experience managing ski resorts and he agrees. “We are always going to battle the weather and rely heavily on snowmaking,” he said. “The nice thing about the Midwest is the climate tends to be more consistent than other places, but you are not a resort in the Midwest if you don’t have a robust snowmaking system.”

According to a recent Forbes article, approximately 87% of all U.S. ski resorts use snowmaking in some capacity. Some more than others, but it is becoming more and more of a necessity in today’s changing world and is likely to play an increasing role in the future of the industry.

Benefits of Consolidation

More Value and Options for Skiers

When resorts consolidate, it typically means that a season pass will allow the pass holder to ski at all the resorts the company owns. The season pass is typically priced extremely affordably. This also gives the skier the luxury of skiing multiple resorts on the same pass and being able to travel to different regions and still have “free” skiing.

Financial Stability and Access to Capital

As mentioned earlier, if a ski resort is struggling financially, then being bought out is a better option than bankruptcy. The new company could provide economies of scale as well as expertise and capital to invest heavily in ski lifts, snowmaking, and maintenance.

Independent Resorts Can Claim a Niche

The bigger the company the harder it is to be unique. This could be an advantage for smaller independent resorts to adapt quickly to change and provide a unique experience for their guests.

“If you have your own niche market and continue to work it, independent resorts can continue to thrive,” Meyer offered. “Independent resorts all have their own vibe. You come in and it is just different. I think having independent resorts is important in the industry.”

Downfalls of Consolidation

Smaller Resorts Could Struggle

Consolidation has the potential to push skiers to the more valued season passes. This could cause small resorts to grapple and lose revenue. These resorts may have to diversify their business mix and become four-season operations. This typically means reinventing the business model to include summer recreation as well as spring and fall offerings like meetings and convention facilities.

“You better figure out how to make money the other eight months of the year,” Fish observed. “The season is four months long in a decent year. That gives you eight months to figure out how to make money. There’s plenty of ways to do that.”

This is something Boyne Resorts has been doing for decades. “From our perspective, this is not just the ski business, this is a four-season resort business we’re in,” Kircher said. “Since 1954 we’ve been diversifying into summer activities and offseason attractions and creating other reasons to come to the resort in the wintertime beyond skiing. As skiing gets shorter, we’re hoping to continue to improve our hotels and other attractions to keep people coming to the mountain.”

Caberfae Peaks has also implemented this into its business model. “Our business is still very seasonal where 85% of our revenue is from the winter,” Meyer declared. “In the off-season, we have a really nice banquet business of weddings on the weekends as well as golf and lodging.”

Increased Cost of Day Tickets

While the big resorts may charge an especially reasonable amount for a season pass, they have countered that by charging exorbitant prices for day passes. Several resorts will charge over $200 for a day ticket this coming season. This practice pushes people to buy the season pass or just choose not to ski at all. This could cause a longer-term decline in skier visits as new skiers won’t make the financial commitment to get started with the sport.

Loss of Character, Soul, and Local Management

Some long-time resort visitors complain that their local mountain just isn’t the same after it was bought out. The management team may be replaced and sweeping changes made to policies and operations.

A prime example of this is Stevens Pass in Washington State. Vail Resorts bought Stevens Pass in 2018 and if you ask long-time locals, it has since been on a downward trajectory. It got so bad last year that an online petition accusing the owners of mismanagement gained traction. Some of the complaints were opening late and closing early, limited terrain openings, especially on powder days, and staffing shortages due to underpaid, overworked, and undervalued employees.

What Does the Future Look Like?

Will there be more consolidation? Will independent resorts survive?

“We do not have a goal of growing,” Kircher pronounced. “We are trying to be better, not bigger. We definitely aren’t looking. We have people pinging us a lot to discuss that possibility and we engage in those conversations as we feel they meet certain criteria, but we are not actively pursuing anything.”

Kircher also made it clear that both conglomerates and independents have a bright future. “Both can co-exist; both will co-exist. I think there will be continued consolidation. I also think the good operators can be very successful in their own niches and survive and prosper.”

Fish agrees with Kircher. “I think consolidation will continue although not as rapidly as it has over the last five years because there just aren’t as many resorts out there for [corporations] to consolidate,” Fish declared. “I think the future of the ski resort business is bright. It is a very compelling business to be in. The big guys will continue to expand and acquire and the little guys who know what they are doing will continue to thrive.”

Maybe this is why the number of ski resorts has remained steady in the 470 range over the last decade. The resorts that are going to close have done so already and the management teams in place at the remaining ones have the expertise to run an efficient operation.

For now, it looks like the industry could still see some consolidation and the viability of both independent and corporately owned resorts should continue to progress. The ski season may be shorter, climate change presents a challenge, and ski resorts will have to adapt and invest in the necessary infrastructure needs. Conclusively, we should all look forward with hope and optimism for the sport we all love.

I forgot to mention longer lift lines. More lawsuits. Less powder days. More wind holds. More gapers.

NO NEW SKI RESORTS cuz of the abolitionists enviros

Even after we fix global warming the enviro whackos will still not allow new ski resorts or reopen backcountry terrain to electric powered snowmobiles.

Consolidation. Higher Ticket Prices. Higher Food Prices. Higher Real Estate Prices.

NO NEW SKI RESORTS.

NO NEW SUPPLY OF SKIING.

More environmental regulations.

More rules and more closures in the backcountry.

The future is bright.

Big business has ruined skiing.

Do any of you know that the game monopoly was invented to teach children about the dangers of capitalism.

But go ahead and keep listening to the rich, CEOs definitely have your best interests in mind!