For the first time in Jackson Hole real estate history, the single-family home average sale price has topped $5 million. Not only is this record-breaking, but it only took three years to double. In 2019, the average sale price reached $2.6 million, reports the Jackson Hole Real Estate Report.

If that shocks you, consider the average list price of a single-family home at year’s-end was $7.6 million in 2022. Only eight homes are listed for under $2 million versus 24 homes for over $7 million.

The average condo/townhome sale price increased 81% over the previous year, the vacant residential land sale price increased 10%, and the single-family home sale price increased 6%.

While the number of available listings increased 63% over 2021, it’s still the third lowest in 40 years, with 166 active. The highest number of active listings in the history of Jackson Hole happened in 1996, with 1,596 active listings at the year’s end. Of those, 529 were single-family homes versus the 77 single-family homes currently on the market.

Five factors contribute to this lack of inventory, the largest being the lack of local property owners trading up. It is estimated that up to 35% of all transactions in the last 30 years have been trade-ups. Historically, a first-time home buyer in Jackson would purchase a small condo. After a few years, enough equity accrued to sell the condo and buy a small, single-family home with a backyard. After a few more years of built-up equity, the homeowners would trade up to a house with a few acres. Today, as prices have skyrocketed, it is almost impossible for a condo owner to trade up to the least expensive single-family home ($1.3 million)—putting the American dream of home ownership out of reach for many. At the end of 2022, only 1.4% of all free-market deeds were listed for sale in Teton County. Nationwide, the average in a given county at any given time is 10% of the overall free-market deeds.

While no one knows precisely what the future has in store for Jackson Hole, prices are predicted to flatten out in some segments and continue to climb in others. Those hoping competition will slow in 2023 are out of luck. In 2023, buyers can expect trends similar to the past two years: elevated prices, low inventory, and bidding wars on well-priced listings. Also, expect inventory levels to decrease continuously until Spring 2023.

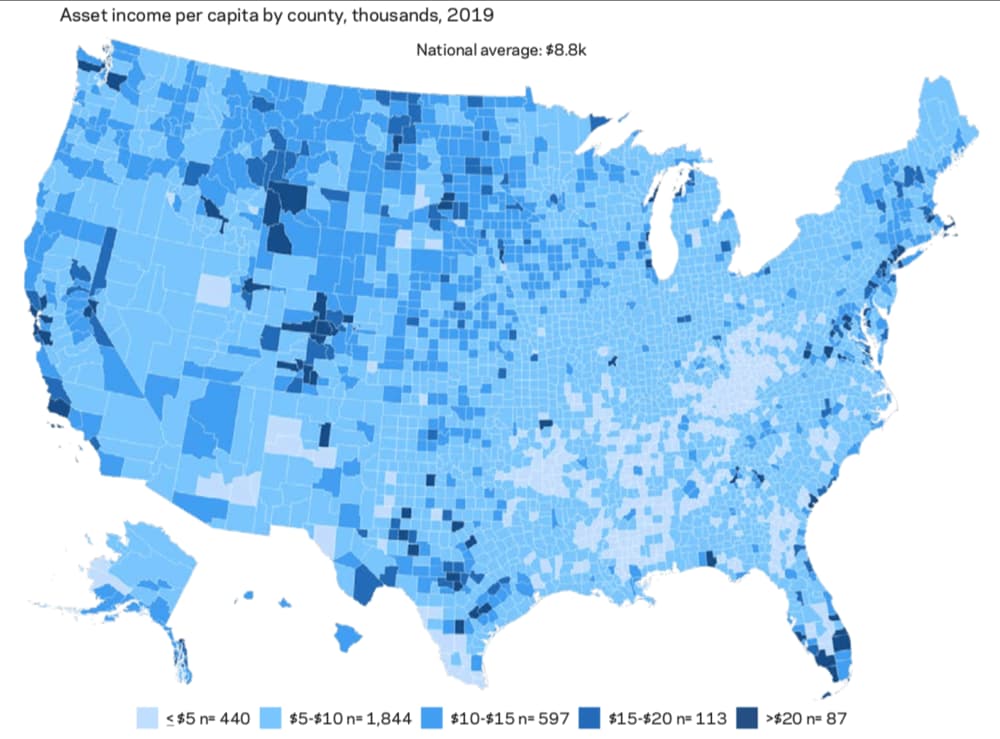

A 2021 study found that Wyoming’s Teton County, home to Jackson Hole, has the nation’s highest per-capita income from assets. Annual revenue from assets in Teton County was $161,400 per capita. The national average is $8,800 per capita. A South Dakota county has the lowest income from assets, with $2,800 per capita.

Similarly, a 2016 report found that Jackson, WY, is the most economically unequal city in the USA—by an enormous margin. If fact, Jackson is the most economically unequal city in the USA by 140 fold.

The 2016 numbers showed that Teton County, ID, and Teton County, WY, have the top 1% earners bringing in 68.3% of the income, with the bottom 90% taking in only 17.3% of the income. The average income of the top 1% of Jackson is $20 million per year, while the other 99% of Jackson is taking home an average income of $94,000 per year. The wealthiest 1% in Jackson make 213 times more money than the other 99% of the population.

Why is it this way? Because the uber-wealthy live in Jackson, WY. Why do they live there? Because Wyoming is a tax haven for the rich and corporations—not just the rich of the USA, but for the rich of the world. No corporate taxes are collected in Wyoming, no individual income taxes are collected, sales tax is 4% (one of the lowest in the USA), and property tax is low.

Ten years ago, Wyoming was ranked the tax-friendliest state in the USA by USA Today.

#1. Wyoming

• Taxes collected per capita: $4,347 (3rd highest)

• Unemployment: 4.9% (5th lowest)

• Corporate taxes collected per capita: none (the lowest)

• Sales tax rate: 4.0% (tied-13th lowest)Wyoming is the highest-rated state in the nation for business tax policy. Like other states with strong business tax climates, it benefits from the absence of any individual income tax. Like Nevada and South Dakota, which ranked just behind Wyoming for the quality of their business tax climate, Wyoming has neither corporate income tax nor gross receipts tax. But while other states that did not tax income choose instead to tax sales heavily, Wyoming does not. As of January, its state sales tax rate was just 4%, one of the lowest of any state with such a tax. Including the average local sales tax, consumers paid an effective sales tax rate of just 5.3% on purchases, among the lowest in the nation.” – USA Today, March 2013

Does all this make it hard to ski bum in Jackson Hole, WY? Yes. Yes, it does. Many friends have been priced out of Jackson Hole and had to move to other, more affordable ski towns like Salt Lake City, UT.